Should You Buy Silver SLV ETF?

Commodities / Gold and Silver 2010 Nov 23, 2010 - 10:28 AM GMTBy: Peter_Degraaf

Featured is the daily bar chart for SLV. Price has risen for five days, but volume has not yet supported the rise. This lack of volume could be because more and more people are becoming aware of the fact that JPMorgan (one of the bullion banks that is short a large amount of silver), is a custodian of SLV. As people begin to distrust the integrity (justified or not) of SLV, they could very well make a decision to avoid buying into SLV.

Featured is the daily bar chart for SLV. Price has risen for five days, but volume has not yet supported the rise. This lack of volume could be because more and more people are becoming aware of the fact that JPMorgan (one of the bullion banks that is short a large amount of silver), is a custodian of SLV. As people begin to distrust the integrity (justified or not) of SLV, they could very well make a decision to avoid buying into SLV.

Charts presented in this report are courtesy Stockcharts.com.

This would show up in a slow-down in volume, even as price rises to keep up with silver bullion. The RSI and MACD are positive in this chart and a breakout at the blue arrow along with an increase in volume will be bullish for SLV and will indicate that there are still enough people interested in SLV to keep it rising. Confirmation of the theory that people are beginning to distrust SLV would first show up in a comparative performance with other, similar silver investments, where other investments outperform SLV. Some of these are shown below.

Featured is the index that compares the SLV to the Horizon silver ETF that trades on the TSX. Clearly the HZU has outperformed the SLV over the past few months.

Likewise the comparison between SLV and AGQ the silver ETF with double leverage shows AGQ to be the better performer. (The double leverage has something to with this outperforming, but not to this extent).

Featured is the index that compares SLV to the Sprott silver trust. Obviously we do not have a lot of data to go with, but the short-term trend appears to favor PSLV.

The conclusion we draw from the above charts is that regardless of whether traders and investors believe in the integrity of SLV the silver ETF, there are competitive investments in the same sector that are outperforming SLV. The 'proof is in the pudding', as can be seen in the next chart.

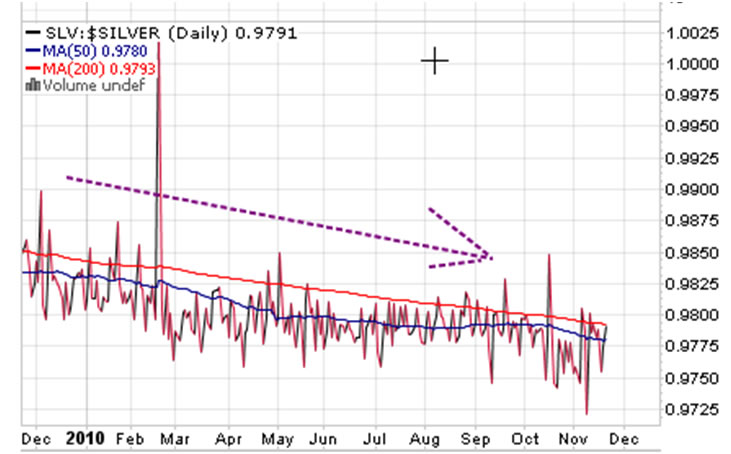

Featured is the index that compares SLV to silver bullion. Although the descent is slow, it nevertheless shows SLV to be losing ground to silver itself.

In summary, and despite the fact that other investment vehicles are outperforming SLV, in the event that price breaks out at the blue arrow in the SLV chart above, on increased volume, then those who own shares in SLV will continue to profit, but those who invest in the alternatives can expect to do even better, and without having to worry about the JPMorgan influence at SLV. (As most of you know, JPMorgan has at least 14 law suits pending against it for illegally manipulating the silver price. This bank is still carrying a very large large 'short silver' position on its books).

Happy trading!

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2010 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.