Existing U.S. Homes Sales Advance, But Inventories Remain Problematic

Housing-Market / US Housing Oct 26, 2010 - 02:59 AM GMTBy: Asha_Bangalore

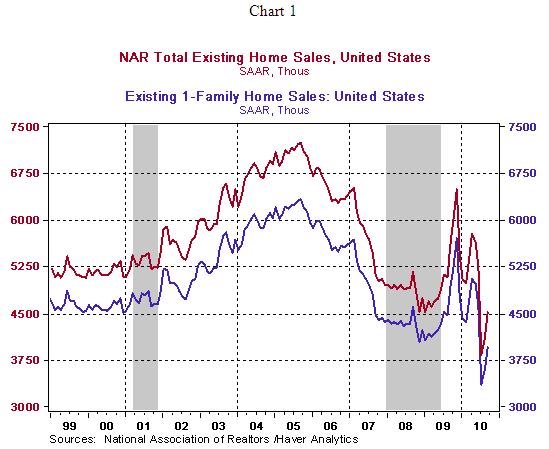

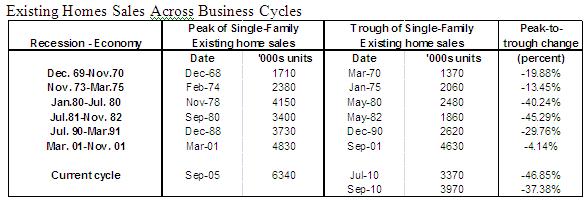

Sales of all existing homes rose 10% in September to a seasonally adjusted annual rate of 4.53 million units following a 7.3% increase in the prior month. Sales of existing single-family homes increased 10.0% to an annual rate of 3.97 million units during September vs. a 7.1% gain in August. On a regional basis, sales of all existing homes rose in all four regions of the nation, with the gains in the Midwest leading the group.

Sales of all existing homes rose 10% in September to a seasonally adjusted annual rate of 4.53 million units following a 7.3% increase in the prior month. Sales of existing single-family homes increased 10.0% to an annual rate of 3.97 million units during September vs. a 7.1% gain in August. On a regional basis, sales of all existing homes rose in all four regions of the nation, with the gains in the Midwest leading the group.

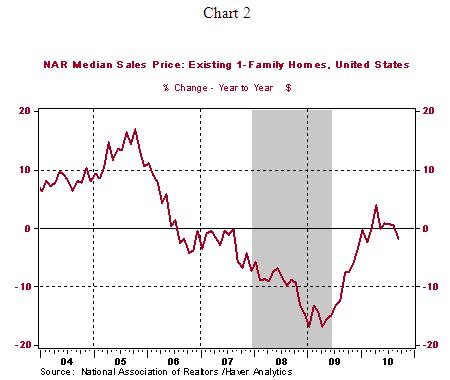

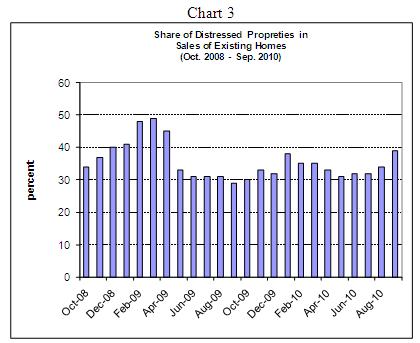

The median price of an existing single-family home declined 3.1% from August to $172,600 during September. From a year ago, the median price of an existing single-family home is down 1.9%. Elevated level of unsold homes and distressed properties are the reasons for declining home prices. According to the National Association Realtors, 39% of all home sales in September were distressed homes, up from 34% in August 2010 and 29% in September 2009 (see chart 3).

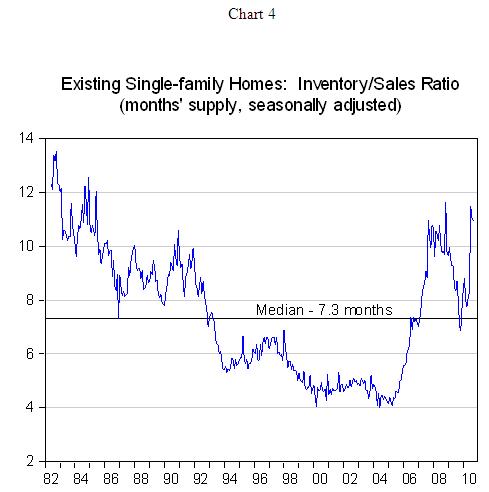

In addition to foreclosed homes, the inventory of unsold homes holds at an elevated level (see chart 4). There was a 10.95-month seasonally adjusted supply of unsold homes in the marketplace in September 2010, putting third quarter average at an 11.2-month mark. The back-to-back monthly gains in sales of existing homes are encouraging but more is necessary for housing market stability.

"Austerity" Overlooked in the United States

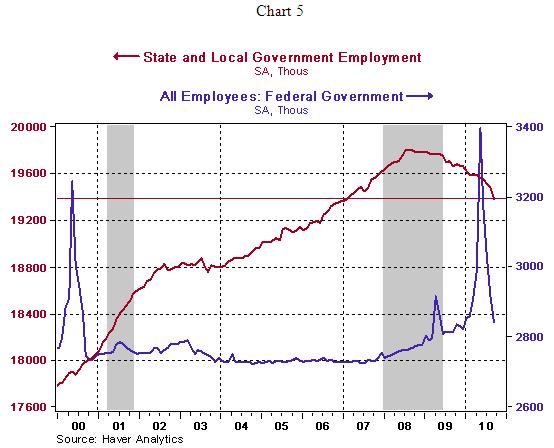

There is a great deal of chatter about "austerity" in Europe and the resolve of these nations to tighten government spending. The nearly 500,000 government jobs lost from the "austerity" program in the United Kingdom has made many headlines. "Austerity" in the United States has received scant attention. State and local government employment has dropped 416,000 between August 2008 and September of 2010 (see chart 5). Federal government employment has moved up only slightly after adjusting for the spike from temporary Census-related employment. In sum, overall government employment has dropped during the current recession. Employment at state and local governments is at the level seen in early-2007. Austerity in the United States would have more severe if the stimulus package did not include support for state and local governments.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.