West Loses Resources War, China Controls Rare Earths and Middle East Has Crude Oil

Commodities / Metals & Mining Nov 11, 2010 - 06:32 AM GMTBy: Dian_L_Chu

While most are anxiously anticipating a grand currency showdown at the G20 summit in Seoul this month, rare earths is bound to be one act of the G20 high Korean Drama amid the mounting worries among corporations and governments around the world about China’s recent export restrictions and embargo,

While most are anxiously anticipating a grand currency showdown at the G20 summit in Seoul this month, rare earths is bound to be one act of the G20 high Korean Drama amid the mounting worries among corporations and governments around the world about China’s recent export restrictions and embargo,

Seventeen Metals Make the World Go Around

Rare earths or rare earth minerals / metals (REMs) represent a group of 17 metals. Among them, "heavy" rare earth such as europium -- used to produce color in TVs and other screens -- are becoming increasingly scarce, while "light" REMs such as cerium – used in enamels and glasses -- are plentiful.

They are considered strategic resources since they are essential in the manufacturing of a wide array of products ranging from cell phone, laptops, to military equipment. (See the Consumer Products image)

Low Concentration & Radioactive

These metals are rare partly due to the low concentration in the typical rock formations. That is you have to mine lots and lots in order to get the quantity you need.

Another reason it has become rare is because of the great amount of radioactive waste produced during the REMs mining and refining process.

Outsourced to China

During the 1980’s, the United States, once the world's leading producer of the minerals, gradually shifted the production to China, mostly due to its lower environmental standards, and lower labor costs.

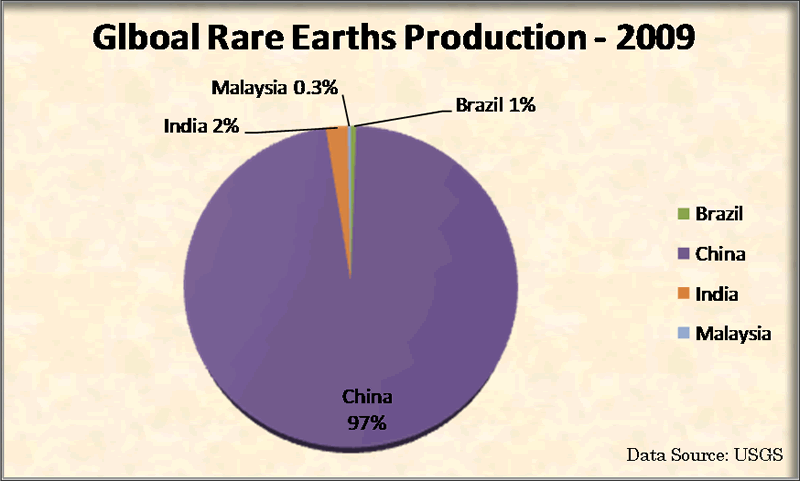

Rising production of electronics such as Apple Inc.’s iPhone and ipod in recent years have driven up demand for rare earths. So inevitably, China has come to controls 97% of the global supply of rare earths (see chart), mostly from its Inner Mongolia region.

Japan Embargo Still On

It is this supply monopoly that raised global concerns in recent weeks when China swiftly banned exports to Japan of REMs following a fishing boat mishap in the East China Sea, which subsequently escalated into a global geopolitical event.

The “unofficial embargo” later also got extended to all countries, but shipments to the United States and Europe did resume, after a brief suspension in October. Japan--on the other hand-- is not so lucky as Beijing is continuing to ban exports to Japan, according the latest NY Times account.

Export Quota

However, even before the boating incident with Japan, China has increasingly restricted rare earths exports in the past two years with reductions in export quotas. The export quotas apply only to the raw REMs, and not the processed minerals.

The total Chinese export quota for 2010 is 30,258 tons, 40 percent less than that for 2009. Its most recent reduction could cut up to an additional 30 percent of supply in 2011.

Recent Price Spike

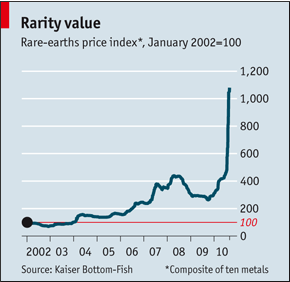

The sudden supply shortage has forced some companies to shut down operation, and sent the REMs prices soaring. (See price chart).

China Ahead of the Rare Earths Curve

You might wonder how we could have been in this position in the first place. It has a lot to do with China being decades ahead of the global curve when it comes to understanding the strategic importance of rare earths.

