Crude Oil at a Crossroad of Inventory and Fed’s QE2

Commodities / Crude Oil Oct 18, 2010 - 04:11 AM GMTBy: Dian_L_Chu

Oil prices have continued to soften at $82.51 a barrel for November delivery on the NYMEX Friday after a Federal Reserve Chairman Ben Bernanke’s speech sparked some uncertainty as to how far the central bank will support the economy.

Oil prices have continued to soften at $82.51 a barrel for November delivery on the NYMEX Friday after a Federal Reserve Chairman Ben Bernanke’s speech sparked some uncertainty as to how far the central bank will support the economy.

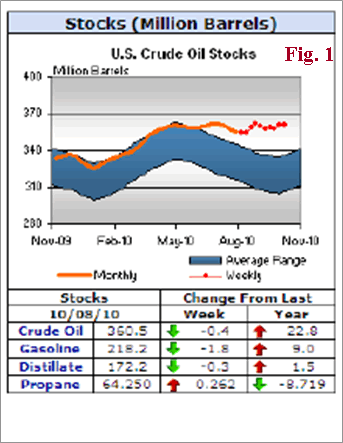

Crude was also weighed down by the weekly inventory report from the U.S. EIA. Despite a week-on-week draw of product and crude inventory, and supply interruptions from Canada due to Enbridge Inc. 670,000 b/d crude pipeline shut-in since Sep. 9, and at the Houston Ship Channel after a barge knocked down a power line, the overall stocks are still well above the 5-year average with a year-over-year increase (Fig. 1)

Decoupled from Equities and Metals

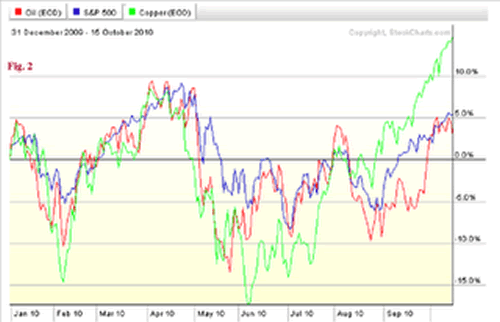

Crude oil prices had generally correlated with the base metals and equities on U.S. dollar weakness and strong Asian demand. However, due to the abundance of inventory and supply, crude has remained range-bound despite improved market sentiment, and started to decouple and underperformed other commodities with tighter supply conditions, such as copper, as well as equities. (Fig. 2)

According to Barclays, over the past month, the average price increase of base metals has been 11%, compared to only 3% for WTI crude. While this has surprised some traders, it is nevertheless a reflection of diverging market fundamentals, particularly in terms of supply.

Transparency Kills the Mystery

Crude oil prices are also at a “disadvantage” due to the lack of a cross-sector transparency. As one of the most widely traded and liquid commodity, oil has relatively better transparency in the form of weekly inventory / demand detail reporting and various widely available forecasts and analyses, while other commodities remain more “shrouded in mystery.”

So, from that perspective, crude is subject to more volatility cue to the weekly inventory report, and agencies’ demand/supply forecasts. (Just imagine if there’s a weekly inventory report with similar detail, say for gold, silver and copper).

WTI and Brent Disconnect

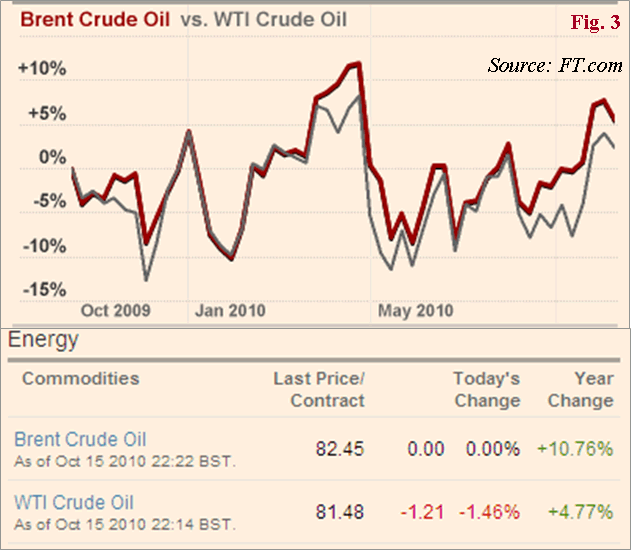

The persistent inventory overhang at Cushing, OK, the delivery point of NYMEX crude contracts, has also rendered WTI at a discount to the North Sea Brent (Fig 3), whereas WTI is a sweeter and higher grade crude than Brent, and should trade at a premium. This, in turn, has made WTI somewhat disconnected with the global picture, and diminished the status of WTI as a global oil price benchmark.

