US Housing Crash Deepens As the US Drifts Towards Stagflation

Economics / US Economy Sep 26, 2007 - 12:19 AM GMTBy: Nadeem_Walayat

The US Shiller House Price Index which reflects the housing market of America's ten largest cities fell by an annualized 4.5%, which greatly increases the probability of a US recession sparked by the deepening housing bear market that has already made itself felt in the form of the Subprime mortgage sparked credit crunch. As an adjunct to falling house prices, property sales also continue to tumble with the National Association of Realtors reporting sales of family homes falling by 4.3% in August alone to the lowest annualized rate since August 2002.

The US Shiller House Price Index which reflects the housing market of America's ten largest cities fell by an annualized 4.5%, which greatly increases the probability of a US recession sparked by the deepening housing bear market that has already made itself felt in the form of the Subprime mortgage sparked credit crunch. As an adjunct to falling house prices, property sales also continue to tumble with the National Association of Realtors reporting sales of family homes falling by 4.3% in August alone to the lowest annualized rate since August 2002.

If it was not clear before, it should be clear by now that the US housing market is no where near the bottom. Not only that, but things are going to get much much worse, as numerous articles on the Market Oracle over the past year have been forecasting such as US Housing Market Crash to result in the Second Great Depression (23rd Feb. 07).

US Fed Panic Rate Cut

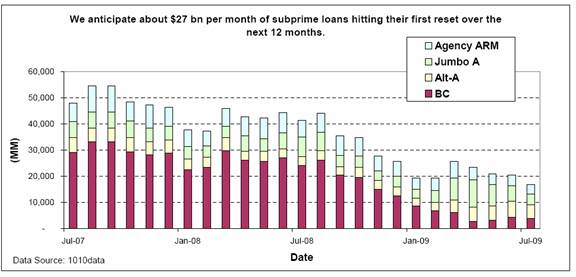

The US Fed last week panicked by cutting interest rates by 0.5% despite resurgent inflationary pressures. The rate cut was an attempt at preventing the meltdown in the housing market sending the US into a recession. Unfortunately the US housing market is expected to be depressed by an tightening in the liquidity squeeze despite desperate actions by the Fed. Over the coming 12 months mortgages will reset in ever greater numbers from low fixed rates to much higher higher interest rates and lending requirements due to the credit crunch.

John Mauldins Article of 18th August 07, explains in depths the structure of the US mortgage markets and the expected impact of Adjustable Rate Mortgages (Arms) over the next 12 months.

The conclusion is that US house prices will continue to decline for at least a further 12 months, we are probably some way off the half way point yet for price falls.

US Drifts Towards Stagflation

The Fed will therefore continue cutting interest rates the consequence of this and a weakening US economy will result in further falls for the US Dollar and therefore higher inflation further out. This suggests the US is entering a climate of stag-inflation, that will only end with much higher US interest rates in the longer term. The stagflation scenario is already reflected in the money supply data, where M3 has grown from a low of 4% in 2004 to over 14%.

The inflationary outlook is reflected in the resurgent commodity prices trading at multi decade and all time highs with the latest additions to the commodities inflationary bull market being the agricultural commodities on the back of rising global demand mainly from China and India as well as increasing demand for bio-fuels such as ethanol.

China Exporting Inflation

During the past decade the US and much of the western world have enjoyed deflationary pricing imported from China, that deflation is now turning into inflation as both chinese workers demand higher wages and chinese domestic inflation soars to above 6%. In response the Chinese government has raised interest rates and will continue to do so. Another consequence of rising chinese inflation is China letting their currency (Yuan) strengthen and thus increasing the price of Chinese exports, as china looks to both reduce inflationary pressures and to diversify a significant proportion of its vast US dollar reserves out of US Treasury Bonds and the Dollar.

Fed Will Act Belatedly to Nip Stagflation in the Bud.

If CPI inflation rises to above 3% then the Fed will be forced to start raising interest rates, thus further depressing the US economy. If the Fed refused to or delayed raising interest rates then that could result in a crash in the US Dollar and the US lurching further towards stagflation after which much much higher interest rates will be needed to bring inflation under control than if pre-emptive action is taken to nip stagflation in the bid.

Unfortunately as we have seen with the September rate cut, and despite media commentary, the rate cut has actually come too late as the subprime blowout warnings have been flashed for over a year. Hence the Fed will probably delay raising interest rates by too long, and thus eventually requiring much higher US interest rates to bring inflation under control.

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

Nadeem Walayat is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

MARVIN ROSEN

11 Nov 07, 12:38 |

STAGFLATION

SO WE ARE HEADING TO STAGFLATION...A MARKET CORRECTION....LETS DISCUSS WHAT WORKED IN 1973-74 |