Was TARP Good for the Taxpayers?

Politics / Credit Crisis Bailouts Oct 07, 2010 - 10:16 AM GMTBy: Robert_Murphy

On Sunday the Troubled Asset Relief Program (TARP) officially expired, though its "legacy programs" could continue for years. Lately there has been a growing campaign to tout the success of TARP, Henry Paulson's extremely controversial plan to use (originally) $700 billion of taxpayer money to save the financial system. Despite this chorus of praise, the TARP bailout was a terrible idea that will cost taxpayers both directly and indirectly through its perverse incentives.

On Sunday the Troubled Asset Relief Program (TARP) officially expired, though its "legacy programs" could continue for years. Lately there has been a growing campaign to tout the success of TARP, Henry Paulson's extremely controversial plan to use (originally) $700 billion of taxpayer money to save the financial system. Despite this chorus of praise, the TARP bailout was a terrible idea that will cost taxpayers both directly and indirectly through its perverse incentives.

The Politics of TARP

The Politics of TARP

Probably more than any other issue, the pundits' handling of TARP has been extremely political. There were many right-wing analysts who were for the bailout when Bush Treasury Secretary Hank Paulson proposed it in September 2008, and yet these supporters mysteriously became some of the fiercest TARP critics after Obama was in the White House. (Glenn Beck is the most obvious example, but there were others.)

On the other hand, I can't help but think that at least some of the left-wing analysts who are currently singing the praises of TARP would be singing a different tune had John McCain won the election. We can't know what would have happened in that alternate timeline, but I'm guessing many of these progressive bloggers would have excoriated the Republican bailouts of their fat-cat banker friends. (In fairness, Matt Yglesias and Paul Krugman have been consistent — they were for TARP, with caveats, from the beginning!)

Say what you will about Austrian libertarians, we are a pretty consistent bunch, who heap scorn upon massive expansions of government power — whether in economic, social, or military arenas — regardless of the party in power. For example, on these very pages I described TARP way back when as "The Great Bank Robbery of 2008."

Did Taxpayers Make Money on TARP?

In mid-September Matt Yglesias perfectly summed up the verdict being crystallized among interventionists in the blogosphere regarding TARP:

More opinion leaders really have an obligation to point out that TARP, the Troubled Asset Relief Program, looks set to go down in history as one of the most unfairly maligned policy initiatives of all time. The government took hundreds of billion dollars, gave it to banksters, and in exchange all we got was this lousy $7 billion in profit. Which is to say that even if TARP had no positive impact on the economy whatsoever, it had a negative cost to taxpayers. How many programs can you say that about? And how many of them are toxically unpopular?

The interesting thing here is that if you follow the link Yglesias himself provides, it is to a CNN Money article from last March with the headline, "Price Tag of TARP Bailout: $109 Billion." Now Austrian economists are famous for eschewing complex math, but even we can tell that $109 billion is larger than negative $7 billion.

If we dig into the article, we see where Yglesias came up with the claim that TARP "had a negative cost to taxpayers":

The government's unprecedented $700 billion economic bailout will actually cost taxpayers just 16% of that total, according to a Congressional Budget Office report released Wednesday.

The Treasury's losses on the Troubled Asset Relief Program (TARP) will total $109 billion over the program's lifetime, CBO latest estimates [made back in March 2010] show. …

TARP's two big moneysuckers are AIG and the auto industry.

AIG got TARP money in two forms: the government bought $40 billion in preferred stock and created a $30 billion line of credit for the company. CBO previously estimated the AIG bailout would cost the government $9 billion, but AIG hasn't paid the Treasury the quarterly dividends it owes. AIG's weak financial position prompted CBO to increase its loss projection to $36 billion — more than half of the AIG bailout cost.

Other major losses — a total of $34 billion — will come from TARP assistance to the automotive industry, CBO said. The government committed $85 billion to bailing out the automakers.

On the flip slide, the highly unpopular capital infusion for banks will actually net the government $7 billion, CBO expects — even including a $2 billion loss from CIT Group … which declared bankruptcy, and Pacific Coast National Bancorp, which was taken over by the Federal Deposit Insurance Corporation.

So let's be clear: When proponents say TARP "made money," they are narrowly referring to the infusion of funds into banks. The taxpayers have still lost money on the entire deal, because the slight profits on the bank investments have been dwarfed by the injections into AIG and the auto industry.

But even if we focus on the capital infusions into banks, it's hard to see how the Treasury made a good investment, or netted the taxpayers money.

