Gold’s Toxic Noose Is Untied: Next Crude Oil $150

Commodities / Crude Oil Nov 04, 2010 - 12:34 PM GMTBy: Andrew_Butter

Even a Gold Sceptic can go along with the idea that Ron Paul could buy a smart outfit with one ounce of gold in 1920 (including shoes), and that’s how much he would need in 2010.

Even a Gold Sceptic can go along with the idea that Ron Paul could buy a smart outfit with one ounce of gold in 1920 (including shoes), and that’s how much he would need in 2010.

Although by that marker he would have needed four ounces in 2007, given that the sort of tailors that Ron frequents have slashed their prices in half; and the price of gold has doubled. But that’s just splitting hairs…Big Picture, it’s not a bad storyline, and the message is that gold holds value, regardless of how insane governments get.

And by all accounts the recent bunch were as insane as Edward II (and ought to have got what he got too (look it up – they do it to Tigers when they want to stuff them)).

What’s hard to understand is why gold prices have gone up so much in a time of very low inflation in the biggest economies in the world which, depending of course on your point of reference, might have included a touch of the dreaded deflation. Although no one wants to talk about that; anymore than they want to talk about the insanity of owner’s equivalent of rent.

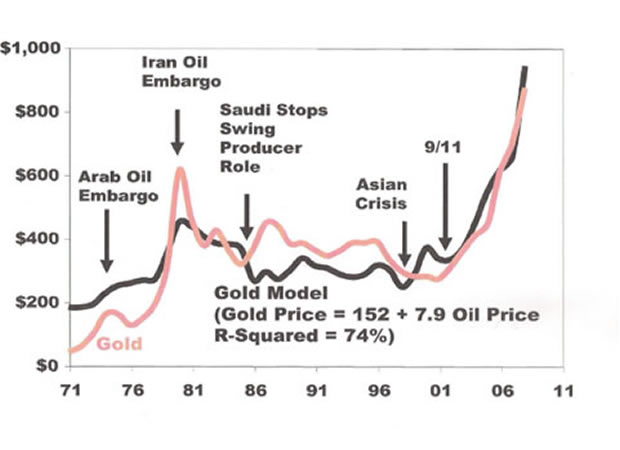

Traditionally a good benchmark for the price of gold was the price of oil, which makes sense; oil is an essential, the world stops without it.

Go back to the time gold was set free by Richard Nixon and that explains 74% of the changes in the price of gold year on year. But by that marker, with oil averaging say $80 gold ought to be about $1,000; so according to that logic now gold at $1,360 is a bubble.

Of course another way to look at that is that Gold is correctly priced and oil, these days, ought to be $150.

Put that in your Stetson and chew it!!

In theory in the “modern world” oil ought to mean more to people than gold, but there again, the price of oil is not exactly something that is market driven.

On one hand there is a cartel, which ought to push prices higher, plus there is all that talk about “peak oil”. On the other hand there are incentives for despots like Saddam Hussein and Nigerian generals (etc) to pump out their country’s birthright as fast as they can and stash it out of reach of the grubby fingers of their subjects, by buying “protection”, in return for discounts.

So how do you figure out ultimate value, right now, in real time? Try this:

The white line explains 96% of changes in the price of gold on a year on year basis since 1996. Cute correlation Eh! That’s much better than oil prices as an explanatory variable.

So where does that come from…got to be spurious right?

Like some sort of random once in a lifetime constellation of completely uncorrelated events, like a Black Swan for example. We all know about Black Swans, the place has been swarming with them recently.

Maybe not! Try adding the US current account deficit (a negative number since 1996) to the amount of toxic assets that USA sold to dumb foreigners; then cumulate those numbers.

That’s not exactly some random numbers, and it’s not often you can get to 96% R-Squared from two lines of data compared to something that for all intensive purposes is independent. Who would have thought there might be a link? Like in

Σ (US Trade Deficit+ US Toxic Asset Sales)1996-i = φ + λ Gold Price

By the way I could have written “B” and “C” (like in “a constant”) instead of φ and λ but I figured this is “economics” and I’ve noticed they like using those funny hieroglyphics, and I do like to “conform”.

Economics (whatever that is), or not, that’s not some random Black Swan; perhaps there is logic in there somewhere?

