Nasdaq Stock Market Not Doom & Gloom; Cyclical Investment Opportunity!

Stock-Markets / Cycles Analysis Oct 01, 2010 - 03:31 AM GMT Unfortunately investors as a group are slow to adapt to change, which can be a harsh and costly lesson to learn. But where there is turmoil there is also opportunity for those who can recognize change and make that adaptation.

Unfortunately investors as a group are slow to adapt to change, which can be a harsh and costly lesson to learn. But where there is turmoil there is also opportunity for those who can recognize change and make that adaptation.

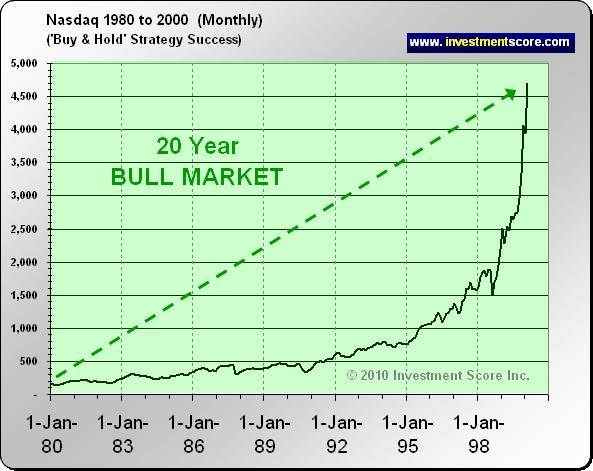

From 1980 to 2000 the world enjoyed expanding credit and a seemingly forever growing stock market. By the end of the twenty year run in stocks the predictable investment environment led advisors and investors to believe in an apathetic strategy of ‘buy and hold’ and ‘forget about your investments’.

The above chart illustrates the relentless rise of a US stock market from 1980 to 2000. For the average investor the above market conditions turned out to be a trap. The majority of the investing public will usually enter a bull market when it is the most exciting and nearing an end. The result of not recognizing the change in the market environment is buying high, and suffering through the inevitable bear market.

From an investment standpoint a lot has changed from the relatively cool 80’s and 90’s. The above chart shows us the current decade long bear market in stocks.

The warning signs of instability are everywhere and this is devastating for stock prices.

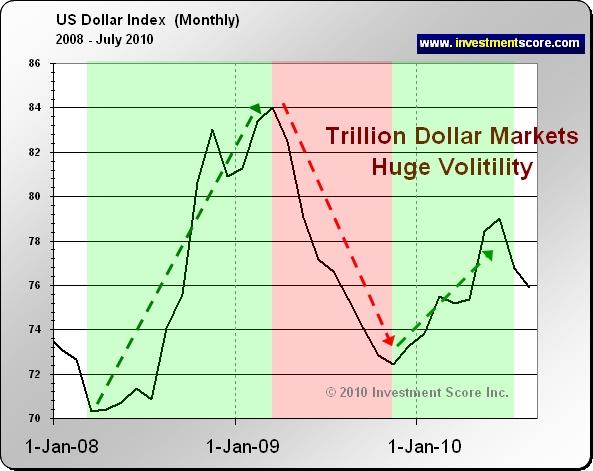

- Trillion dollar currency markets that are thrashing up and down like small cap equities.

- A soaring bond market with near zero interest rates. (investors seeking safety)

- A skyrocketing gold price. (investors seeking safety)

- An increase in the number of corporate scandals.

- More corporate bankruptcies.

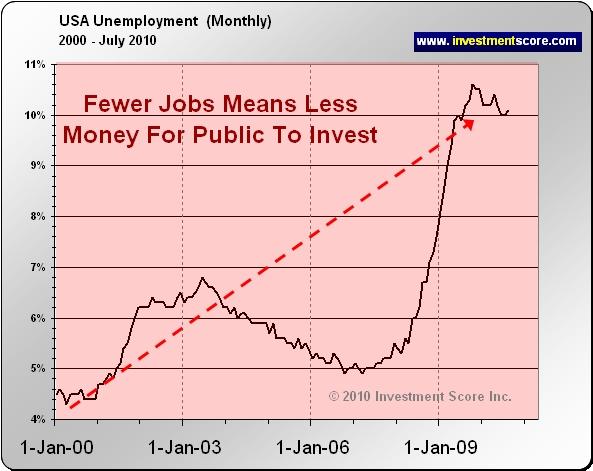

- More unemployment.

- Less available credit for consumers.

- A devastated real-estate market in some nations and wounded markets in others.

- Entire nations imploding and falling into bankruptcy.

- An aging population wanting to retire, consequently there will be less of the population producing wealth.

- An aging population requiring more medical attention, resulting in higher economic costs.

- More government intervention in markets in the form of bailouts and regulations.

- More government social programs.

- More open frank and open discussion of market intervention by policy makers.

- Wars.

- A public that is more heavily dependent on the government to “fix” these problems, transfer wealth and intervene.

The warning signs are there. The bells are ringing for those who are paying attention. None of these things are evidence of an environment that supports an expanding stock market.

The world’s largest, trillion dollar currency markets bouncing around is not a sign of stability. In the above chart the US dollar, as represented by the black line, clearly trends sharply higher as the first green arrow illustrates, then down as the red arrow points out, and then again up.

Investors are fleeing stocks and putting money into bonds no matter what the return is. We believe this is clearly defensive and out of fear of the current market environment.

People are looking for work at a time when it is harder to get credit. Clearly this makes it harder for the public to invest in stocks.

Investors are looking for the safety of hard assets such as gold.

The important message in this article is that one needs to recognize:

- Markets are cyclical and not linear. Change is inevitable.

- Investors must learn to recognize change in market conditions.

- Investors must learn to adapt to change to protect their wealth and possibly profit from it.

From 1980 to 2000 market conditions made gold a terrible investment. For 20 years capital fled from gold, oil, silver and other hard assets as it rushed into stocks. A look back in history shows us that from 1970 to 1980 market conditions pushed funds from stocks and into hard assets. The current market conditions have created opportunities in hard assets as capital flows out of stocks and into “things”.

The warning signs and opportunities are there for those who are watching and adapting to changes in the market environment. Investors who stubbornly hold onto outdated strategies will continue to suffer the consequences. All markets will have their ups and downs, but in our opinion being aware of long term trends is the key to success.

At investmentscore.com we look at investments relative to various markets in order to gain a unique perspective to their “Value” instead of their “Price”. We believe it is a common mistake for investors to be misguided by “price movement” instead of by true value. At the end of the day understanding “Value” is where wealth can be created and stored as “Price” can be greatly distorted by the constant fluctuations of currencies. To learn more about our strategies and to sign up for our free newsletter please visit us at www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.