Fed’s QE2 Ponzi Scheme Sets HyperInflation Trend in Motion

Economics / HyperInflation Dec 08, 2010 - 12:15 PM GMTBy: Gary_Dorsch

In a taped interview with CBS’ “60 Minutes” that aired on December 5th, Federal Reserve chief Ben “Bubbles” Bernanke tried to brainwash the American public, into believing that “Quantitative Easing” (QE), is absolutely necessary in order to prevent further losses of jobs, and tried to assure his listeners that he has the skills to keep inflation under control. The US-jobless rate would have risen far higher, “something like it was in the Depression, at 25%,” -- had the Fed not provided tens of trillions in loans to Wall Street banks and other financial companies, he said.

In a taped interview with CBS’ “60 Minutes” that aired on December 5th, Federal Reserve chief Ben “Bubbles” Bernanke tried to brainwash the American public, into believing that “Quantitative Easing” (QE), is absolutely necessary in order to prevent further losses of jobs, and tried to assure his listeners that he has the skills to keep inflation under control. The US-jobless rate would have risen far higher, “something like it was in the Depression, at 25%,” -- had the Fed not provided tens of trillions in loans to Wall Street banks and other financial companies, he said.

Two-years ago, the Wall Street Oligarchs played the central role in the greatest financial scandal in the history of the world, - one which wiped out tens of trillions of dollars in wealth, nearly bankrupted giant corporations and entire countries, and plunged the world into the deepest slide in global trade since the Great Depression. Huge profits were made in sub-prime mortgages, based on a Ponzi scheme of exotic financial derivatives and sliced packages. When it came crashing down, the public treasury was looted to cover the financial aristocracy’s losses.

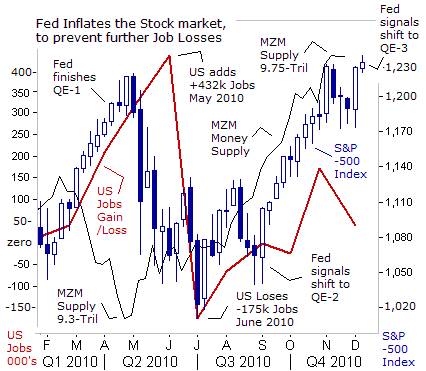

Since then, the Fed has carried out QE-1 between March 2009 and March 2010, in which it bought $1.45-trillion in mortgage-backed securities and $300-billion in Treasuries. Together with pegging interest rates at zero-percent, weakening the US-dollar, and flooding the stock markets with cheap credit, - the Fed enabled US banks and S&P-500 companies to record bumper profits, even as they slashed jobs and capital spending, and suffered revenue declines.

With QE-1, the Fed channeled interest free money into the coffers of the Wall Street Oligarchs, which in turn, was used to buy higher yielding Treasury bonds. In a single stroke, the Fed monetized the US-government’s debt, and at the same time, bankers earned double or triple the interest rate at which it was borrowed. They pocketed billions under the scheme. Wall Street banks also bought high-grade corporate and junk bonds, and emerging market bonds, to fatten their profit margins. At the end of the day, QE-1 was utilized to recoup the gambling losses of the financial aristocracy, and created fertile conditions for driving-up equity markets.

Mr Bernanke is an addicted money printer. He’s the most idolized Fed chief among a growing number of gold and silver worshippers. Beyond his epoch history making with QE, the Fed chief is also famous for the “Bernanke Put”, which is deeply ingrained in traders’ minds. Traders need not worry about market declines, since the Fed will always bail them out with rate cuts. If interest rates are already slashed to zero, then the Fed would open the floodgates with massive injections of QE.

Mr Bernanke is an addicted money printer. He’s the most idolized Fed chief among a growing number of gold and silver worshippers. Beyond his epoch history making with QE, the Fed chief is also famous for the “Bernanke Put”, which is deeply ingrained in traders’ minds. Traders need not worry about market declines, since the Fed will always bail them out with rate cuts. If interest rates are already slashed to zero, then the Fed would open the floodgates with massive injections of QE.