First of all, the TARP plan was reconfigured almost the moment Paulson got his authorization. It was originally sold as a plan to buy troubled assets — hence the name of the plan. After Paulson got his $700 billion ransom payment, he instead decided to use the money not to buy mortgage-backed securities, but instead to acquire partial government ownership of major banks.

It's important to point out that at least some of these capital injections were offers that the executives couldn't refuse. We can never know exactly what went on in that room, but it seems likely that the strongest banks — which would look relatively healthy to markets if they had had the option to refuse a taxpayer bailout — were muscled into accepting packages by the Treasury Secretary.

This is an important difference. When TARP was first implemented, free-market economists were asking, "If these purchases of preferred bank stocks are such a good investment, why aren't people in the private sector putting up the money?" Yet private investors may not have had the option of acquiring some of the deals that Paulson was able to finesse with his privileged position.

Another important point is the risk involved. Just because an investment pays off in retrospect, doesn't mean it was a good idea all along. For example, if the United States Treasury offers loan guarantees to a shaky third-world government, in order to induce banks to accept its bonds, it may turn out not to "cost" the taxpayers anything. But it would be wrong to say such a loan guarantee had really been "costless," because in the event of a default, the taxpayers would have been on the hook.

A similar analysis holds for TARP. At least for the banks in the worst shape, they received generous terms from the Treasury. In other words, the Treasury infused capital into these banks at a risk of loss higher than private investors would have tolerated. The mere fact that this gamble didn't blow up in their faces doesn't prove it was a good idea.

The Role of the Fed

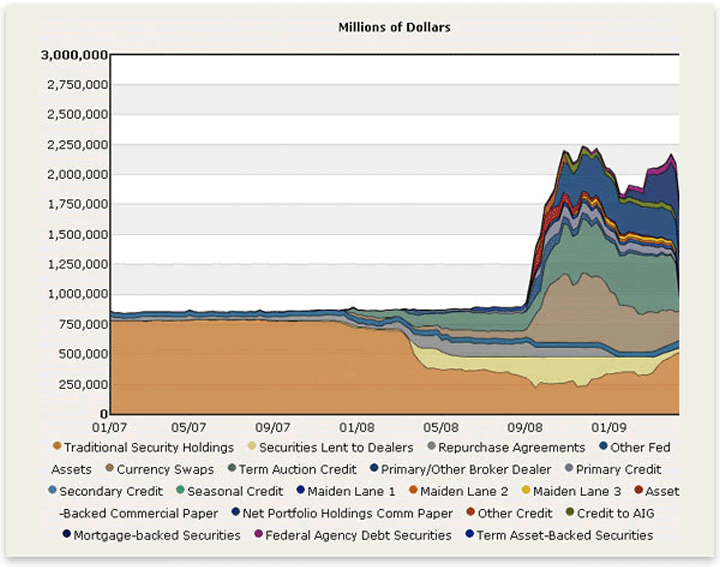

The role of the Federal Reserve is even more important than the above points. Under Ben Bernanke's leadership, and in coordination with then–New York Fed President Timothy Geithner, the Fed expanded its balance sheet by more than a trillion dollars in late 2008, relieving the banks of their bad assets through various purchases and other deals on terms that no private hedge fund would have offered:

So although the Treasury may have "made money" on a certain category of the TARP investments, this is hardly a boon to the taxpayer, because some (possibly all) of the major banks were propped up by the Fed's money creation. If this is success, then let's cut out the middleman. The Fed can simply print up $10,000 in new bills and mail them to every taxpayer. Woo hoo! We'd each make $10,000 on that deal, after subtracting out the Post Office's cut.

Dean Baker, a Keynesian economist who nonetheless can smell a rat, couldn't believe that the New York Times couldn't find any critics of TARP in its congratulatory write-up. Baker explained,

[If the NYT had found some critics], and they talked to them for their article on the end of the TARP, the critics likely would have told the NYT that the TARP preserved Wall Street as we know it. Had the market been allowed to do its magic, Citigroup, Goldman Sachs, Morgan Stanley, Bank of America, and many other fine institutions would have been bankrupt. This would have redistributed more than a trillion dollars of wealth from the shareowners, the creditors, and the top executives to the rest of the country.

By providing them with loans at below-market interest rates, the TARP and the much larger Fed and FDIC bailouts, allowed the banks to survive the crisis created by their own recklessness. This was like giving away food during a famine. The banks have repaid the food with interest now that the harvest has come in, but to pretend that we did not do them an enormous favor at enormous cost to taxpayers (we could have rescued others with these loans) is absurd.

