Case-Shiller U.S. Home Price Index Dips in August as Jobs Outlook Remains Poor

Housing-Market / US Housing Oct 27, 2010 - 04:07 AM GMTBy: Asha_Bangalore

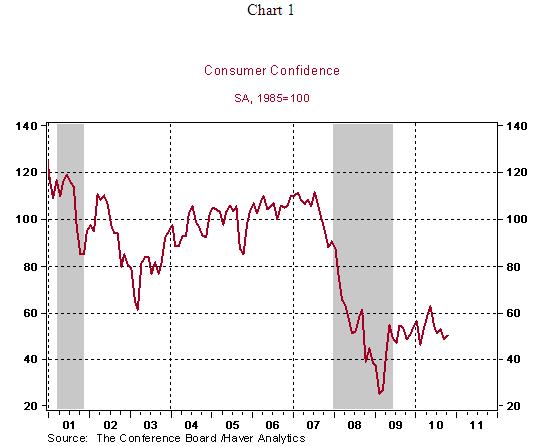

The Conference Board's Consumer Confidence Index increased to 50.2 in October from 48.6 in the prior month. The Present Situation Index rose to 23.9 from 23.3 in September and Expectations Index moved up to 67.8 from 65.5 in September.

The Conference Board's Consumer Confidence Index increased to 50.2 in October from 48.6 in the prior month. The Present Situation Index rose to 23.9 from 23.3 in September and Expectations Index moved up to 67.8 from 65.5 in September.

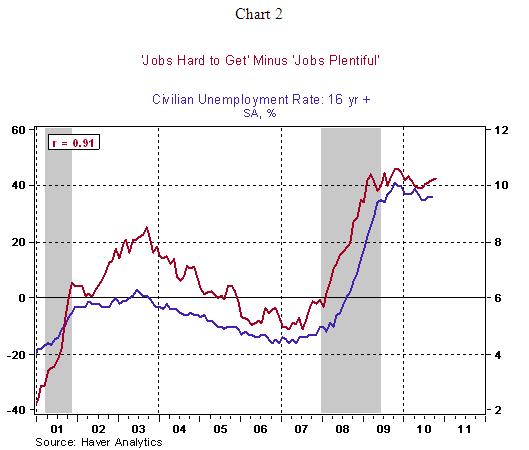

A large number of respondents indicated that "jobs are hard to get" in October (46.1 vs. 45.8) compared with the readings of September. The number of respondents noting that "jobs are plentiful" slipped to 3.5 in October from 3.8 in September. The net of these two indexes is positively correlated with the unemployment rate; a widening of this net suggests a higher unemployment rate in October vs. the 9.6% jobless rate in September.

Case-Shiller Home Price Index Dips in August

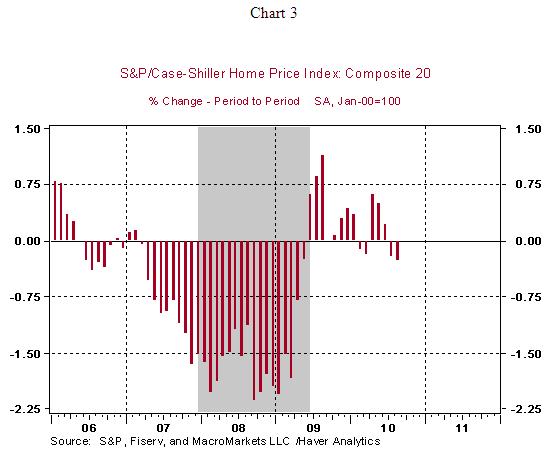

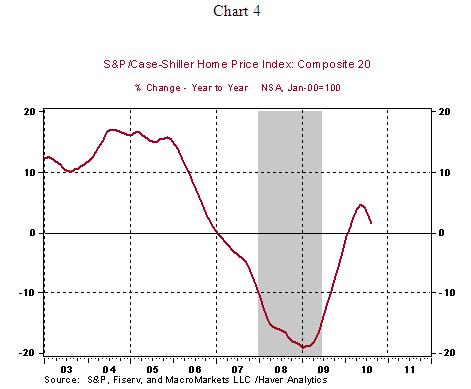

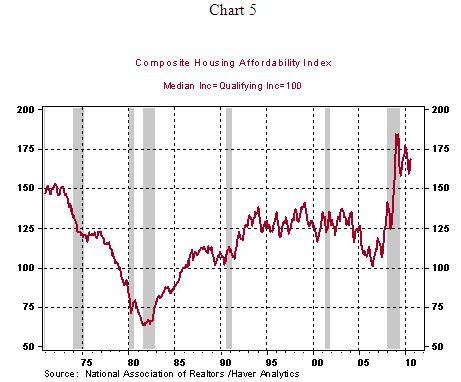

The Case-Shiller Home Price Index fell 0.28% in August after a 0.21% drop in July. The declines of the home price index reflect the impact from the expiration of the first time home buyer tax credit program. The Case-Shiller Home Price Index rose 1.7% in August from a year ago, representing a decelerating trend (see chart 4) in the short period during which home prices have risen. Of the 20-metropolitan areas the index tracks, eight (Washington D.C, New York, San Francisco, Los Angeles, Minneapolis, Boston, San Deigo, and Phoenix) posted year-to-year increases, while the remaining showed declines in home prices. The large inventory of unsold homes holds the key to problematic home price situation. As mentioned in earlier commentaries, although houses remain affordable (see chart 5), the absence of support from hiring continues to hold back improvements in the housing market.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.