Silver Breaks Out From Price Manipulation, The Gains Will be Breath Taking

Commodities / Gold and Silver 2010 Nov 03, 2010 - 06:43 PM GMTBy: Jim_Willie_CB

A love affair with silver is so natural. The fundamentals are astoundingly positive and bullish in price prospects. My basic argument has been repeated many times. Industry has countless uses for silver, significant demand. But industry has only miniscule isolated uses for gold, in trivial demand. So silver wins on the Demand side of the equation. Central banks own a huge amount of gold. They frequently sell it, even through their slippery surrogate the Intl Monetary Fund. Central banks own zero silver. So silver wins on the Supply side of the equation.

A love affair with silver is so natural. The fundamentals are astoundingly positive and bullish in price prospects. My basic argument has been repeated many times. Industry has countless uses for silver, significant demand. But industry has only miniscule isolated uses for gold, in trivial demand. So silver wins on the Demand side of the equation. Central banks own a huge amount of gold. They frequently sell it, even through their slippery surrogate the Intl Monetary Fund. Central banks own zero silver. So silver wins on the Supply side of the equation.

My motto is that gold fights the major political and financial war, but silver will ride in on a shiny white horse and take much larger spoils. That effect has already begun. Since the significant game changing FOMC meeting on September 21st, where the telegraph message delivered to the world financial markets was made by megaphone, the impact has been clear and stark. Compared to closing prices on September 21st versus October 29th, just five weeks, the silver price had risen from $20.64 to $24.56, up 19.0%. During the same timespan, the gold price had risen from $1274.30 to $1357.60, up 6.5%. My claim, a loose forecast often repeated, has been that the silver breakout gains would be at least double and possible triple the gold gains. We have seen exactly that in recent weeks.

An extremely fuzzy factor is the CFTC attention. The Commodity Futures Trading Commission is supposedly investigating the Big Four Banks for gigantic concentrated short positions in the silver market, for naked shorting of silver, and for collusion with other banks. Commissioner Bart Chilton has made a lot of noise, but has done next to nothing. Some find encouragement, an absurd notion in my view. Let me know when court injunctions are slapped at JPMorgan. Several class action lawsuits against JPMorgan have begun, also encouraging, but unclear on substance. They crop up every couple weeks, the latest citing a RICO aspect. Let me know when the full force of the USGovt regulatory bodies order JPMorgan, Goldman Sachs, Citigroup, and Bank of America to liquidate even 10-20% of their short positions. Unless and until such action occurs, the CFTC chirping is just that, noise from the managerie of obedient pets who work on short leashes at the behest of bankers. Mail room clerks do not give orders or make demands to the executive suites, not now, not ever. The regulatory chiefs are mere squires to the bankers, and will follow orders, not give them. By the way, the Big Four positions are naked short positions in all likelihood. They are immune from posting collateral, as required by the metals exchanges. So they routinely sell a stack of silver whenever the price moves have been made, like in the wee hours this Wednesday and very early at the New York open. Good Morning New York resulted in almost a full $1.00 drop in the silver price, undoubtedly another naked short raid before the QE decision by the US Federal Reserve and its statement. The full impact of the ambush decline was reversed by afternoon. Right before important events deemed negative nasty to the USDollar, the Big Four go wild with naked shorts, called ambushes. The evidence, the trails, the fingerprints are easily seen except by blind men, official gold industry wonks, and USGovt regulators.