In this regard, Bernanke is widely admired by the high stakes rollers on Wall Street, for his ability to jig the stock market higher, regardless of signs of a weak economy. Following a sharp correction in the US-stock market last May and June, and steep job losses, Fed chief Bernanke rode to the rescue with promises of QE-2. Within months, the S&P-500 recouped its earlier losses, and stock market bulls praised Bernanke and his merry band of money printers, to the high heavens.

Bernanke has gone several steps further. He’s assured Wall Street that the federal funds rate will be pegged near zero-percent interest rates through 2012, and that he’s not bothered by a weaker US-dollar. Asked on “60-Minutes” if the Fed could cross the Rubicon again, and unleash QE-3, Bernanke replied, “It’s certainly possible. It depends on the efficacy of the program. It depends, on inflation. And finally it depends on how the economy looks,” he said.

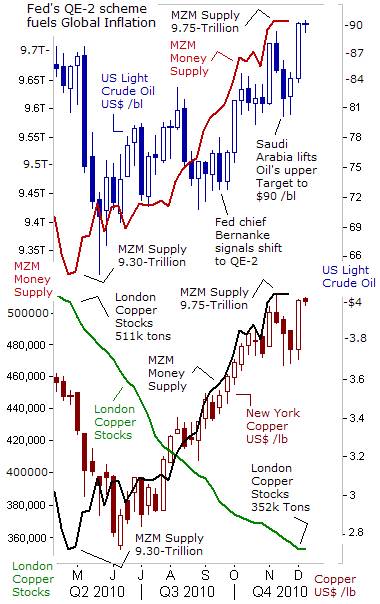

So far, the Fed has injected $1.85-trillion into the money markets, under its QE-1 and QE-2 experiments, which in turn, have fueled huge parabolic rallies in key industrial commodities, such as cotton, copper, rubber, and crude oil, and jettisoned precious metals into the stratosphere. Soybeans have increased 30% under the influence of QE-2, and live cattle prices are at all-time highs. “If the Fed did not act, then given how much inflation has come down since the beginning of the recession, I think it would be a more serious concern,” Bernanke explained.

The Fed argues that QE is not inflationary, because the electronic money is sitting in the coffers of the banking Oligarchs, and isn’t circulating in the general economy. “One myth that’s out there, - is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way,” Bernanke said on Dec 5th.

The Fed argues that QE is not inflationary, because the electronic money is sitting in the coffers of the banking Oligarchs, and isn’t circulating in the general economy. “One myth that’s out there, - is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way,” Bernanke said on Dec 5th.

Is the majority of the American public gullible enough to believe the Fed’s gimmicks? Unfortunately, the answer is yes. Most Americans haven’t even heard of QE. However, they are aware that the cost of gasoline is 50-cents /gallon higher at the pump, than it was a few months ago. But do they realize that the increase is linked to the Fed’s QE-2 scheme? Do most Americans realize that higher gasoline prices are paid, to fund the Fed’s insurance policy to prevent further job losses?

Not everyone is buying into the Fed’s propaganda. Sarah Palin, the former vice-presidential candidate, wrote in a Nov 18th letter, “It’s time for us to refudiate the notion that this dangerous experiment in printing $600-billion out of thin air, with nothing to back it up, will magically fix economic problems. All this pump priming will come at a serious price. And I mean that literally. Everyone who goes out shopping for groceries knows that prices have risen significantly over the past year. Pump priming would push them even higher,” Palin argues.

As the late astronomer, Carl Sagan, and advocate of skeptical inquiry used to say, “One of the saddest lessons of history is this: If we’ve been bamboozled long enough, we tend to reject any evidence of the Bamboozle. We’re no longer interested in finding out the truth. The Bamboozle has captured us. It is simply too painful to acknowledge - even to ourselves - that we’ve been so credulous.”

The facts do not jive with Mr Bernanke’s defense of QE. The fact is, the MZM Money supply has mushroomed in size by $450-billion over the past six-months, - the equivalent of 3% of GDP. That’s even before the Fed’s QE-2 injections begin to take effect. The MZM supply could easily top $10-trillion in the months ahead. MZM measures the most liquid components of the money supply, available for spending. MZM can be immediately redeemed without suffering a penalty or a capital loss.

Traders in the gold and silver markets, have enjoyed the magic carpet ride of the expanding MZM money supply, (M2, plus all money market funds, less small time deposits), - and are guided by the following words of wisdom, “Paper money eventually returns to its intrinsic value – Zero,” - Voltaire 1729.

