China, The Tale of the Asian Tiger Boosting Stock Markets

Stock-Markets / Stock Markets 2010 Oct 02, 2010 - 02:33 AM GMTBy: PhilStockWorld

The Hang Seng rose 179 points in today’s trading and finished down 20 for the day – THAT’S how bad the open was! The Nikkei finished an up and down 100-point swing up 34 points at 9,404 but dove into the close along with the dollar (our 3am trade), which now can be bought with just 83 Yen. The Shanghai, on the other hand, was feeling hot, hot, hot and gained 1.7% just behind the BSE, which flew up 1.9% to take back the position of Global Leader.

The Hang Seng rose 179 points in today’s trading and finished down 20 for the day – THAT’S how bad the open was! The Nikkei finished an up and down 100-point swing up 34 points at 9,404 but dove into the close along with the dollar (our 3am trade), which now can be bought with just 83 Yen. The Shanghai, on the other hand, was feeling hot, hot, hot and gained 1.7% just behind the BSE, which flew up 1.9% to take back the position of Global Leader.

Strong data boosted the Asian indexes overall with China’s PMI rising to 53.8 from 51.7 in August while India’s PMI pulled back slightly from 57.2 to 55.1 but that’s good as over 50 is expansion and 57.2 is running a little hot. Korean exports rose 17.2% in September, also a little too hot as their CPI topped 3.6% but mainly driven by food prices, which seems temporary. China’s upbeat PMI reading indicates that the negative impact of government measures to control the property market is probably waning, ING’s Mr. Condon said. This means China’s slowdown will probably be less abrupt than expected, especially in the fourth quarter.

Strong data boosted the Asian indexes overall with China’s PMI rising to 53.8 from 51.7 in August while India’s PMI pulled back slightly from 57.2 to 55.1 but that’s good as over 50 is expansion and 57.2 is running a little hot. Korean exports rose 17.2% in September, also a little too hot as their CPI topped 3.6% but mainly driven by food prices, which seems temporary. China’s upbeat PMI reading indicates that the negative impact of government measures to control the property market is probably waning, ING’s Mr. Condon said. This means China’s slowdown will probably be less abrupt than expected, especially in the fourth quarter.The effect, he said, should be especially positive on North Asian economies closely tied to China’s demand, such as Korea and Taiwan. Fears of lower Chinese demand have had a particularly pronounced effect on Taiwan’s business outlook. The island’s September PMI ticked down to 49.0 from 49.2. “Sturdy domestic demand” should keep Taiwan’s economy on target to grow 7.3% this year, “provided employment conditions continue improving,” said HSBC economist Donna Kwok.

On our side of the planet, the US markets, especially commodities, got a huge boost as China’s government gave a muted response to House legislation aimed at forcing the Yuan to be valued higher. Aside from China knowing that they already own enough Senators to Filibuster any legislation aimed at protecting American jobs, the bill was watered down in that it PERMITS, but does not REQUIRE, the US to levy tariffs on goods produced by countries found to have undervalued currencies.

Sharp retaliation by China is unlikely in the short term, analysts said, since the bill hasn’t become law and wouldn’t immediately produce restrictions on Chinese goods even if it did. In an apparent gesture to U.S. concerns, China has pushed the yuan up steadily in recent weeks; it was up 1.6% against the dollar in September. ”We think enlightened policy makers in Beijing and Washington understand the economic interdependence of the two countries,” said Li-Gang Liu, China economist for Australia & New Zealand Banking Group. “A trade-war scenario at this stage is unlikely to materialize.”

I love that statement. ”A trade-war is unlikely to materialize” – that’s kind of like telling native Americans that it’s unlikely the Government will take any more of their land – it’s already over! Our trade deficit with China is $300Bn – that is a LOT of money. The only reason that doesn’t seem ridiculous is that our country imports over $300Bn in oil as well so it makes China seem “not so bad” while we are forced to create an endless supply of dollars to pay for all the things we import since no one is willing to give us their currency for our junk.

