U.S. Trade Deficit Narrows in October, Provides Lift to Q4 GDP Growth

Economics / Economic Recovery Dec 11, 2010 - 05:20 AM GMTBy: Asha_Bangalore

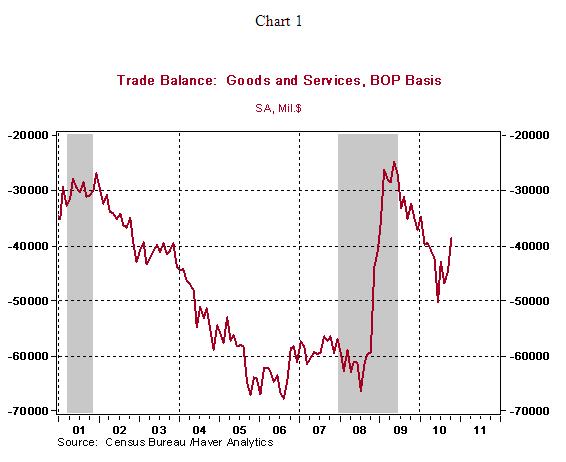

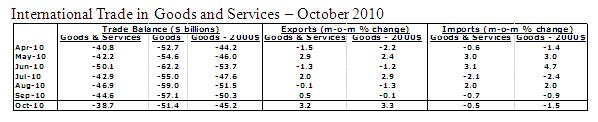

The trade deficit narrowed to $38.7 billion in October from a gap of $44.6 billion in the prior month. The 3.2% increase in exports of goods and services and a 0.5% decline in imports of goods and services brought about a narrowing of the trade gap in October. Overall, this reading is a big plus for real GDP growth in the fourth quarter.

The trade deficit narrowed to $38.7 billion in October from a gap of $44.6 billion in the prior month. The 3.2% increase in exports of goods and services and a 0.5% decline in imports of goods and services brought about a narrowing of the trade gap in October. Overall, this reading is a big plus for real GDP growth in the fourth quarter.

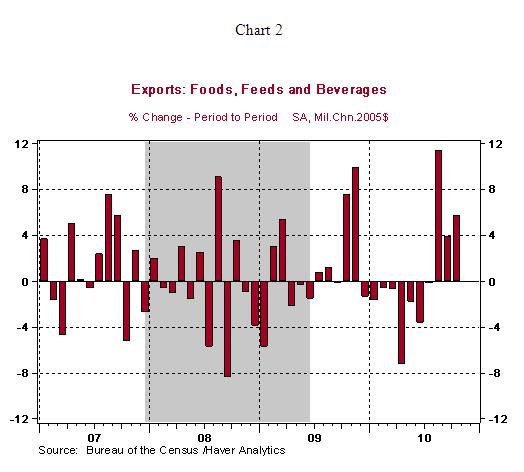

In October, exports of food items (+5.7%), autos (+4.5%) and capital goods (+1.6%) in addition to industrial materials inclusive of petroleum (+5.8%) accounted for the 3.3% gain in exports of the U.S. economy. It is noteworthy that food exports have risen for three consecutive months, reflecting growing demand for food items as growth in emerging markets allows for a larger food budget.

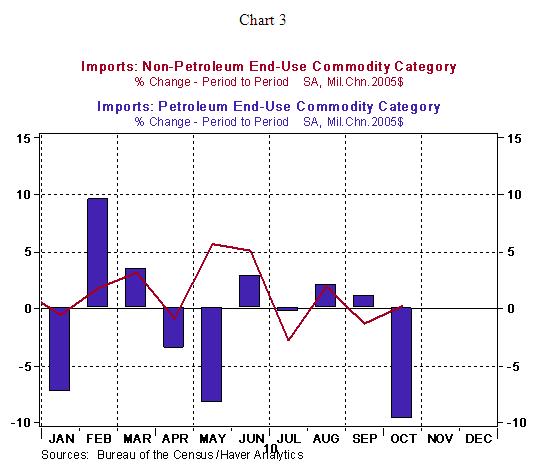

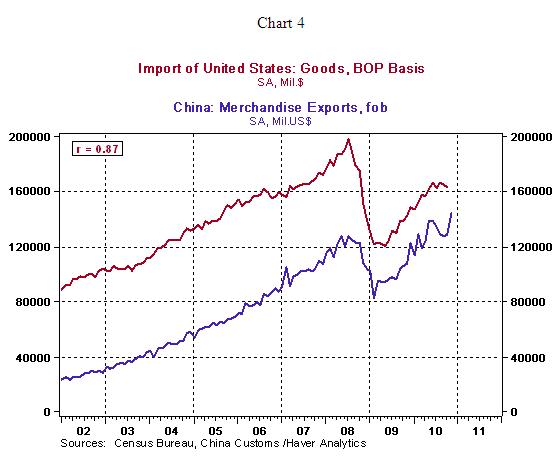

Imports of petroleum fell in October, while non-petroleum goods posted a small increase (see Chart 3). China's international trade figures for November, published today, a surge in exports. There is a strong positive correlation with U.S. imports of goods and exports of goods from China (see Chart 4), which implies that imports of goods could show robust growth in November after a tepid performance during October. In fact, China's exports to the United States rose 14.2% in November after a 5.0% drop in October. The bottom line is that trade deficit is most likely to show a large gap in November following an improvement in October.

In October, the trade deficit vis-à-vis China narrowed to $25.5 billion vs. $27.8 billion in September, widened vis-à-vis the Euro area ($6.0 billion vs. $4.8 billion in September) and Japan ($6.0 billion vs. $4.8 billion in September) but was nearly steady vis-à-vis Canada and Mexico.

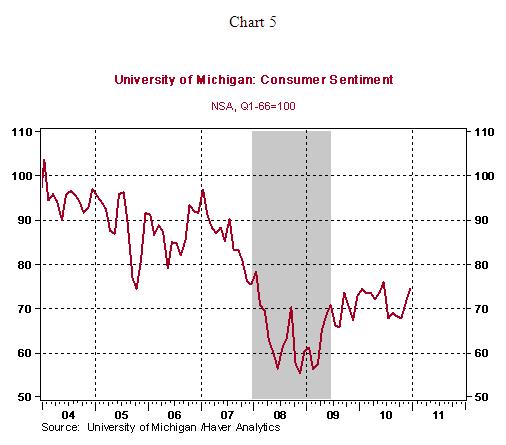

In other economic news, the University of Michigan Consumer Sentiment Index rose to 74.2 in the early-December survey and it is the best reading since June 2010. Both the Current Economic Conditions Index (85.7 vs. 82.1 in November) and the Expectations Index (66.8 vs. 64.8 in November) advanced.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.