SUPPLY & DEMAND BASICS

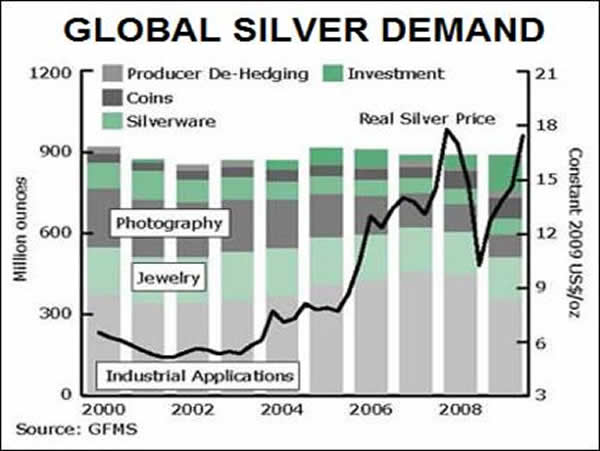

Silver total demand was essentially flat in 2009 versus 2008, as the world adjusted to a mammoth meltdown late in 2008. During the extraordinary disruptions, disturbances, and sudden insolvencies, JPMorgan liquidated much of the inherited (commandeered) precious metals accounts from Bear Stearns and Lehman Brothers. In the case of Bear Stearns, a solid argument can be made that they were targeted for kill due to their long gold account. In the case of Lehman, they were targeted fro kill in order to consolidate the power structure in the twin monoliths at JPMorgan and Goldman Sachs. On silver demand, the bulk of the 11.9% decline in the 2009 fabrication demand was primarily driven by the global financial crises. The reduced drop in industrial requirements was the lowest level since 2003. Total fabrication demand totaled 729.8 million oz and industrial demand was 352.2 moz in consumption. Much of the decline in factory demand was attributed to the car industry.

Implied net silver investment increased by a staggering 184% to 136.9 million oz last year, reaching its highest level in 20 years. Overall jewelry demand fell slightly by 1.1% in 2009 to 156.6 moz, a testament to the historical norm. It falls with a bull market, not to contradict it, but to confirm it!! That is the opposite message, contrary to what the official gold industry propaganda preaches. In fact, India and China posted increases in jewelry demand last year, outside the global trend. Silverware demand rose by a decent 4.6% to 59.5 moz, largely due to a surge in Indian fabrication. Their middle class grows impressively.

As for supply, the silver mine production rose by 4.0% to 709.6 moz in 2009. Gains came both from primary silver mines and output from mining by-product. The strongest growth came from Latin America, where silver output increased by a hefty 8%, the biggest gains logged in Argentina and Bolivia. Again Peru was the world leader in silver production in 2009, followed by Mexico, China, Australia, and Bolivia. All of these countries saw increases last year except for Australia, where output was dragged down from the lead/zinc sector, with the by-product impact. Some mines are devoted solely to silver targets, called primary silver projects. Global primary silver output saw a 7% increase in 2009, accounting for 30% of total mine production last year. The cash operating costs for primary silver mines remained relatively stable, rising by less than 1% to $5.23/oz in 2009. The big story is the huge decline in net silver supply from above ground inventory stocks, which were reduced by 86% to 20.2 moz in 2009. The drawdown was driven mostly by the surge in net investment, higher de-hedging (the active reduction in forward sale contracts), lower government sales (like official mints), and a drop in scrap supply. The scrap supply came down by 6% from 2008, enough to register a 13-year low of 165.7 moz. It was the third consecutive year of losses in the scrap category. Government stocks of silver, the feeder in official coin mint programs, fell by an estimated 13.7 moz last year, to reach their lowest levels in more than a decade. Data was supplied by the Silver Institute (SEE LINK).

IMPACT OF Q.E. CANCER

The big event on the horizon has been the US Midterm Elections, just completed. Its outcome was close to poll expectations. Many decisions have been delayed. Much detail has been withheld. Unfortunate pauses have come as a result. A palpable dread can be identified and pointed to. Difficult unpopular decisions will now be made. Some of the decisions will involve continued bank sector welfare after failed fiduciary responsibility. Some of the next programs or legislation will involve devious political and legal cover for criminal bond fraud related to the mortgage industry, which is fully in the open for dissection, outcry, and acrimonious debate. Basically, the bank sector will see great maneuvers to be supported, protected, with escape routes, now that the consequences of voter backlash are out of the picture. Furthermore is the issue of political partisan gridlock. Only dim bulbs would call the gridlock constructive or a good thing in the current setting. When a nation is mired in a financial crisis, requires leadership, demands restructure, and urgently needs reform, any inaction from gridlock is like fighting over the steering wheel on a big tractor trailer truck unable to manage a winding road, certain to careen over the cliff. Some analysts use the term public serpents to describe public servants, which seems spot on. Activists should demand that private bank accounts be investigated of committee heads, or even past Secretary of State (Colin Powell), or joint chiefs of staff at the Pentagon, or past SEC and CFTC heads. While at it, check the bank accounts of past presidents too.

