Gold and QE2 - Buy on the Rumour, Sell on the News?

Commodities / Gold and Silver 2010 Oct 21, 2010 - 08:13 AM GMTBy: GoldCore

Gold is little changed in London trading this morning with slight losses in dollar and euro terms and slight gains in Swiss franc and British pound terms. Expectations of QE2 are leading to further dollar weakness and continuing strength in commodities and precious metals. Gold could see a pullback on the QE2 announcement as we may see a "buy on the rumour, sell on the news" reaction from traders. However, the pullback would likely be another correction as physical demand, particularly from central banks, looks set to remain elevated for the immediate future.

Gold is little changed in London trading this morning with slight losses in dollar and euro terms and slight gains in Swiss franc and British pound terms. Expectations of QE2 are leading to further dollar weakness and continuing strength in commodities and precious metals. Gold could see a pullback on the QE2 announcement as we may see a "buy on the rumour, sell on the news" reaction from traders. However, the pullback would likely be another correction as physical demand, particularly from central banks, looks set to remain elevated for the immediate future.

Gold is currently trading at $1,347.13/oz, €960.18/oz, £854.51/oz.

Gold in GBP - 20 Day (Tick).

Gold in sterling remains near record nominal highs as the new government embarks on a radical fiscal experiment involving some £81 billion of public spending cuts and some 500,000 job cuts. The risk is that the cuts lead to further economic weakness and a double dip recession. Ironically, the dramatic cuts in and of themselves would likely be positive for sterling in the long term as the UK attempts to get its financial house in order. However, the UK's extraordinarily loose monetary policy and the risks posed by a new round of quantitative easing or QE2 could lead to sterling coming under pressure in the long term. Currency markets are becoming increasingly aware of the real risk of the debasement of major currencies such as sterling.

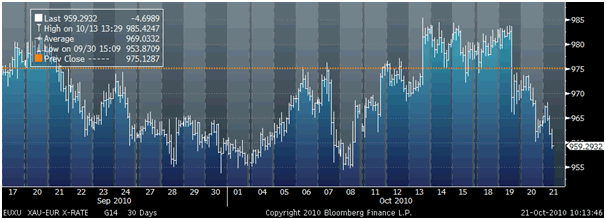

Gold in EUR - 20 Day (Tick) .

While the euro has strengthened against the dollar in the last month, it has only risen slightly in gold terms. The eurozone sovereign debt crisis has abated for now but the real risk is the long term one posed to the European Monetary Union. These risks have recently been annunciated by as warned of by some of the most respected financial minds in the world including Stiglitz, Soros and Buffett. These long term concerns should see the euro continue to come under pressure versus gold in the coming months.

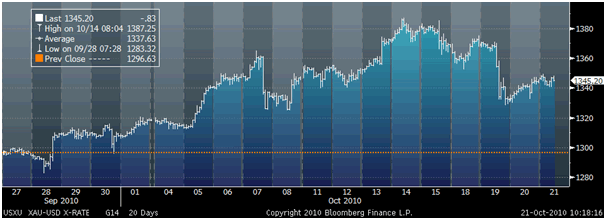

Gold in USD - 30 Day (Tick).

Geopolitical tensions between the US and western powers and Iran continue and may be leading to Iranian resource nationalism. Iran's gold reserves have hit a record high according to Central Bank Governor Mahmoud Bahmani. He said that Iran has supplied its domestic gold market for the next ten years and that "regardless of the recession gripping most of the world in 2008 and 2009, Iran's exports rose 10 percent, reaching 18.3 billion dollars." He claimed that the economic breakthrough came despite the West's efforts to put more pressure on Iran over its nuclear program.

Potentially, more of a risk are reports that China may slash exports of rare-earth elements next year as it is formulating a plan to protect its supply of the valuable material needed in advanced industrial and military products. President Barack Obama's spokesman said the National Security Council staff is looking into reports that China is blocking shipments. Press secretary Robert Gibbs told reporters travelling with Obama on a West Coast campaign trip "They've seen the reports" and "they're looking into them but don't have anything they could confirm about those reports."

Despite a large number of warnings from intelligence agencies of an increased risk of terrorist attacks, geopolitical risks including those posed by terrorism are not to the forefront of investors' minds right now. All that could change very quickly in the event of another terrorist attack on a major western city.

Silver

Silver is currently trading at $23.90/oz, €17.06/oz and £15.18/oz.

Platinum Group Metals

Platinum is trading at $1,679.50/oz, palladium is at $594/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.