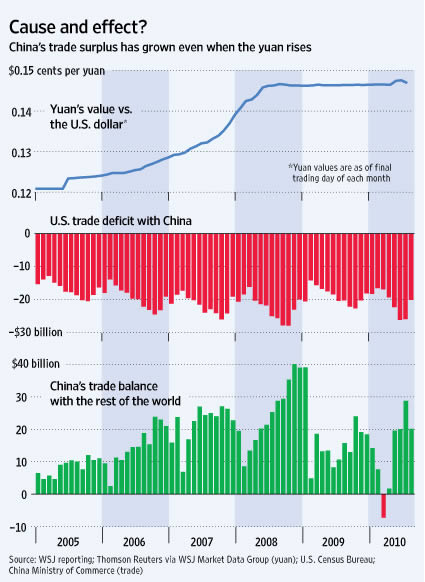

Raising the value of the Yuan may even widen the trade gap as Americans have never been smart enough to stop buying oil when it went up and up in price, nor have we EVER seriously focused on creating a domestic alternate-energy industry to create jobs and secure our economic future. This is despite the fact that Eisenhower, Kennedy, Carter and Gore (not a President but boy did he care!) warned us repeatedly that we faced – well, pretty much what’s happening to us now – if we didn’t get serious about having a US energy policy. If we are so dumb that we can waste generation after generation kicking the energy can down the road, why should anyone imagine that we’ll stop buying Barbie dolls from China if the price goes from $9.99 to $10.99? Clearly the last 25% rise in the Yuan didn’t teach us any lessons:

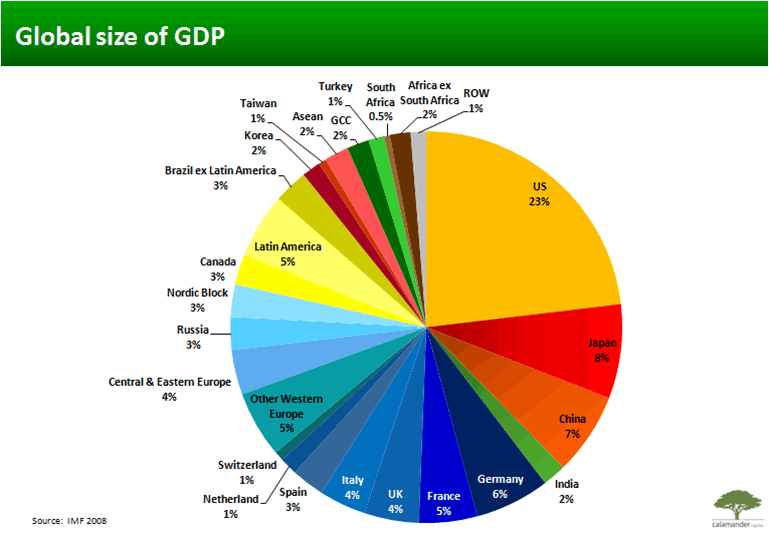

Meanwhile, let’s keep some perspective, shall we? The COMBINED GDP of China, India, Taiwan, Korea, Vietnam and Brazil total just 15% of the World’s GDP. If 15% of the world grows at 8% and the rest of the world grows at 1.5%, what is the total global growth? Well 8% of 15% is 1.2% and 1.5% of 85% is 1.27%. A total global growth rate of 2.47% is simply not enough to sustain $3.70 copper and $80 oil… Speculators, fortunately for the commodity pushers, cannot do complex math like that – they just hear the words “China” and “growth” and they begin to foam at the mouth and throw all their dollars at shiny bits of metal and black sticky goo.

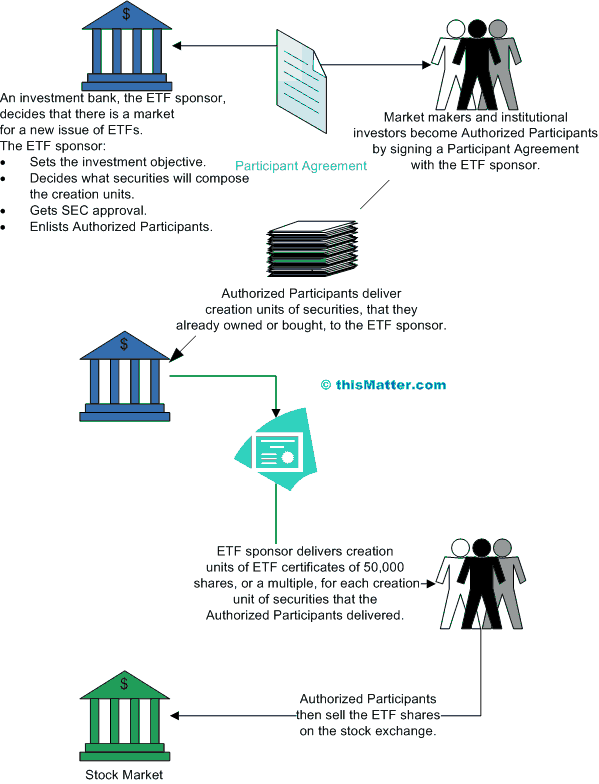

In fact, the commodity/Asian growth bubble is so booming that there is now 70% more money ($136Bn) invested in GLD ($55Bn), EEM ($45Bn) and VWO ($36Bn) than there is in SPY ($80Bn)with Emerging Markets, gold and oil now commanding over 40% of all ETF investments ($900Bn total) – yet another way the US ships hundreds of Billions of dollars overseas each year! GLD is currently the King of the ETF’s, with $214.9M moving into GLD on Tuesday alone out of $394.7M flowing to all commodity funds.