The Fed certainly has the tools to fight inflation. “We could raise interest rates in 15-minutes if we have to. So, there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation, at the appropriate time. That time is not now,” Bernanke said. However, it’s doubtful the Bernanke Fed would get a green light to tighten monetary policy under the command of President Obama, or from the Wall Street Oligarchs, who are overdosing on the highly addictive QE-drug, and won’t be able to kick the dangerous habit.

The Fed certainly has the tools to fight inflation. “We could raise interest rates in 15-minutes if we have to. So, there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation, at the appropriate time. That time is not now,” Bernanke said. However, it’s doubtful the Bernanke Fed would get a green light to tighten monetary policy under the command of President Obama, or from the Wall Street Oligarchs, who are overdosing on the highly addictive QE-drug, and won’t be able to kick the dangerous habit.

As the brilliant Albert Einstein used to say, “Reality is merely an illusion, - albeit a very persistent one.” For the Fed, the specter of soaring commodity prices, across a wide array of markets worldwide, is not a sign of inflation. Instead, it’s a signal of strong demand from emerging economies. In fact, the Fed doesn’t even include food and energy, - the basic staples of life, in its definition of inflation. And that’s very good news for investors in commodities and precious metals.

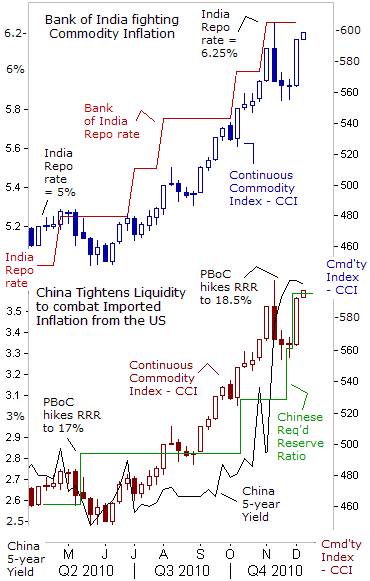

But for the ruling authorities in China and India, the upward spiral in commodities is not an illusion. Sharply higher costs for food and energy cause great angst among their populations that earn less than $2 /day. The Continuous Commodity Index, a broad based index of 17-equally weighted commodities, is now 28% higher than a year ago, and within a few percentage points of its all-time high.

Bank of India chief, Duvvuri Subbarao, warned on Nov 3rd, “While the ultra-loose monetary policy of advanced economies may benefit the global economy in the medium term, in the short term, it will trigger further capital inflows into emerging market economies and put upward pressure on global commodity prices.”

With the world’s biggest populations, and fastest growing economies, the People’s Bank of China (PBoC) and the Bank of India, have led the way, in trying to cap the explosive rise of the commodities markets, by lifting interest rates, and hiking bank reserve requirements. Hiking margins requirements on Chinese traded commodities, initially led to a knee-jerk shakeout, but bullish sentiment is already back in full swing. Furthermore, Chinese and Indian interest rates are yielding less than the underlying inflation rate, encouraging investors to buy precious metals.

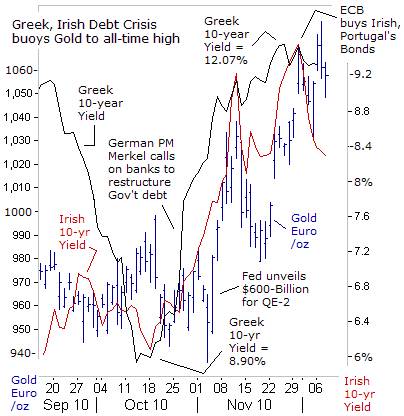

In the Euro-zone, the gold market is thriving amid a perfect storm. Gold has set new all-time highs, reaching 1,065-euros /oz, up from around 950-euros just a month ago. The upward spiral in Greek and Irish bond yields has given the precious metals markets an extra jolt of adrenalin, as traders bet the ECB will be called upon someday, to boost its quasi-QE bond purchasing program, until systemic default risks within the peripheral Euro-zone bond markets begin to recede.

