Stock Market Increasing Evidence of Approaching Short-term Top, Gold Consolidating

Stock-Markets / Stock Markets 2010 Oct 25, 2010 - 04:04 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

Very Long-term trend - Down! The very-long-term cycles are down and if they make their lows when expected, the bear market which started in October 2007 should continue until about 2014-2015.

Long-term trend - In March 2009, equity markets began a corrective move in the form of a mini bull market. Many signs point to a continuation of this trend into 2011 and the surpassing of the April 2010 intermediate top.

SPX: Intermediate trend.The index made an intermediate top at 1220 and is now in an intermediate downtrend which should come to an end in October 2010.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Overview:

The stock market looks tireder and tireder, and in need of a rest. Two weeks ago, I already warned that we were coming into a short-term top, and gave many reasons why. The same reasons still apply today. Already, we have seen signs of topping in gold and the beginning of the creation of a low in the dollar index. These have been good gauges of the SPX trend in the past. Their behavior deserves our attention.

The signs of trend deceleration are noticeable, and we'll look at those signals specifically when we analyze the charts. The main question from investors is: "What kind of a reversal should we expect; how much of a pull-back, and for how long?"

Since the top formation has not yet been completed, we'll have to wait a few more days before we can make projections in terms of price and time for the coming retracement, but there is at least one simple way to picture it. If the pattern which was established in the SPX from May to September is that of an inverted head and shoulders, the break-out came when prices rose above the 1130 tops, and this is where the neckline should be drawn.

The normal process for a H&S pattern is for the index to break out of the base, and then return to the neckline before moving higher. This is probably what we should expect of the SPX over the next few weeks, and if its actual behavior deviates from our expectations, we can change our mind and figure out what else it is doing. But since the longer-term indicators show no signs of ending the long-term trend, it seems logical to only expect a short-term correction in the form of a pull-back to the neckline.

We'll start our analysis with the SPX Weekly Chart -- which we have not deciphered in a long time -- and then move on to the shorter time periods.

Analysis

The following bar chart, to which the correct trend and channel lines have been added, gives us a good perspective of the stock market trends, as represented by the SPX. The larger red and green channels delineate the bear and bull trends. The smaller blue and red channels, the intermediate trends.

What is clear is that we are currently in a bull market which started in March 2009 as a result of the bottoming of the 7-yr and 6-yr cycles. Its uptrend was temporarily interrupted by the bottoming 2-yr and 4-yr cycles, after which the uptrend resumed and continues to this day.

The trend is about to be interrupted again by the short-term correction discussed in Overview, and when it resumes, it will continue until the long-term cycles (7-yr, 6-yr, 2-yr and 4-yr) have made their collective tops. My guesstimate is that this will be in the first half of 2011, and in the vicinity of 1325. At some point, the very long cycles (40-yr, 120-yr) will take over and begin the second leg of this secular bear market, concluding in 2014-15.

The momentum indicators are in an uptrend, are not overbought, and show no signs of topping. Should some other scenario manifest itself, we'll identify it and adjust to it

Now let's move on to the Daily Chart and see why it is very likely that we are approaching the end of the rally which started at 1041.

The weekly trend showed no sign of topping, but there are plenty of signs showing the opposite on the daily chart.

At the beginning of the trend, there was a potential P&F base projection to 1168, and potential Fibonacci projections to 1176 and 1191. The SPX has already made a high of 1189 which may have satisfied the highest target. However, Friday's action opens the door for a possible move to about 1193, which is the P&F projection from the small base for the 3rd phase. I'll point out the phases when we look at the Hourly Chart.

Whether the rally stops at 1189 or moves a little higher is irrelevant. For all intents and purposes, the nearterm projections have been met. Note that the higher target coincides with some tough resistance levels which could turn the trend around. There is the top of the blue channel, resistance from the former April distribution top, and the declining red dotted line which represents the top of a channel formed by drawing the parallel to a line connecting the early February and July lows.

But most of the evidence for a top lies in the indicators at the bottom of the chart. The O/B-O/S momentum indicator has already turned down and is in a declining mode, and the breadth indicator is in a staircase decline, having found temporary support on its last trend line. This indicator action, while the index has been making new highs, is normally a sign that we are near the end of the trend. The only thing that remains to confirm a sell signal is the breaking of the third trend line from the lows. Each trend line marks the end of a phase.

