Oliver Stone's New Wall Street Film Money Never Sleeps is Asleep

Politics / Credit Crisis 2010 Sep 27, 2010 - 09:32 AM GMTBy: Danny_Schechter

The lead headline in the New York Times is “EXTENSIVE FRAUD APPEARS TO MAR AFGHAN ELECTION.” The line below, “A BLOW TO CREDIBILITY,” as if anyone who follows Afghanistan, a country known for blatant and notorious corruption was at all surprised by this latest “blow.”

The lead headline in the New York Times is “EXTENSIVE FRAUD APPEARS TO MAR AFGHAN ELECTION.” The line below, “A BLOW TO CREDIBILITY,” as if anyone who follows Afghanistan, a country known for blatant and notorious corruption was at all surprised by this latest “blow.”

Today’s “blow” followed an earlier “blow” a few weeks back with the disclosure of the crash of the Kabul Bank with $300 billion still unaccounted for.

In America, another fraud: CNN reported the next morning that the pathetic blonde beauty-celebrity Lindsay Lohan put up $300,000 to get out of jail. That’s the kind of story American media considers worthy of constant “Breaking News” attention.

In America, another fraud: CNN reported the next morning that the pathetic blonde beauty-celebrity Lindsay Lohan put up $300,000 to get out of jail. That’s the kind of story American media considers worthy of constant “Breaking News” attention.

When will we see the headlines like “EXTENSIVE FRAUD APPEARS TO MAR ECONOMIC RECOVERY” or “EXTENSIVE FRAUD LED TO FINANCIAL COLLAPSE?’

I ask this question, sort of knowing the answer, after two recent back-to-back film experiences.

On Thursday night, I spoke at a packed screening of my film PLUNDER THE CRIME OF OUR TIME that indicts financial crimes and corruption behind the financial crisis. The audience seemed overwhelmingly positive except for one Wall Streeter in the house who insisted that while there may have been “ethical lapses,” no crimes were committed, an expression of a conventional wisdom that most of the media has reinforced without investigating any evidence.

At a reception after the film in suburban Long Island’s Cinema Arts Center, several people told me that one impact the crisis has had on them is sleeplessness because of anxiety over whether will can pay their bills and avoid joblessness or foreclosure.

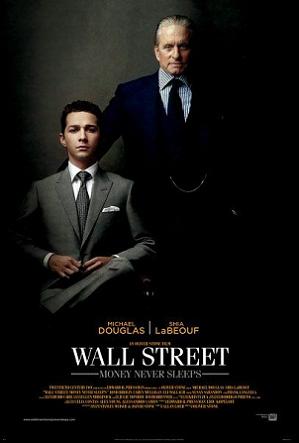

Ironically, film director Oliver Stone also had sleep on his mind. “Money Never Sleeps” is the subtitle of his remake of the movie Wall Street. To my surprise, the theater was not packed on opening night for a film distributed, ironically, by the money-mad mogul Rupert Murdoch’s News Corpse. You would think that the outspoken Stone, known for conspiracizing, would be slaying some dragons.

Think again.

After watching the movie, I realized why the right-wing Rupert Murdoch could be comfortable enough releasing the latest from the nominally left-wing Oliver Stone.

The movie built an “explainer” around a love story that in the end was as much as about child-parent conflicts and pretentious philosophizing as the collapse of Wall Street which is treated, ultimately, with a “we are all to blame” viewpoint, In many ways the movie celebrates the brash culture of greed and excess of our era while we watch the return of Michael Douglas’ portrayal of Gordon Gekko, infamous in earlier times for the slogan “Greed Is Good.”

Now, Stone sees greed everywhere, and suggests there ain’t much we can do about it. A Wall Street insider writes on the Self-evident blog, “the film somehow lacks any relatable misery. The human costs of the larger crisis remain abstract. The traders that the film revolves around talk about the market crash as if they are spectators and not participants.” He concludes, “we produce some beautiful art, but do we ever butcher the facts.” Facts, for example, about mortgages designed to fail and an epidemic of fraud encouraged by Wall Street. The film reinforces impressions, but offers no revelations.

Gekko does offer up some good lines but the movie is more about personal redemption than financial crime. He says, “The mother of all evils is speculation — leveraged debt.” He claims the economy is merely moving money around in circles and the business model itself is like a “cancer.”

True, but he’s more concerned with winning back his daughter’s love.

Personally, I saw many of the stories I report in my film turn up in his—with even the same lines, leading me to unprovable suspicions after having given my film personally to Stone with a request for his help months earlier.