Finally, even if we put aside all the above complications and concede that the TARP injections into the banks "made money," it was for the politicians, not the taxpayers. I certainly don't remember getting a dividend check in the mail for my share of the $7 billion profit that Yglesias trumpeted.

It is notoriously difficult to pin down money flows in Washington. But I have yet to be convinced that the government won't simply spend the incoming paybacks on other things.

Did TARP Prevent Another Depression?

A crucial point in the case for TARP is that without it, we would have plunged back into another depression. For example, Simon Johnson wrote last week,

People who are opposed to bailouts of any kind like to argue that TARP was not really necessary. Banks could have been allowed to fail and the economic fallout around the world would not have been so dramatic.

This was, of course, the view taken by policy makers in 1929–31, after the Great Crash. Top people at the Federal Reserve and Treasury argued that the United States had experienced a financial mania (true), that a fall in asset prices was long overdue (quite likely, at least for stocks), and that the right approach was to stand back and — in the unforgettable words of Treasury Secretary Andrew Mellon, let the private sector "liquidate labor, liquidate stocks, liquidate the farms, liquidate real estate."

The result was the Great Depression. No responsible policy maker would want to run that risk again.

There is so much wrong in the above quotation that it would take a whole book to set the record straight. For now, let me mention two things: First, the only source we have for that infamous Mellon quote is from Herbert Hoover's memoirs, and his point in setting up Mellon's position is to then declare that Hoover didn't listen to Mellon's advice. There is no ambiguity here; Hoover repudiates the liquidationist plan in his memoirs immediately after laying it out.

Second, we don't have to trust Hoover's memoirs to know that he wasn't a liquidationist. To take just one example, we can go look up in Wikipedia to learn that the Reconstruction Finance Corporation was established in the Hoover Administration in 1932 and "gave $2 billion in aid to state and local governments and made loans to banks, railroads, farm mortgage associations, and other businesses." The article then adds, "The loans were nearly all repaid." See, the taxpayers made out like bandits back in the 1930s, too!

Did TARP Restore Business Lending?

The primary reason that TARP allegedly averted another depression is that it fixed the credit markets. Here's Timothy Geithner praising his staff two weeks ago:

Two years ago the financial system was falling apart.

The banks and financial institutions that Americans rely on to protect their savings, help finance their children's education, and help pay their bills were at risk in ways few had ever experienced.

The institutions and the markets that businesses rely on to make payroll, build inventories, fund new investments, and create new jobs were threatened like at no time since the Great Depression.

Across the country, Americans were starting to question the safety of their money in our nation's banks, and a growing sense of panic was producing the classic signs of a generalized run. …

Now, TARP was not perfect. But it has delivered in ways few could ever have imagined.

It's not just that people are confident today that their money is safe in banks; it's not just that household wealth is much higher than when the President came into office; it's that the cost of borrowing for businesses and municipal governments has come down significantly; it's that families can again buy a new home or car at low rates and put their kids through college.

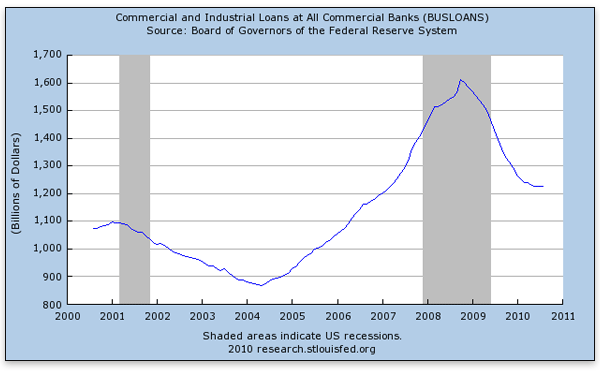

Geithner was wise to focus on interest rates, rather than the actual amount of loans going to businesses. Look at the chart:

Yes that's right, commercial and industrial loans at all commercial banks were at an all-time high … right when TARP was implemented. And then they fell like a stone. This doesn't prove that loans would have been higher in the absence of TARP, but it should make us pause when we hear how great the program was in getting credit to small businesses.

Conclusion

The TARP was crooked from the very start, using taxpayer funds to bail out some of the world's richest people from their own foolish investments. The claims that it made taxpayers money are unfounded. Even worse, TARP taught investment bankers an important lesson: During a boom, make as much money as you can, no matter how short-term the profits will be. When the bubble pops, the Treasury and Fed will be there with a taxpayer-funded pillow.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2010 Copyright Robert Murphy - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.