The light blue line at the 1137 level points to an open gap on the chart. This would make a good target for the index when it starts to decline.

We can now turn to the Hourly Chart for a more detailed analysis of what it would take to end the rally.

I have identified and labeled the price progression since the beginning of the rally at 1040. Each completed phase was followed by a consolidation/correction. Each correction gave us a P&F projection for the top of the next phase. The final correction from 1185 gives us a projection to 1190-93 -- which could be extended to 1210 if there is a move above the top (dashed, blue) channel line which is strong enough to wipe out divergences in both daily and hourly indicators. Much of the SPX action will depend on the dollar behavior on Monday morning.

Cycles

From the last newsletter: "The only cycles which concern us at this time are the 9-mo and the 17-wk cycles. They should both make their lows near 10/18." These cycles, often clearly dominant, appear to have brought little down pressure on the market this time and only caused an 18-point retracement to mark the end of the second phase. It is possible that their effect will be felt in the coming days on the upside, instead.

Projections

Short-term projections for the SPX have been discussed earlier. If the rally should extend beyond 1193, the next target is probably 1210. The QQQQ has valid projections to 53-54.

Breadth

The NYSE Summation index (courtesy of StockCharts.com) has, once again risen to a new high -- a sign that the intermediate trend is not in danger of ending. But the RSI is overbought and showing some negative divergence signaling that a short-term peak is near.

Negative breadth divergence also exists in daily and hourly indicators.

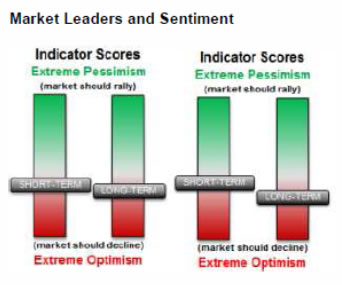

Market Leaders and Sentiment

I have kept the SentimenTrader (courtesy of same) of two weeks ago (left) to show how little change there has been with today's readings. The intimation is the same as that of the Summation Index, above; there is no appreciable danger to the intermediate trend, and this is also reflected in NDX:SPX ratio.

Gold

I want to reproduce what I said to my subscribers a week ago in the Week-end Report:

"I have been trying to determine price targets for GLD without taking into consideration the large re-accumulation base above 70. I used smaller re-accumulation phases above that level to derive projections, and it gave me a count which was inaccurate. I could not get a Point & Figure chart from Stock-Charts, because they do not have one available which extends back far enough. So I decided to create my own from the daily chart. The results are shown on the GLD weekly chart which follows."

The new targets have already been vindicated since GLD has reversed from the 134 level and started a correction, but it is unlikely that there will be a significant correction in GLD until after the 139 target has been reached.

I also want to show a long-term P&F chart of Gold, (courtesy of Investment Tools) which goes back to 1976. This chart shows the base from which the long-term measurement for gold should be taken. I apologize for the lack of clarity of the chart. It had to be reduced in size to fit properly on the page and this has blurred the image. However, it is still clear enough to get a count across the base of 45 squares. Multiply by 50, and it gives you a target of 2252.

Now, go back to the weekly chart of GLD on which long-term projections are made. Note that the next to highest target is 225. GLD is priced at approximately 1/10 the price of bullion, so if you multiply 225 by 10, you get 2250, the same price projection that you get on the long-term gold chart.

It will probably be several years before we know if this long-term projection for a major top on gold is correct, but if you have the same trust in the accuracy of P&F projections that I do, you should keep this number in the back of your mind.

Summary

There is continued evidence that we are approaching a short-term top, but confirmation will come only when the current uptrend line is broken and the SPX decline below 1160.

GLD has entered a period of consolidation after reaching its 134 projection. That could be a sign that the SPX is also ready to correct, especially if the USD has made a short-term low.

FREE TRIAL SUBSCRIPTONIf precision in market timing is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate the claims made by the following subscribers:

Thanks for all your help. You have done a superb job in what is obviously a difficult market to gauge. J.D.

Unbelievable call. U nailed it, and never backed off. C.S.

I hope you can teach me about the market and the cycles. I want to be like you and be the best at it. F.J.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.