The most reliable and expert sources within my contacts mention a specific point, with consistency. When the US elections are over, and after the USFed gives some guidance on the QE2 Launch for monetized debt, the system will experience tremendous added strains and will gradually show signs of breakdown again, in accelerated mode. This time, unlike September 2008, efforts to stabilize will not be possible. The system will degrade, as supports, pylons, control cables, levers, guy wires, and buttresses will be removed in the coming weeks. The Midterm Elections served at the roadblock event, the beacon on the horizon, the gate factor, the delayed lit fuse. The actions taken in November will involve both the US captains and foreign entities. The US brass can act without as much concern of voter backlash. The foreign financial decision makers can act with knowledge that the USGovt, the USFed, and Wall Street will not make a single solitary move toward bank system reform, toward bank debt restructure, or toward debt liquidation on the balance sheets. Instead, the US will redouble the magnitude of what failed, their habit, their engrained failure in policy, their legacy.

The main worry by the USFed and USDept Treasury will center on foreign creditors and abandonment. US bank leaders will ramp up the monetization under the QE2 banner with added motivation. Trade war stokes the fires of hostility, angst, and rebuke. Foreign creditors are worried that their debt security paper is being diluted. Its value will be diminished, but later in time. Expect a new European Dollar Swap Facility to be announced soon, but with less delay than the last one. They must match and offset the power of the QE2 initiative. It could be urgently declared by EU in next several weeks. They must defend against a rising Euro currency. Do not be trapped into thinking a USTreasury Bond rally means a USDollar coincident rise. The USTBonds are from the Printing Pre$$, which means no source of funds to convert. The Jackass still believes 2.0% is an important 10-year USTreasury yield target. All hell breaks loose after the target is hit, as the USTBond bubble is likely to give off massive greenhouse gas afterwards.

UNWIND OF TREMENDOUS SUPPRESSION

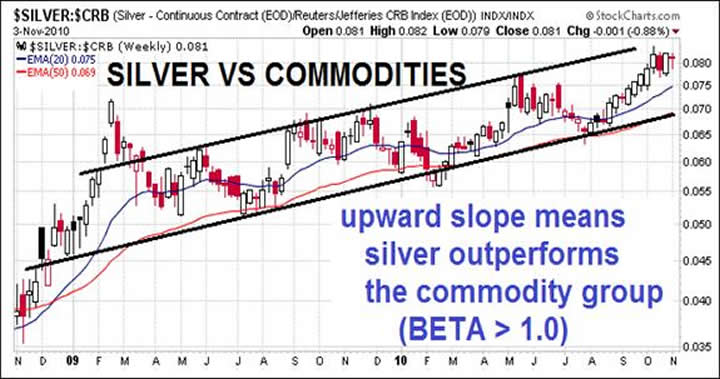

When professional equity analysts ply their craft in examining the merits of a certain stock, they often use a simple statistical technique. They fit a model of the growth in a stock Y versus the sector X in which it trades, like BAC (Bank of America) versus the BKX (bank index). They fit a model of the growth of a major stock Y versus the X market backdrop, like IBM versus the S&P500 index. A stock Y performs well if it does better than its sector or does better than the entire market. That shows up as a BETA over 1.0 within the fitted model using data as weekly change entries in price for X and Y. Take silver as Y and the entire commodity arena as X, as measured for instance by the CRB index. Clearly silver rises and falls with the commodities, and even makes swings with more volatility than other items. That testifies to a high silver BETA. Lately, the silver move has been powerful, much bigger than other commodity items since it is being recognized as a currency hedge, a safe haven asset, with the menace of lawsuits and investigations hanging overhead. In fact, Silver is a currency, if pure money can be classified as currency at all. Like gold, silver is a super-currency.