Since the 1960’s, China has placed great emphasis on research and development on improving efficiency to recover REMs. That increased the nation’s competitive advantage over time and propelled China into the virtual sole provider of REMs of the world.

“The Middle East has its oil, China has rare earth.”

Deng Xiaoping predicted in 1987 that the Inner Mongolia Autonomous Region would very likely be 'in the front ranks' of development. Deng was quoted as saying “中東有石油,中國有稀土.” (The Middle East has its oil, China has rare earth) in a speech he made in January 1992 during his Southern Tour.

Deng also made the following remark in the same speech:

“…..it is of extremely important strategic significance; we must be sure to handle the rare earth issue properly and make the fullest use of our country's advantage in rare earth resources.”

Risk of Single Sourcing

Obviously, Deng’s vision has been quite successfully executed…..while the rest of the world fell asleep at the wheel, so to speak, by allowing a critical resource to become single-sourced.

Now, the Chinese government warns that it possesses just 15 to 20 years worth of medium and heavy minerals, and must act to protect the resource from over-exploitation, and to preserve its own supply as well as environment.

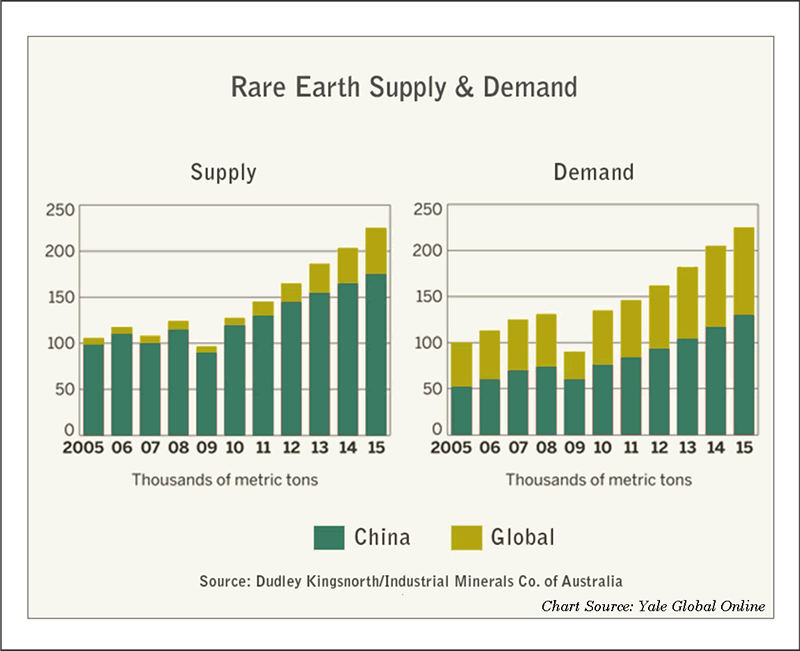

Yale Global Online quoted consultancy Industrial Minerals Company of Australia that out of the REMs China’s currently producing, about 60% is for domestic use….and that trend line is going up!

Substitute or Produce Thyself…in 15 Years?!

So instead of sitting around for some kind of resolution from the WTO or G20 (don’t hold your breath), the rest of the world needs to either seek alternative or substitution of REMs, and/or take on the responsibility of producing and securing the supply of REMs in its own backyard.

However, rebuilding the REMs supply chain, i.e., mining, extraction, fabrication and refining, is that easy since a lot of the skill labor, expertise and infrastructure has been long gone from the field during the past 20 years.

In a report released in April 2010, the U.S. General Accountability Office (GAO) calculated it will take up to 15 years to re-establish sufficiently to meet the domestic demand.