I guess I was naïve. Then again, maybe great minds think alike. Smile. (I do know/respect one of his screenwriters, Stephen Schiff), Clearly, we work in different leagues, and maybe, on different sides.

In an interview on CNN, Stone seemed to argue that free speech is more of an issue than the insolvency of the banks. He became totally obsessed with the rumors that brought down Bear Stearns, an issue I explore in depth.

“What I found out,” he says, “what shocked me back in 2009, was that Goldman Sachs and those type of banks were really going long and short at the same time and were actually selling out on their clients. I thought that was shocking information to me, as well as the power of rumor, which, amazing. We show the power of that and how it can destroy a company.

...I'm not so sure that's good for the system, although it's more transparent. But it does lead to circles of viciousness and rumor and hype and a stock, as you know, drops. I mean, look at what happened a few months ago, right? The market just crashed. So what's going to happen?

It does scare me, and I think it's the nature of the modern world, I suppose.”

The respected website Ml-implode.com commented:. "There you go, "rumor,” mentioned as a causative factor 4 or 5 times; insolvency/leverage? Zero. Those poor, poor Wall Street banks -- they're victims, you know.”

The movie dances on all sides of the issues actually featuring an on camera cameo by Stone, of course and, Grayon Carter, editor of Vanity Fair, who I quote in the my film and book, The Crime of our Time, because he labeled the crisis “the greatest non-violent crime in history” Stone feigns towards that view but ultimately rejects it.

Hedge Fund investor Jim Chanos who I also quote, and who has called for the prosecution of wrongdoers, was even an advisor. It seems like he was wanted for his insight more on the atmospherics of the scene, than his demand for more perp walks.

Wall Street 2 features a father-son subtext as the young banker played by Shia LaBeouff watches as his mentor at a firm made to resemble Bear Stearns or, is it, Lehman Brothers commits suicide after the company is brought down by rumors and dirty tricks. In the end, he marries and has a son with Gekko’s daughter who, natch, runs a left-wing website.

Their kid is named Louie after The banker who died. Undisclosed is that Stone’s dad who worked on Wall Street was also a Lou. Clearly this movie was as much about the personal psychodrama of Stone’s life as many of his earlier films about the ghosts of Vietnam. His movies about Nixon and W also featured father-son conflicts. The banker who died by jumping into the subway, Frank Langella, recently played Nixon in the movie about David Frost’s interview.

More disturbing was the film’s failure to call for any action. It starts with Gekko getting out of jail and getting back in the industry. So jail, in the end means nothing.

Many Wall Streeters interviewed about the film seemed confused about its message and meandering plot points. Most (including myself) liked the luscious cinematography of New York that even profiled Bernie Madoff’s former office, and featured David Byrne’s great music. Said former banker Nomi Prins who is in Plunder, “ I liked it until halfway through, and then it was a hodge-podge bunch of events.”

The pro-free market Daily Bell wrote; “Always, Oliver Stone seems a propagandist and apologist…Would it be any news to him that the United States is over-extended from a monetary and military standpoint? Or that Fed money printing was the proximate cause of the economic crash. It should not be too hard to figure this out.”

Critic Roger Ebert liked the film but added, "I wish it had been angrier. I wish it had been outraged. Maybe Stone's instincts are correct, and American audiences aren't ready for that. They haven't had enough of Greed."

Was it those “instincts” that led to the pandering, or was it just the logic of the market or Murdoch’s neutering its critical edge with an insistence to “Just tell us an entertaining story if you want this to be big.” He was going to make the film before the crash—when it might have warned us—but waited to try to become the ultimate word. Alas, he isn’t.

In my experience, audiences are furious about what’s happened to them and the country. Late last week Paul Volker warned that the financial system is still broken. Others fear another crash is only just a matter of time. This reality is not evident on Oliver Stone’s radar screen.

After my screening, a man named Milton told me he is active in The Democratic Party but that the Dems will not really act against Wall Street. “They don’t have the guts,” he said. Can the same be said about Oliver Stone, who loves the Hugo Chavez’s of the world South Of The Border, but echoes CNBC here at home?

News Dissector Danny Schechters film and book Disinformation. For more information, Http://www.plunderhecrimeofourtime.com.

News Dissector Danny Schechter has made a film and written a book on the “Crime Of Our Time.” (News Dissector.com/plunder.) Comments to dissector@mediachannel.org

© 2010 Copyright Danny Schechter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.