In the Euro-zone, the gold market is thriving amid a perfect storm. Gold has set new all-time highs, reaching 1,065-euros /oz, up from around 950-euros just a month ago. The upward spiral in Greek and Irish bond yields has given the precious metals markets an extra jolt of adrenalin, as traders bet the ECB will be called upon someday, to boost its quasi-QE bond purchasing program, until systemic default risks within the peripheral Euro-zone bond markets begin to recede.

Last week, the ECB bought 2-billion Euros worth of Irish and Portuguese bonds, pushing down Ireland’s 10-year bond yield by 85-basis points. However, the 10-year borrowing cost for Greece was left unchanged at 12-percent. ECB chief Jean-“Tricky” Trichet insists that any emergency bond purchases would be sterilized, and the ECB wouldn’t inflate the M3 money supply. Yet at the same time, the “Tricky” Trichet will continue to make unlimited loans available to Euro-zone banks well into next year, at its record low interest rate of 1-percent.

EU finance ministers agreed to a proposal sponsored by Germany and supported by France for a new fund to replace the existing €750-billion bailout fund, which expires in May, 2013. The new European Stability Mechanism (ESM) allows for the restructuring of debts that are owed by weaker Euro-zone governments in dire straits, and can result in big losses for bond holders and major creditors. Amid a flight from risky Greek and Irish bonds, and fears that Germany might eventually ditch the Euro, traders have flocked into the “safe havens” of gold and silver.

Sharply higher commodity prices are creating havoc for Beijing. The US Treasury hopes the new reality would force the Chinese Politburo to allow the yuan to climb at a faster pace against the US-dollar. On Nov 13th, China’s FX chief, Jin Zhongxia, criticized the Fed’s QE-2 scheme. China “doesn’t support the monetary easing that causes capital inflows to increase the risk of asset bubbles. Major countries that excessively print money to get out of their own economic difficulties, pose a policy dilemma for emerging economies. That will impose greater pressure on capital inflows, bigger bubbles in asset markets and inflationary pressure,” Jin warned.

Sharply higher commodity prices are creating havoc for Beijing. The US Treasury hopes the new reality would force the Chinese Politburo to allow the yuan to climb at a faster pace against the US-dollar. On Nov 13th, China’s FX chief, Jin Zhongxia, criticized the Fed’s QE-2 scheme. China “doesn’t support the monetary easing that causes capital inflows to increase the risk of asset bubbles. Major countries that excessively print money to get out of their own economic difficulties, pose a policy dilemma for emerging economies. That will impose greater pressure on capital inflows, bigger bubbles in asset markets and inflationary pressure,” Jin warned.

But Bernanke shot back on Dec 5th, “Keeping the Chinese currency too low is bad for the American economy, because it hurts our trade. It’s bad for other emerging market economies. If they fix their currency to the dollar, then they’ll have the same monetary policy, essentially, that the United States has. China is growing very quickly. They’re risking inflation by importing US monetary policy. And that’s a problem for them,” Bernanke warned. Thus, QE-2 is also aimed at China.

Crude oil has rebounded to $90 /barrel, and copper has eclipsed $4 /pound in New York, fueled by the Fed’s QE-2 scheme. The OPEC cartel is meeting in Ecuador on Dec 11th, and is giving its blessing to higher oil prices. Shokri Ghanem, Libya’s oil chief said, “We would love to see $100 a barrel. We’re losing real income. Libya in particular would like to see a higher oil price, to help offset the loss of revenue from the weaker dollar.” The Fed’s QE-2 scheme could backfire however, if it sparks an “Oil Shock” for the world economy, not seen since the surge to $147 /barrel.

Copper might begin to outpace gold, amid rapidly dwindling stockpiles in London, and speculation that a large trader is hoarding around two-thirds of existing supplies. Stockpiles monitored by the London Metals Exchange have declined 30% this year to 352,200-tons, the lowest level since October 2009. That small stockpile could be mostly wiped-out, since global demand for copper is expected to outstrip production by 250,000-tons next year, and lead to panicked buying from China.