Hedge fund managers LOVE to see your money in ETFs as they truly are the dumb money on the street. Not only are ETFs forced to buy high and sell low but they publish their methodology so any fund manager with a few Billion Dollars to play with can pretty much make them dance a jig whenever he wants to. If your ETF’s prospectus says you balance your fund in the last hour of trailing based on the day’s average, then all I have to do is pump up the day’s average and unload my stock back into the ETF into the close – this a a recurring pattern we follow in the markets.

In yesterday’s post I told you to take advantage of the DIA suckers, who bought and bought into the open and we were easily able to pick up the Sept 30th $109 puts for .20 (.15 was the low). Those puts topped out at $1.55 but I told Members enough was enough at $1.40 as a 600% gain was plenty of money to buy us lunch, with $200 invested in 10 contracts at 10am returning $1,400 at 12:30! That’s why we are starting to love the new weekly options – it used to be we could only do this stuff once a month…

So I apologize for being so boring and educational on a Friday but understanding the mechanics of the things we invest in is what makes us better traders. The rise of ETFs has led to the rise of High-Frequency Trading, which is able to take advantage of both retail transactions as well as the big-fish ETFs, which churn and churn and churn their assets in a volatile market and throw off tens of Billions of Dollars in profits for the Banksters, who simply insert themselves in between the buyers and sellers and grab pennies Billions of times each day. Ironically, they now do this using YOUR money, which was lent (assuming 0.25% interest is not considered a gift) to them by YOUR government, who devalues YOUR assets pretty much every single day with the US Dollar finishing at 78.72 yesterday, the lowest level since January.

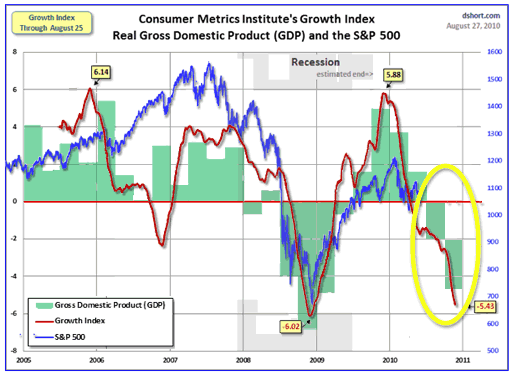

This, as I pointed out yesterday, masks the overall deteriorating fundamentals in our own economy with the Consumer Metrics Growth index posting what is becoming some scary readings, as detailed by The Automatic Earth, who point out that the S&P 500 lags the BEA data by about an additional quarter, so it can be shifted backwards about that much. This does not bode well for us in Q4 if the trends do not reverse themselves.

We have gotten some indication of improvement but a single report does not a rebound make and we already know Japan’s auto makers are posting some terrible numbers for September and we get the US data today so we’ll be on our toes for another excellent opportunity to short the Dow (it could be QQQQ or IWM or SPY as well but yesterday, the DIAs were our best target) but, unlike yesterday, we don’t have an obvious entry before the bell so I’ll have to call an audible in Member Chat.

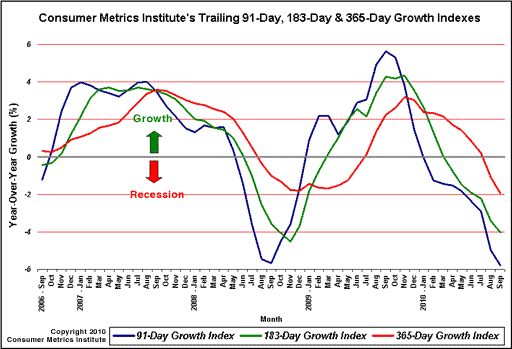

Rick Davis (no relation) of the CMI says: “The wild-cards in all of the GDP data are inventory builds, exports and industrial stimuli — all of which should reverse or soften in the 3rd and 4th quarters. It will be interesting.” Interesting? Obviously Rick doesn’t have any money invested in equities or commodities! Rick was also kind enough to provide a chart that superimposed the 91-day, 183-day and 365-day averages, which detail the alarmingly sharp downward trend we’ve been observing this month that turned us a lot more bearish on the short-term markets:

I would urge you to read Automatic Earth’s entire article (and thanks to John Rolls for pointing it out) as I still feel we’ve come too far too fast. We went ahead with our October Overbought Eight list, taking short positions into yesterday’s excitement. Our shortest-term play was our #1 picks, shorting the NFLX WEEKLY $170 calls at the open for $3.50, they finished the day at .25 – up a nice 92% but no where near as exciting as our ETF plays. Hopefully, we can have some more fun today to close out this exciting week.

Have a great weekend,

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.