Real Economic GDP Growth, U.S. vs Germany

Economics / Global Economy Sep 07, 2010 - 01:42 PM GMTBy: Paul_L_Kasriel

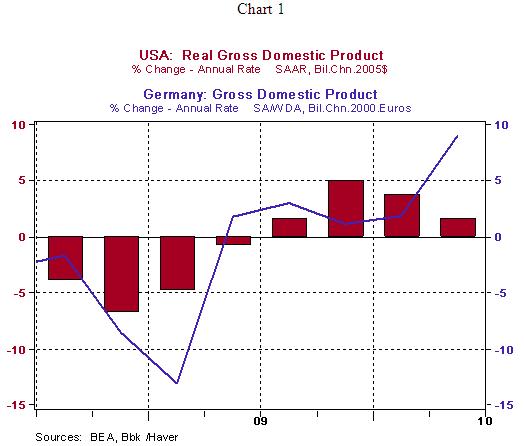

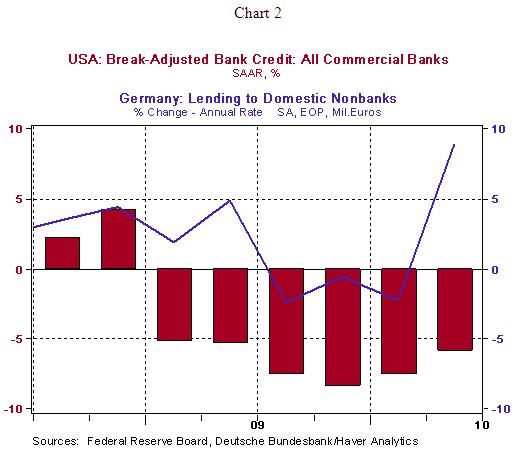

As Chart 1 shows, German real GDP growth, at an annualized rate of 9.0%, blew away U.S. growth at a paltry 1.6%. A number of factors might account for the stronger performance of the German in economy in the second quarter vs. the U.S. But one I want to concentrate on is the change in credit provided by private-sector financial institutions. These data are presented in Chart 2. I do not have oranges-to-oranges data to compare, but I do have oranges to tangerines data.

That is, for Germany, the change in credit is for all monetary financial institutions (MFI); for the U.S., it is for commercial banks. Notice that in the second quarter of this year, MFI-created credit soared at an annualized rate of 8.9%. In the U.S., commercial bank credit contracted at an annualized rate of 6.0%. In fact, ever since the fourth quarter of 2008, U.S. commercial bank credit has "underperformed" German MFI credit. As I said, the behavior of MFI credit or commercial bank credit is not the only factor accounting for stronger second-quarter German real GDP growth vs. the U.S., but I think it is an important factor.

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.