Y = α + β X

The important aspect to highlight of the linear price change model is the ALPHA component. When an asset or stock has a particular advantage or unique strength, it can outperform its class. Take for instance a pharmaceutical firm with a vaccine discovery, or a computer firm like Apple with a nifty IPod winner, or a mining firm with a huge ore discovery or great process improvement. Silver and gold each share a robust ALPHA feature that is not often mentioned, even in the gold community. As the monetary system crumbles further, as the big banks topple amidst insolvency, as the sovereign debt for certain nations defaults, as the USGovt deficits spiral endlessly into the $trillions, the concept of real money is being questioned by important chambers of global finance. Money wants to escape the false monetary clutches, and find true safe haven. Sound money is sought out with increased vigor and even desperation to preserve wealth. At the same time, illicit activity from two to three decades of gigantic price suppression, extended from enormous naked short positions being revealed, has conspired to suppress the price of gold & silver. The slow healing of the market infestation reveals the manifestation of the Silver Alpha, during its release.

The monetary system works gradually to unmask the corrupt precious metals market, and to lay bare the absent bullion at the official metals exchanges. Angry depositors like the Chinese and Arabs have been demanding their bullion for return back home, no longer trusting the London and New York banksters. They have grown fully aware of illicit gold leasing as commonplace. The fraud of the USGovt balance sheets, recording deep storage gold as a ledge item, an utter absurdity, only adds to the motive to unmask the banksters at their own game. The fast rising deadly USGovt deficits has brought cries to prove the collateral for new debt added upon old debt, in an uncontrollable debt episode. The world pursues gold & silver, knowing the USGovt has none, even as it continues to suppress its price with heavy hands. Foreign creditors are angry that the gold & silver they hold has been pushed down in price by illicit USGovt devices.

The consequence is that SILVER possesses a high ALPHA. What lifts the ALPHA is many factors, each powerful. The Silver price will rise much more than price inflation. The Silver price will rise in response to money fleeing corrosive vehicles like the major currencies, whose basis is not gold but rather rapidly growing debt resting upon broken banking and economic foundations. The Silver price will rise as the USTreasury Bond bubble becomes more widely recognized. The Silver price will rise as greater volumes of freshly printed money undermine the USDollar well behind controlled activity. The Silver price will rise more than most analysts anticipate out of the sheer release from corrupted markets that hold down the price after a mountain of silver has been shorted in the market without collateral. THIS IS THE ESSENCE OF ALPHA!! The shorts are being squeezed, in clear fashion since August. The naked short quantity for Silver is well beyond a full year of annual global output from the mining industry. As the markets work toward a freely traded system that seeks a true equilibrium, the Silver price will move past $100 per ounce easily. Laughter now will be followed by sheepish quiet in three years. But first it will surpass the $40 price, maybe as soon as late 2011 or early 2012. The silver ALPHA is big, and that fact will be quite evident very soon, if not already. My forecast is for a $29 to 31 price for Silver by mid-January. Both December and January are strong seasonal months for silver, just like September. Notice how silver is outperforming the commodity group, and shows a BETA over one.

INELASTICITY PARADOX

In many recognized markets, a higher price dampens demand, and a higher price adds to new supply. That is the normal Elastic market. Imagine the price of beef steak like tenderloins or porterhouse or T-bone, even the high end eye of the round. Suppose the steak price rose 10%. Two things would happen in the market for steak. Demand would reduce as consumers would turn to pork or chicken or fish to a greater extent, or order their steak less often. As a result, less steak would be bought. On the supply side, ranchers would be more encouraged to raise more cattle, while at the same time they would be led to slaughter less of the herd. More steak would come to market. That is what Elasticity is, a direct market impact from price.

Actually, an interesting fine point is necessary for a deeper concept on Elasticity. Among the big battles for market share, sometimes a slighter lower price offered by a big supplier can result in impressive gains. Suppose Sony Ericsson decided to cut their cellphone prices by 5% in an attempt to win a larger slice of market share. The profit margin is sufficient to permit the tactical maneuver, as that margin would come down by 5%. Refer not to a loss leader tactic or a losing ploy in order to gain market share. They sacrifice some profits in order to wrest more market share and at the same time, they test whether the cellphone market is Elastic. If sales rise by more than 5%, then economists claim this market has strong Elasticity. Total sales revenue of greater proportion comes from a corresponding slight price reduction, thus greater profit. The most capable firms can rely upon the aggressive tactic, since they are more efficient, and can afford to take the profit risk. If the cellphone market already is loaded with excellent competition, with several very efficient firms battling it out, then the response of the Sony Ericsson 5% marketing plan might result in only 3% sales growth. The Elasticity would be 0.6 (less than 1.0) and thus not worth the promotion. Under such circumstances, the giant would discontinue the program. It would not be worth it. The price would slide back to where it was. If the promotion was a big hit, they might realize a 6% sales gain. That would translate to a 1.2 Elasticity and very much worth the promotion.

