Gold Divorces from the U.S. Dollar

Commodities / Gold and Silver 2010 Oct 31, 2010 - 11:45 AM GMTBy: Barry_M_Ferguson

Nobody knows nothing. The data, cooked and contrived as it is, gives no definitive answer. The bulls think the economy is mending but ever so slowly. The bears think the economy is taking on water and bound to sink like the Titanic. Investors are clueless and there is an election a few days away. Bernanke described the current conditions very well with his ‘unusual uncertainty’ reference a few months ago. We are all guessing. Which way is Bernanke guessing?

Nobody knows nothing. The data, cooked and contrived as it is, gives no definitive answer. The bulls think the economy is mending but ever so slowly. The bears think the economy is taking on water and bound to sink like the Titanic. Investors are clueless and there is an election a few days away. Bernanke described the current conditions very well with his ‘unusual uncertainty’ reference a few months ago. We are all guessing. Which way is Bernanke guessing?

SuperBen emerged from the Jackson Hole retreat at the end of August hell bent on another round of quantitative easing. My posts from September chronicle the casino’s reaction (www.bmfinvest.blogspot.com). In layman’s terms, quantitative easing is when the Fed snaps its fingers to conjure dollars with which they then buy US Treasuries from the shill banks that are required to buy the debt issuances of the US Treasury. Obviously the idea is to stoke the economy by pumping trillions into the banking system. Banking voodoo quickly turns a trillion into ten times that with the lending power of nine. The Fed would not consider doing such a thing unless the economy was in critical condition. Point taken.

The poor old US dollar, though, is in for a shellacking if the Fed pulls a trillion out of its derriere. Sure, the Fed pretends that creating dollars from a mouse click in a spreadsheet isn’t really increasing the dollar supply but who’s kidding who? Since their inception, the Fed has destroyed the dollars value. In fact, they have substituted the Federal Reserve Note for the Dollar Bill. The Federal Reserve Note is a promissory note. It is a debt instrument in and of itself. It has no value whatsoever. But this is the Fed’s con game.

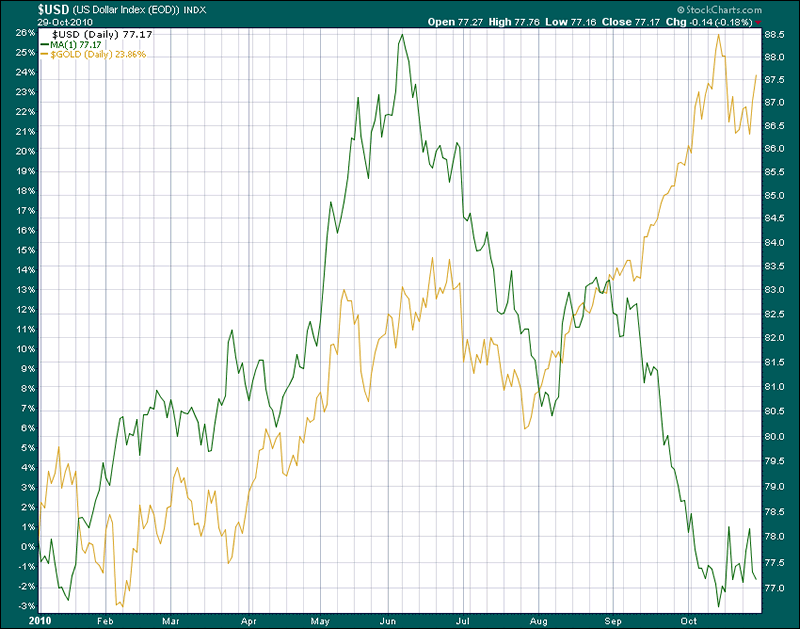

But what about inflation? Most people associate inflation with currency devaluation. Indeed, as the Fed has increased its balance sheet by creating electronic dollars to buy Treasuries, inflation has accelerated. Commodities of all types are on the rise and will likely continue the upward trajectory with more quantitative easing. Most people who believe inflation is rising also believe gold is a hedge against inflation. However, that’s not entirely correct. Gold is more of an alternative to currency. In fact, gold and the dollar are like a marriage. I included the chart below which is a year-to-date look at gold and the US dollar. The fact is, the two climbed in harmony (the chart is not meant to be of scale) until Bernanke emerged from his hole at the end of August. Suddenly, it seems that gold and the dollar have filed for divorce. The moment Bernanke brought up the subject of QE2, gold and the dollar went their separate ways. The driving force in the separation is not inflation or even monetary supply. The driving force is the Fed. They are the fornicator.

What does the chart imply as we move forward? It all depends on QE2 and how much Bernanke pumps into the banks. If he goes for a trillion or so, gold looks poised to rocket higher. If blundering Ben disappoints investors with less than $500 billion, the dollar may find footing and gold may tumble. Whatever you invest your money into, pay attention to Ben. He is the ruler of Wall Street and whatever he does will have an instant impact. A big QE2 should be good for gold and bad for the dollar. Divorces are always an ugly matter.

YTD - GOLD in gold and US Dollar in green

Chart courtesy StockCharts.com

Disclaimer: The views discussed in this article are solely the opinion of the writer and have been presented for educational purposes. They are not meant to serve as individual investment advice and should not be taken as such. This is not a solicitation to buy or sell anything. Readers should consult their registered financial representative to determine the suitability of any investment strategies undertaken or implemented. BMF Investments, Inc. assumes no liability nor credit for any actions taken based on this article. Advisory services offered through BMF Investments, Inc.

Barry M. Ferguson, RFC is President and founder of BMF Investments, Inc. - a fee-based Investment Advisor in Charlotte, NC. He manages several different portfolios that are designed to be market driven and actively managed. Barry shares his unique perspective through his irreverent and very popular newsletter, Barry’s Bulls, authored the book, Navigating the Mind Fields of Investing Money, lectures on investing, and contributes investment articles to various professional publications. He is a member of the International Association of Registered Financial Consultants, the International Speakers Network, and was presented with the prestigious Cato Award for Distinguished Journalism in the Field of Financial Services in 2009.

Barry M. Ferguson, RFC

President, BMF Investments, Inc.

Primary Tel: 704.563.2960

Other Tel: 866.264.4980

Industry: Investment Advisory

barry@bmfinvest.com

www.bmfinvest.com

www.bmfinvest.blogspot.com

Barry M. Ferguson, RFC is President and founder of BMF Investments, Inc. - a fee-based Investment Advisor in Charlotte, NC. He manages several different portfolios that are designed to be market driven and actively managed. Barry shares his unique perspective through his irreverent and very popular newsletter, Barry’s Bulls, authored the book, Navigating the Mind Fields of Investing Money, lectures on investing, and contributes investment articles to various professional publications. He is a member of the International Association of Registered Financial Consultants, the International Speakers Network, and was presented with the prestigious Cato Award for Distinguished Journalism in the Field of Financial Services in 2009.

© 2010 Copyright © 2010 Copyright BMF Investments, Inc. - All Rights Reserved

Disclaimer: The views discussed in this article are solely the opinion of the writer and have been presented for educational purposes. They are not meant to serve as individual investment advice and should not be taken as such. This is not a solicitation to buy or sell anything. Readers should consult their registered financial representative to determine the suitability of any investment strategies undertaken or implemented.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.