Institutional Buying and Selling Levels Predict the Stock Market's Direction?

Stock-Markets / Stock Markets 2010 Oct 01, 2010 - 09:34 AM GMTBy: Marty_Chenard

Using Institutional Buying and Selling data is not a trading system, but some people do base their trades on Institutional Buying and Selling activity.

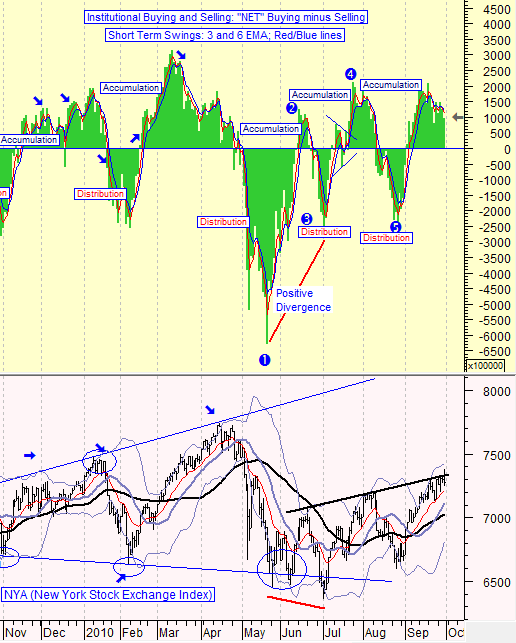

We post the Institutional buying and selling data everyday on our paid sites, and today's chart shows the "Net" of Institutional buying minus the amount of Institutional selling for any given day.

Reading the chart is really easy ...

When the green bars are above zero, Institutional Investors are in Accumulation. When the green bars are below zero, Institutional Investors are in Distribution. When investing, don't try to go against Institutional investors because they will win.

So, are Institutional Investors in Accumulation or Distribution now?

Well, they are in Accumulation. BUT ... their Accumulation levels peaked on September 20th. Since then, the amount of Accumulation has been decreasing. That pausing is fairly normal right now, because the NYA Index is testing a critical, 3 month resistance line as shown on the chart.

Commentary: For the NYA index to break above its resistance line now, it will need the Institutional Accumulation levels to start rising again.

If Institutional Accumulation levels continue to drop, then the market and the NYA Index will also drop. (Today's Net Institutional Buying and Selling chart is posted every day on our paid site, and is being posted as a courtesy to our free members today.)

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.