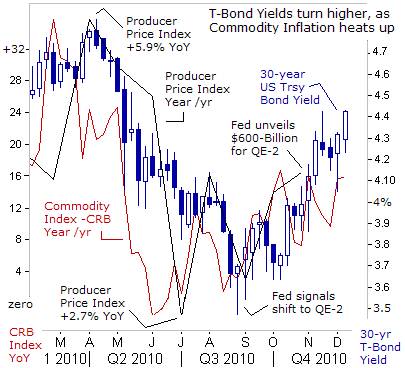

The Fed is feeling pretty giddy about its ability to jig-up the stock market. Privately, it’s happy to see commodity prices soaring, thus lessening the odds of deflation taking hold in the US-economy. However, there’s trouble spot that brewing in the financial markets, and its something for the omnipotent Fed to worry about. QE-2 was supposed to push long-term T-bond yields lower. But instead, T-bond yields are surging higher. The yield on the Treasury’s 30-year bond has moved 1% higher since late August, to around 4.45% today. Yields on the ten-year T-Note have climbed 75-basis points higher to 3.25%, since the Fed unveiled its QE-2 scheme.

The Fed is feeling pretty giddy about its ability to jig-up the stock market. Privately, it’s happy to see commodity prices soaring, thus lessening the odds of deflation taking hold in the US-economy. However, there’s trouble spot that brewing in the financial markets, and its something for the omnipotent Fed to worry about. QE-2 was supposed to push long-term T-bond yields lower. But instead, T-bond yields are surging higher. The yield on the Treasury’s 30-year bond has moved 1% higher since late August, to around 4.45% today. Yields on the ten-year T-Note have climbed 75-basis points higher to 3.25%, since the Fed unveiled its QE-2 scheme.

With so much monetary stimulus flowing in the pipeline, and hundreds of billions more on the way, and commodity markets hovering at multi-decade highs, could the infamous bond vigilantes, - who have already dealt severe blows to the Greek and Irish bond markets, turn their weapons on US Treasury bonds? For American retail investors, who sought safe haven in bond mutual funds for an “unprecedented” 100 straight weeks, and plowed in $643-billion since the start of 2009, they’re about to learn that QE-2 and QE-3 are poison pills for bond holders.

“What’s the end game here? Where will all this money printing on an unprecedented scale take us? Do we have any guarantees that QE-2 won’t be followed by QE-3, QE-4, and QE-5, until eventually, - inevitably, - no one will want to buy our debt anymore?” Sarah Palin asked on Nov 5th. However, the political cronies appointed to the Fed aren’t listening. They have a hidden agenda.

“What’s the end game here? Where will all this money printing on an unprecedented scale take us? Do we have any guarantees that QE-2 won’t be followed by QE-3, QE-4, and QE-5, until eventually, - inevitably, - no one will want to buy our debt anymore?” Sarah Palin asked on Nov 5th. However, the political cronies appointed to the Fed aren’t listening. They have a hidden agenda.

If the Bond vigilantes can turn the US-Treasury market into a Greek style wasteland, then the Fed’s wild-eyed QE-experiments would go up in smoke. Mr Bernanke will be on the telephone, consulting with former Fed chief “Easy” Al Greenspan, seeking guidance on ways to stem the bleeding in the T-bond market. However, “The budget deficit problem, I believe, is far more dangerous than most of us contemplate on a day-by-day basis,” Mr Greenspan warned on Sept 24th.

“What we see is politicians cutting taxes with borrowed money, and spending on new programs, new projects with borrowed money. But the debt is increasing at a rate of over a trillion dollars a year. And because interest rates are low, being in a weak economy, it is very easy for the government to sell as many bonds as it wants. I think there’s a complacency rising at this stage. Interest rates are down for a number of technical reasons. But, assuredly they’re not going to stay here,” Greenspan warned. “We don't know at this stage why or how the markets respond to this sort of -- this type of massive budget deficit. And I think we’re taking a very high risk. This is not a tradeoff between good and bad. In fact, I sometimes put it between terrible and catastrophic,” Greenspan added.

On Dec 8th, Li Daokui, an advisor to China’s central bank warned, “we should be clear in our minds that the fiscal situation in the United States is much worse than in Europe. When the European debt situation stabilizes, attention of financial markets will definitely shift to the United States. At that time, US Treasury bonds and the US-dollar will experience considerable declines,” he said. “Oh what a tangled web we weave, when first we practice to deceive,”-- Sir Walter Scott.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.