Adobe, A Case For Stock Trend Trading

Companies / Tech Stocks Sep 23, 2010 - 03:10 AM GMTBy: Dian_L_Chu

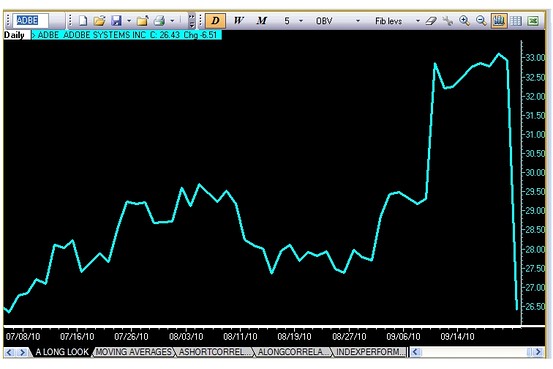

Adobe Systems Inc. (ADBE) shares got slammed big time on Wednesday in heavy volume after the company gave a weaker-than-expected guidance for its fiscal fourth quarter. Price plunged 19% to $26.52 in after hour trading after hitting a 52-week low of $25.81 earlier. (See the ugly chart from WSJ.com)

While some analysts said the company's longer-term prospects remain solid as the economy recovers, there are warning signs indicating otherwise

Adobe, best known for Photoshop and the Flash technology for online games and video websites, actually reported a stronger-than-expected fiscal Q3 earnings--$0.44 per share, up 69% year over year—getting a boost from strong demand for its flagship Creative Suite 5 (CS5) software package and its large enterprise customer base.

The strong recent momentum has built up high market expectation. But investors remained cautious as demand for Creative Suite (CS5) has picked up along with an improving economy; it is not selling as brisk as its previous version (CS3) from before the financial crisis.

Then, Adobe confirmed investors' worry- the company said weak education markets in the U.S. and Japan will lead to its current-quarter revenue in its creative solutions business, including CS4, to be flat to down slightly from the previous quarter. Since Creative Suite is Adobe’s core product accounting for 55% of the company's revenue over the past twelve months, Adobe’s earnings visibility--for the two to four quarters--is quite clear.

There are other bearish indications. Earlier this year, Apple (AAPL) dropped Adobe Flash technology for iPhone and iPad, which means Steve Jobs and Apple, sees Flash as replaceable, instead of a “must-have” technology. Then, even when Apple finally allowed third-party programming tools to be used to develop apps, the news barely registered a blip on CS5 sales.

These are suggestions that Adobe is losing its technology niche--in the tech jungle surrounded by super competitive rivals--and given the still tepid economic recovery, the company seems to lack significant stock boosting catalyst in the near term.

Companies typically find growth either organically or through acquisition. In Adobe’s case, to meet growth target, the shortest route would be the latter, which would weaken its financial position, as noted by WSJ:

"Perhaps compounding investors' concern is the possibility Adobe will resort to using the firm's strong balance sheet on acquisitions to reach its fiscal 2012 revenue target of $5 billion, 30% above this year."

Furthermore, due to the poor earnings outlook, we could see more selling and downward price pressure in the coming trading sessions, as it takes time for some larger funds to unload shares. On a more speculative note, Adobe fits the bill for a M&A target as well, particularly with this new price drop; however, it would be the wrong reason to hold a stock.

Although I don’t typically buy into trend trading, in Adobe’s case, I’d say go with the flow, unless some very compelling catalyst emerges.

Disclosure: No Positions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.