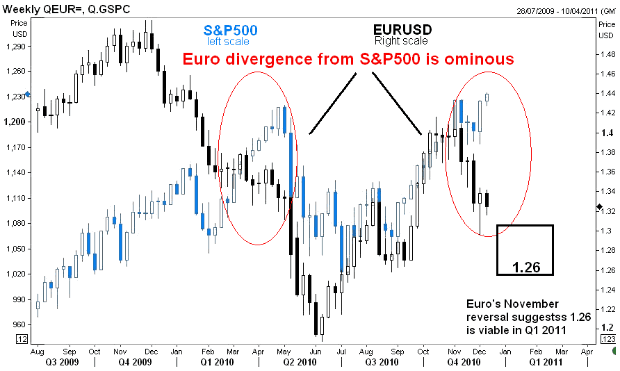

Ominous Euro Divergence From Rising US and European Equities

Currencies / Euro Dec 10, 2010 - 05:59 AM GMTBy: Ashraf_Laidi

China's latest action to raise banks' reserve requirement ratios is no longer weighing on market sentiment as participants expect the more aggressive option of higher interest rates (borrowing and lending). The overnight decision to hike RRR for the 6th time this year is seen as part of a broader tightening.

With 1-year lending rates standing at 5.56% and deposit rates of 2.50% below 4.40% CPI, the case for higher rates into 2011 remains intact. This helps explain why Shanghai Composite Index is down 11% YTD even as US indices are up +10% on the year. This divergence is largely explained by the contrasting monetary policies involving the Fed and the rest of the world. But as the rally in US yields makes the transition from reflecting higher GDP growth to fiscal concerns, US equities may be in for a needed correction. (See more on EUR-stocks relation)

Euro Bulls Beware of the Divergence

The euro's divergence from rising US and European equities is growing similar to the divergence prevailing in Jan-April (see 1st red circle) when EURUSD fell 15% and S&P500, Dow-30 and FTSE-100 rose 16%-19%. If the Jan-April pattern repeats itself, then it is feasible to expect equities to catch "down" with the euro. The fundamental rationale would be based on i) broadening Eurozone concerns weighing on UK and Eurozone banks; ii) prolonged rise in US yields and iii) growing doubts upon the completion of the $600 bln QE2. We stick with our technically negative euro stance based on: i) the inability to regain the all important 55-week MA (1.3370); ii) the inability to regain the Nov 4 trendline. EURUSD eyes short term target of $1.3070, followed by $1.26 in mid Q1 2011.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.