Precious metals have an Inelastic market, a remarkable anomaly, the opposite effect at work. When the gold price falls, demand slacks off. In fact, demand for gold has never been lower in almost the last 20 years when it made a price low in 2001. It is called the Brown Bottom after numbskull Gordon Brown, who sold half of the British gold in aid of Deutsche Bank. When the gold price rises, demand jumps. It is called a gold fever. The same effect applies to silver. So gold & silver demand is inelastic, a counter-intuitive market. The truly intriguing part of the equation is that Gold Supply is also inelastic, a claim made in 2005 and repeated in 2006 and 2007 in the Hat Trick Letter. As the gold price rises, supply actually falls. The more accurate statement should be the supply inelasticity combines with geological and jurisdictional factors to reduce supply over time. During the passage of time in recent years, the gold price has risen. In statistical parlance, we call this a confounding of factors, a confounding effect, impossible to separate and measure without experimental design. The gold ore deposits are deeper underground, in thinner veins, of lower yield grade (as in grams per ton). The multitude of national governments that host mining operations varies tremendously. Some are suing the mining firms like Indonesia for massive pollution runoff in the water systems. Others like Uzbekistan engage in contract treachery to basically steal property rights. Others like South Africa introduced marxist nitwits to manage the electrical grid, only to cripple the output urgently needed to run underground operations. Others like Mexico are in the middle of a systemic failure, an explosion of violence during a battle for national control with drug cartels. Others like Mongolia have turned fickle, on again, off again, to the point that mining firms cannot maintain enough trust to invest heavily. Others like China and Russia has closed their doors to export.

The analytic fabric is even more interwoven. The supply of silver, in particular, is wrapped within the economic outlook and fallout. Silver is a major by-product of mining operations for copper, lead, tin, and zinc. Ore deposits that contain silver actually contain orders of magnitude more industrial metals. As these more common industrial metals suffer reduced demand, due to a decline in the global economy, a reduction is seen from mining output. Therefore the silver output falls in tandem. Although sizeable, the silver mine output is a fraction of the major industrial metals. It runs as the tail on industrial metal mining operation dog. Matters related to silver do not drive the decisions for the majority of its mining output. As copper, lead, tin, and zinc push the decision process in business operations, the silver output follows. Silver might have numerous important and even unique industrial applications, but its niche market is subservient to the major metals. Hence, as the global economy has entered a decline over the last three years, the global output for silver has actually come down. It has not responded to a higher silver price with much greater supply from encouraged profit. Instead, it responds to demand for base industrial metals.

PROPAGANDA ANGLES

The Quantitative Easing name makes the Jackass irritable, whose sound is much like that made by fingernails on a chalkboard. The QE nametag is hyper-inflation in official parlance. QE is ruinous to the monetary system and the major currencies. QE represents a magnificent escalation in the currency war. It motivates central bank retaliation, often called the Competing Currency War, in the defense of large native export industries. It triggers amplifies gestures toward trade protection. It can be easily stated and more easily defended that the United States has done more to worsen global trade war than any nation. Its export of fraud-ridden mortgage bonds and tainted USTreasurys that support annual $1.5 trillion deficits has flooded the global banking systems, inviting sharp response. Its decision to export a significant portion of its industrial base to China, the so-called Low Cost Solution, promoted from 2001 to 2005, is an unmitigated disaster not yet recognized as such. The USGovt turned from promoter of the factory export to China early on, only to condemn its fruit harvested by China in the form of $20 billion monthly surpluses.

How unspeakably incredibly blockheaded stupid, deceitful, and destructive can a nation be from its leadership helm?? A tight race exists between stupidity and corruption. The Quantitative Easing has been hinted in August, confirmed in September, and detailed in November. The QE program has been minimized in the press, more pure propaganda slop. It has been estimated to arrive as $500 billion more in pure monetary inflation, only to rise to another $1000 billion by next year. QUANTITATIVE EASING IS PURE HYPER-INFLATION of the most egregious magnitude in modern history. The bubble is found in the USDollar.