By the way also (sorry to keep changing the subject), I couldn’t help noticing how looking at that chart it seems broadly that the propensity of USA to spend more buying “stuff” from foreigners that the “stuff” it sold to foreigners (the current account deficit), got balanced out by sales of toxic assets (the official name for those is “US Securities Other than Treasuries”, (you can find them on Line 66 of the “US International Transactions” on the BEA website):

http://www.bea.gov/international/index.htm#bop

So Americans hocked their houses so they could drive SUV’s with cheap imported gasoline, and (for example) they happily paid three times the price anyone else does to get that last shot of morphine that takes the pain to another place before you check out.

Sorry for the “dark” analogy, but you realise two things holding someone’s hand when they do that (a) it’s darn expensive in USA, and (b) in the end it often ends up as just a negotiation with the doctors about the settings on the morphine pump.

Here’s a tip by the way on dying in the modern world, make sure you got someone standing-by to negotiate that deal, and watch out for “euthanasia by de-hydration” which is a real favourite of the medical profession these days (they disconnect the drip and you die of thirst – it’s legal…make sure you have someone who won’t let them do that).

I got two points there (a) people die, they really do, and so do countries; and (b) 19% of GDP in USA is to pay for “medical”; if they paid market prices that would be less than 7%; that’s a cartel to die for (no pun intended).

The real point is did you ever wonder how come America managed to run such a huge current account deficit for so long without the dollar going to nothing?

Now you know! They borrowed to live beyond their means, but they didn’t finance the deficit by “printing” money, they did it out the back door. No one noticed how that was destroying value and the real purchasing power of the US Dollar, thanks to the genius of financial engineering.

But Gold Noticed!

Or more precisely it noticed when the actual difference between money coming in and money going out was no longer “neutralized” by the toxins that were being drip-fed into America. That did more damage than Osama bin Laden even dreamed about.

And for an encore, is anyone in the “market” for a Toxic Asset these days? How about a nice AAA rated synthetic collateralized debt obligation lovingly crafted by Goldman Sachs, with “Made in America with Pride” stamped on its backside?

My point is that sadly, although they had a great run, and from 2000 to 2007 Toxic Assets were America’s biggest export, the only people who are up for buying that garbage these days (at a price that comes anywhere close to what people paid for them), is the Sucker of Last Resort (as in on Wall Street, “the value of something is what you can sell it for, to someone dumber than you”).

And the next Plan is QE-2!!

OK I admit it; I’ve been wagging the dog from its tail.

And actually that’s a bit of an over simplification (although it’s hard to argue a lack of cause and effect with 96% R-Squared, even if you are an economist).

And sure the explanation is that what matters in terms of determining what the REAL value of a US dollar is (like measured against gold), is the accumulation of how many dollars went “OUT” compared to how many came “IN”.

So if you plot the net current account position (goods & services) plus the net financial accounts, against gold you can get an 81% R-Squared (that’s not as “good” as 96% in case you wondered). Take out sales of Treasuries and you get up to 89% (better).

The point is that selling Treasuries to foreigners doesn’t really count, because everyone knows that Helicopter Ben (or the next guy) can just print dollars to pay those off…but that devalues dollars.

What matters is how much of America’s birthright it sold to buy those fancy Chinese goods and to swan around in the SUV? The real “value” issue there is the collateral, like how much does the foreigner own of America, in the trade?

That’s the beauty of securitization (manufacturing toxic assets), worst-case, the owner of the Toxic Asset gets to own the pound of flesh from the heart of America (the collateral).

The problem America (and to a lesser extent Europe) face now, is that they got nothing left to trade so they can finance their “dreams”. And US Treasuries sold to foreigners don’t hack it unfortunately; the sellers want “real” assets in exchange for their goods and services.

Of course the “problem” is not hard to fix:

Simple, one thing, add $5 a gallon tax on gasoline, that would pump up “inflation” which is what Ben has been trying to do for the past two year (sadly he couldn’t get it up), and after a while it would start to address the $500 billion a year, rising soon to $1,000 billion a year, that America spends buying oil.

Oil prices used to be determined by the amount the oil producers could “Milk Daisy” for, which is what Parasite Economics is all about. That’s how much blood can you suck out of your “host” before he drops down dead. But now “Daisy” is not just USA, it’s the whole world, and any oil producer with any sense (with a government that is not trying to grab the money and run), is keeping their oil in the ground.

Gold prices are not going to go down, but oil prices are going to go up (measured in dollars), as the consequences of the corrupt politicians (in USA and UK too – don’t forget Tony Blair’s psychopathic Special Relationship, plus the Freemasons and the Labour Unions), who should long ago have got the Edward II treatment…unfolds into it’s logical conclusion.

Hold on to your Stetsons!!

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2010 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.