OPEC has voiced its concern about WTI, which culminated in Saudi Aramco’s decision last November to ditch WTI for the Argus Sour Crude Index to its oil for sale in the US market. (Saudi Aramco had priced its U.S. deliveries against WTI since 1994.)

And Reuters reported there’s new push from Asia-Pacific--user of a third of global crude-- in favor of European Brent to price Southeast Asian crudes. A Reuters survey of traders showed that by 2012, Brent is expected to replace other Asia-Pacific regional benchmarks.

This move will further extend Brent's influence--currently tops WTI and referenced in about 70 percent or global crude supplies--and most likely divert the trading volume from NYMEX into ICE, weakening the U.S. status as the world’s leading financial trading hub.

Meanwhile, widespread strikes, sparked by the pension reform, at all of France's 12 refineries have caused supply concerns among oil producers including Total, and if prolonged, could further widen the WTI-Brent spread. (However, it most likely will not have much impact on the U.S. since France is not one of the major importers of crude product into the U.S.)

"We'd Love to See $100 a Barrel"

While high stocks level traps crude, the 13 percent decline in the Dollar Index since June, on the other hand, has prompted some OPEC members to support $100 oil. For example, Bloomberg reported that Libya indicated “We would love to see $100 a barrel” to help offset the loss of revenue from the weaker dollar. And Venezuela claims the U.S. currency’s weakness means the “real price” of oil is about $20 less than current levels.

QE2 Brings New Normal To Crude

Federal Reserve Chairman Ben Bernanke said in a speech on Oct. 15 that the Fed is prepared to buy Treasury bonds to stimulate the faltering U.S. economy, i.e. a second round of quantitative easing (QE2), and that the interest rate will remain low and longer than the markets' expectation (meaning probably through 2012, instead of 2011).

Such policy typically will further weaken the U.S. dollar, while artificially pushing up prices of dollar-denominated commodities such as crude oil, which could lift crude oil into a New Normal of crude oil trading range of $80 to $95 a barrel from the current $70 to $85 price band, through the end of the year, along with lots more jabs from OPEC, particularly Hugo Chavez.

“Trader’s Market” Through Year End

For the remainder of the year, a “miracle story” in either the demand or supply side of the equation is highly unlikely. Barring geopolitics and/or an exceptionally freezing winter season, crude oil probably will be a “trader’s market” before 2011, and prices will be mostly dictated by its inverse relationship to the U.S. dollar, and the timing and extent of the widely expected QE2 from the U.S. central bank.

Asia Holds the Demand Card

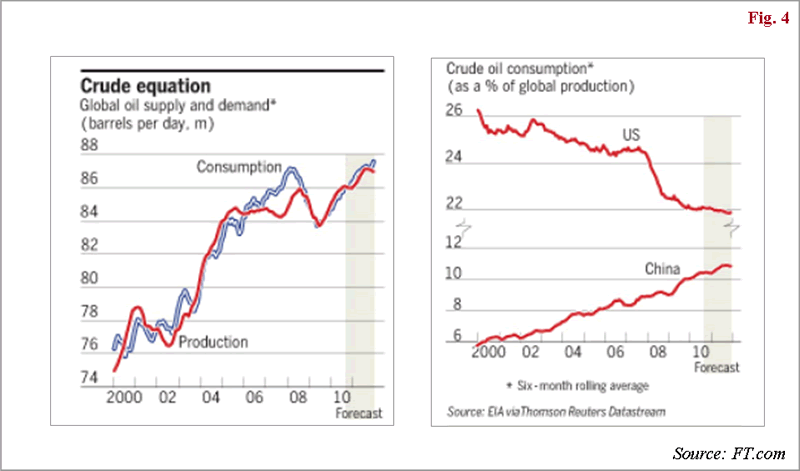

For now, Asia and the Middle East are expected to account for the majority of the world's oil demand growth over the next few years, while in the long term, demand is still looking to outstrip supply. (Fig. 4)

Furthermore, China might just put some extra excitement into the crude market next year as Bloomberg reported that China’s new strategic petroleum reserve storage tanks are expected to come online next year. This means Beijing could be ready to stockpile on strategic petroleum reserves to safeguard the country’s rapidly rising hunger for energy.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.