Reserves Not So Rare

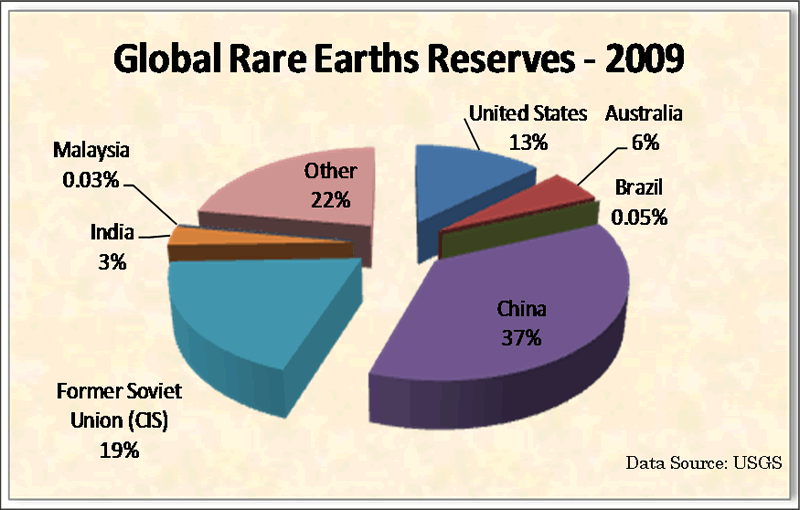

The good news is that unlike the production side, China does not have a complete lock on the rare earths reserves. China does hold the largest share of world reserves at 38%, but there is still plenty around in other parts of the world, including the U.S., Australia, and the CIS, based on the latest U.S. Geological Survey (USGS) data. (See Reserves Chart)

Supply Response Coming

And with the heightened attention, and the recent price spike, a lot of new capital has gone into this once obscure sector, which could accelerate the estimated time table.

For example, Molycorp, a U.S.-based rare earths miner, was able to raise $380 million through an IPO in July. In the U.S., there are also government subsidies and loan programs (e.g. H.R. 6160 ) in the legislative pipeline.

According to Molycorp, the only major rare earths mine in the U.S. at Mountain Pass, CA, which was mostly shut down in 2002, is on schedule to be operating at the full production rate of 20,000 tons of rare earths per year by the end of 2012. That level would be sufficient to meet domestic needs of the moment. U.S. consumption of rare earths is currently estimated at between 15,000 and 18,000 tons a year.

No Threat to the Pentagon

The GAO report also noted for now, there are no effective rare earths substitutes for defense systems. But Bloomberg quoted Australian rare earth developer Lynas Corp. estimating the military would need only about 10 tons to 20 tons of REMs, and that its $545 million Mount Weld rare earths project in Australia, due to go into operation next year, will be able to fully meet the U.S. Defense Department’s needs.

This is most likely part of the reasons that the U.S. Defense Department concluded that China’s REMs monopoly poses no threat to national security, a person familiar with a yearlong study by the Pentagon said Oct. 31.

The Lesser Evil - Oil or Rare Earth?

Nevertheless, the demand and supply projection is still worrisome. Molycorp estimates that total worldwide demand for rare earths is expected to double to 225,000 tons by 2015, not accounting for the burgeoning green energy industry, e.g., EVs, wind turbines, solar panels, etc.

For instance, one 2.5-megawatt permanent magnet generator (PMG) wind turbine requires half a ton of rare earths. China alone plans to spend two to three trillion yuan in the renewable energy sector in the next decade and deploy 300 gigawatts of wind turbines by 2020.

Apparently, supply chain planning must not have been part of the Green Energy Movement. While trying to wane ourselves off oil, we ended up with rare earth dependency instead, and still have to deal with the environmental consequence even worse than oil or oil sands mining, for that matter.

Nobody's Immune, Including China

What that says is that we will need to pull in everyone’s resource in the coming years--China, U.S. Australia, etc. Some estimate that China's own demand for some of the minerals (See Forecast Chart) could outstrip its supply in two to five years; and will drive production in other countries, and development of other known and new reserves, similar to the current rising exploration and mining activities in the base metal sector.

Quid Pro Quo Backlash

That means China would, in the not so distant future, depend on external sources for its REMs needs, very much like iron ore, copper and crude oil. From that perspective, Beijing likely will be reasonable and not “hold the world hostage” with rare earths, as the potential quid pro quo could be far more unpleasant.

Inelastic Demand?

For now, it looks like we could have a supply shortfall probably by 2014 or 2015 leading to higher prices due to the leadtime needed to develope resources and alternatives. The recent price spike, although not entirely speculative, is nevertheless more an end product of panic and hype rather than the actual market condition.

According to Thomson Reuters, the Stuttgart Stock Exchange's MV Rare Earth PR Index has risen 69 percent just since May this year. This pace of appreciation is clearly unsustainable as no demand could be that inelastic.

Rare Earth Bubble?

The sector landscape is still very fluid and could change very quickly depending on government policy. That in turn could drastically impact those junior mining companies’ valuation. For instance, China might drop quota and tariff, the U.S. could open up more mines, not to mention there could be some breakthrough technology coming online.

So, my advice would be to skip the exotic rare earths sector for now, and put your money into the more traditional base metals or other commodities or commodities producers.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.