The cancer is infectious and contagious, if not a metastasis in progress. Capital is in steady profound destruction. Europe took charge of $750 billion in Dollar Swap Facility that monetized European bank debt. The entire world must quarantine the US cancer, but it feels somewhat helpless. Therefore, initiatives proceed behind the scene, like the movement by the Eastern Alliance to find a USDollar alternative in global trade settlement, like The Group of Central Europe in fashioning, implementing, and executing a New Nordic Euro currency. If Germany does not launch a new Nordic Euro currency with a gold component, it will sink into oblivion, and suffer a financial collapse, the same type that United States finds itself sinking deeper into.

Propaganda extends to the Canadian Mint story. At one point a large number of gold bullion tonnage was missing. Then it was reclaimed in part by accounting corrections, even nonsense like recovery of drips and waste on the floor. Then came the final coverup story of the gold bullion actually being found. What a relief? Perhaps they found tungsten laced gold bars, and did a quick recovery in the dead of night, forcing losses on the supplier. Couple the mint story with the bizarre deceptive IMF stories of gold bullion sales. The IMF sales announced during the last several years were rife with blatant falsehoods, as most were close-outs of old USGovt leased sales. On the books, an amateur or an ignoramus could call it a sale. It was a sale, but it occurred back in the Clinton Admin days. Lease, then sale, and years later buy it back, but put press focus on the original sale and lie about the timing. Clever indeed!

RISING SPECTER OF CHAOS

The beacon event in the elections has passed. Those in power will feel free to redeem more US$-based bonds. The official story came from the USFed on Wednesday, that $600 billion in long-term USTreasury Bonds would be bought with freshly printed money. The key is how the number exceeds the consensus $500 billion. Also, the USFed announced up to $900 billion in total asset purchases. The key is how mortgage bonds will be bought, fair game. One can be certain as an observer, a vassal bound within the castle walls, that TARP-2 has been secretly launched. More toxic bank assets will be purchased. No waste of bank lobby funds will be squandered on the USCongress minions. They will be circumvented as will the annoyance. This is all about the ruling elite in a nation of the banks, by the banks, and for the banks. A process will resume for redeeming blood on the floor, banker blood, as their death episode never ended. The big bank mortgage bond putbacks (under legal force) will proceed with dangerous high volume. The QE2 will absorb much of this swill and thereby relieve the big banks. No TARP-2 could possibly pass as legislation, so the bankers will rely on a hidden QE2 expansion, a vast expansion. The amount stated for QE bond purchases is a ruse. The stated volume represents a line in the sand brushed away by a banker footprint or sudden wave of seawater, even sheer expedient.

The unknown is whether the USFed will detour the high volume of toxic mortgage bonds from monetization operations into the Fannie Mae basement filing cabinets. The emphasis of the USFed QE bond purchase is between 5-year and 10-years duration. Look for the 2.0% TNX target to be hit easily, even shock the textbook bond analysts who point too much to heavy USGovt debt supply and ignore the monetization initiatives. The USTBond rally in the face of huge deficits is proof of never ending monetization, hidden poorly. It should be noted that the USFed will only devote 3% of purchases to TIPS. They have been purchasing the Treasury Inflation Protection Securities all along for the last year. Doing so is a travesty and violation of its security prospectus. Imagine monetizing an inflation meter, a ruinous step much like placing a thermometer in a cold glass of water next to the flu victim suffering a fever. The patient What a charade! Only in America!

The inescapable truth is that as for restructure of banks, NOTHING. As for the return of US industry from Asia, NOTHING. The USFed with USDept Treasury running interference will next fund programs without reform or restructure, which Joseph Stiglitz is quick to point out will not produce any positive results, and accomplish little if anything. It is like feeding a man whose legs require amputation from gangrene. He (the big banks) cannot walk (lend). By the

end of 2011, expect a full discussion with debate on the need for QE3. Witness the ruin of currencies, part & parcel to the monetary system destruction. Gold will respond. Its highly inelastic little brother Silver will respond even more.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.