Gold Consolidates in October as QE2 and US Elections Loom

Commodities / Gold and Silver 2010 Oct 29, 2010 - 07:43 AM GMTBy: GoldCore

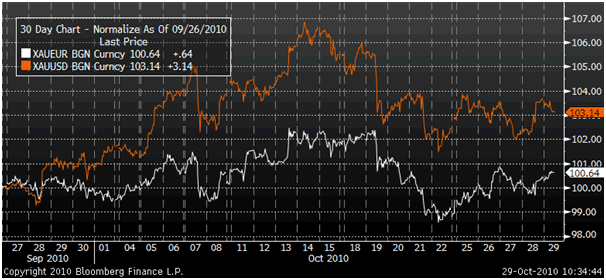

Gold is marginally lower in dollar terms and in most currencies except for the euro this morning as there are renewed budget and sovereign debt concerns in the eurozone. Peripheral sovereign bonds have fallen sharply in value (see below) - although losses were limited by rumours that the European Central Bank may have resumed bond purchases. This is leading to weakness in the euro and gold rising in euro terms as traders question whether the period ofrecent euro strength was overdone.

Gold is marginally lower in dollar terms and in most currencies except for the euro this morning as there are renewed budget and sovereign debt concerns in the eurozone. Peripheral sovereign bonds have fallen sharply in value (see below) - although losses were limited by rumours that the European Central Bank may have resumed bond purchases. This is leading to weakness in the euro and gold rising in euro terms as traders question whether the period ofrecent euro strength was overdone.

Gold is currently trading at $1,341.13/oz, €967.77/oz, £842.35/oz.

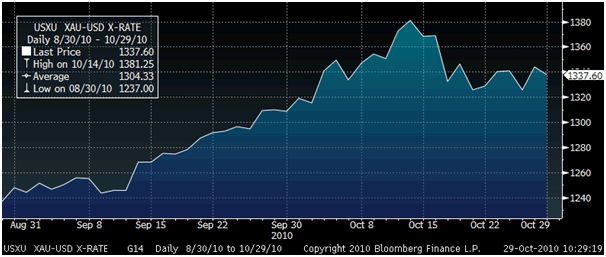

Gold in USD - 60 Day (Daily).

Markets are keeping an eye on the midterm elections next Tuesday with polls showing that Republicans may gain control of Congress. Traditionally, gold has performed better during periods of Democratic power as they have traditionally been less fiscally conservative than their Republican rivals. However, in recent history, Republicans under George Bush spent money in a manner that would make a drunken sailor proud. The fiscal challenges facing the US are of a magnitude that no matter which party comes out on top in next week's midterm elections, gold is likely to remain robust for the foreseeable future. Indeed, it is hard to see how gold could fall significantly as long as interest rates remain near zero and fiscal and monetary policy remains extremely expansionary.

Gold closed last week at $1,328.55/oz and so is marginally higher on the week. Gold's close today will be important and a higher weekly close will negate the negative short term technical picture generated by last week's lower weekly close.

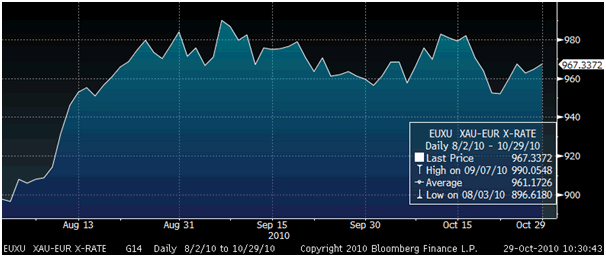

Gold in Euros - 90 Day (Daily).

While gold fell last week, gold is set to close October some 2% higher (2% in dollars, 0.8% in euros and 1% in British pounds) which means that the medium and long term technical situation remains positive. Gold has consolidated in October after the very sharp gains seen in September.

While stock markets are also set to finish October positively, Treasuries are set for their first monthly decline since March due to increasing concerns about QE2 and the real risks it poses to the dollar and bonds and the growing risk of inflation and stagflation.

Gold in Dollars and Euros - 30 Day.

Gold priced in euros has consolidated between €950/oz and €1,000/oz in September and October, despite the recent relief rally in the euro. But the challenges facing the eurozone economies and debt markets remain immense and renewed euro weakness should see gold challenge the €1,000/oz level in the coming months.

In Greece, 10-year bonds weakened for the fifth consecutive day, pushing the extra yield over German bunds above 800 basis points for the first time since October 1. In Portugal, the failure of the government and the main opposition party to reach agreement over the country's 2011 budget hung over the market, widening the 10-year yield spread against German Bunds by as much as 20bp to 362bp. The Irish-German spread touched 462bp, the widest in a month, while five-year Irish credit default swaps soared 21bp to 465bp.

Silver

Silver is currently trading at $23.98/oz, €17.30/oz and £15.05/oz.

Platinum Group Metals

Platinum is trading at $1,688.50/oz, palladium is at $636/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.