U.S. Dollar Bounces Off Important Support on Post QE2 Reality

Currencies / US Dollar Nov 10, 2010 - 12:07 PM GMTBy: Jeb_Handwerger

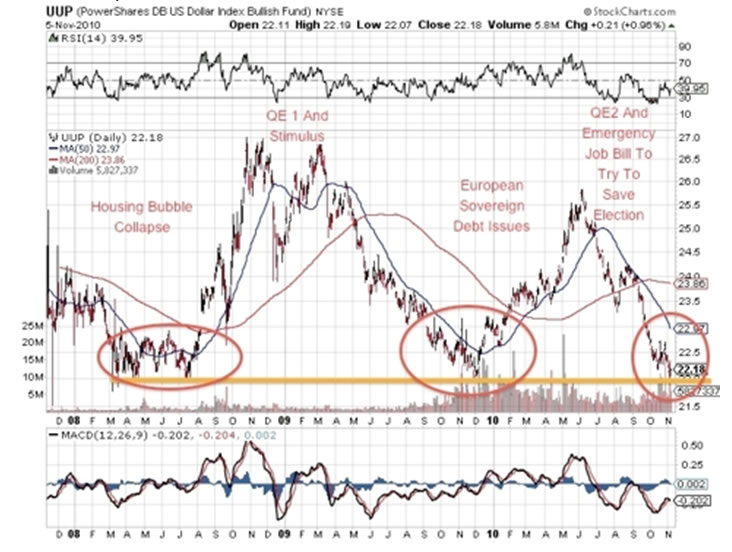

This week we are reaching price levels in the dollar that have only been touched 3 major times in the last 3 years. After touching this level the dollar has bounced higher in reaction to major deflationary forces.

This week we are reaching price levels in the dollar that have only been touched 3 major times in the last 3 years. After touching this level the dollar has bounced higher in reaction to major deflationary forces.

First in August of 2008, investors flocked to the dollar as stocks and commodities crashed during the credit crisis and housing bubble. In reaction we had TARP, The Obama Stimulus and QE1 which devalued the dollar until December of 2009. This was when the European Debt Crisis began in Greece, Portugal and Spain. Investors again returned to the dollar as a liquidity trap began in Europe and culminated in a record flash crash in May of 2009, which shut down the markets. In reaction to this threat to the financial system, QE2 was announced which saved the markets temporarily from a major bear market and double dip. Now the dollar is reaching this price level for the third time. From prior history as the U.S. Dollar touches this price level economic conditions deteriorate and risk aversion returns. Right now we are seeing borrowing costs rising in Ireland and the Euro coming under pressure.

Bernanke surprised the markets last week with a QE2 program that was greater that Wall St. expected and many disagreed with this decision. This decision was met with opposition domestically and internationally. Bernanke wrote an editorial in the Washington Post to defend his actions. China has been very critical and this debasing of the dollar could have negative consequences on foreign exchange rates and global economic growth.

Asset prices gapped higher on Bernanke’s dollar debasing. Europe and Asia are under pressure from this move as a cheap dollar hurts their economic growth. China has voiced their disapproval It appears the European Debt Crisis is resurfacing, the U.S. housing market is continuing to decline and a currency devaluation war is beginning. This could cause deflationary forces to return. If risk aversion returns to the market we would see a significant bounce in the dollar. This would put pressure on equity markets and commodities. As QE2 euphoria subsides, reality sets in.

This is a crucial chart to monitor as a triple bottom may be developing in the U.S. dollar. This price level on the world’s reserve currency has triggered international events. I expect the dollar to rally as post QE2 reality sets in.

Please check out my blog and free newsletter at http://goldstocktrades.com where I post up to the minute observations.

By Jeb Handwerger© 2010 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.