Inflation, Deflation and the U.S. Economy Year Ahead

Economics / US Economy Dec 13, 2010 - 03:34 AM GMTBy: Clif_Droke

The inflation versus deflation debate has raged for years but since the credit crisis the debate has become highly politicized. If the credit crisis taught us anything it is that the risk of deflation far outweighs that of inflation. Yet there is an entrenched view emerging in political circles that is actively opposed to the government’s attempts at re-inflating the economy following the deflationary collapse of 2008.

The inflation versus deflation debate has raged for years but since the credit crisis the debate has become highly politicized. If the credit crisis taught us anything it is that the risk of deflation far outweighs that of inflation. Yet there is an entrenched view emerging in political circles that is actively opposed to the government’s attempts at re-inflating the economy following the deflationary collapse of 2008.

One of the most popular icons to emerge from the credit crisis is a long-time Congressman from Texas, Ron Paul. Perhaps more than any other figure, Rep. Paul has done more to capture the imagination of the voting public which has concerns about big government. His loyal followers (“Paulites” as they’re called) share his view that government has become too big and cumbersome to be an efficient servant of the people (indeed, they charge that government is no longer a servant but has become a rather harsh master). The “Ron Paul Revolution” as it has been called is aimed at shrinking government, restoring the Constitution and, significantly, reducing or eliminating the role of the Federal Reserve in the nation’s monetary affairs.

It’s amazing to think that just 10 years ago the “abolish the Fed” movement was rather small by comparison and was viewed by the mainstream as the province of cranks and conspiracy theorists. The movement was barely given even mainstream coverage at all except to highlight its more unsavory elements. Yet today, in the wake of the worst financial catastrophe since the Great Depression, the anti-Fed party has become a force to be reckoned with. The message of Ron Paul’s recent book, “End the Fed,” has resonated with millions of middle class Americans who view the central bank as one of the primary culprits of the nation’s economic woes.

Fear of inflation is perhaps the prime motivator for Paul’s economic platform. In an article spotlighting Rep. Paul’s quest for the chairmanship of the House Financial Committee, Businessweek magazine observed, “Next to the doorway in his Washington office are six framed German bank notes dating from the 1920s hyperinflationary era. The notes are sequentially dated ‘to show how quickly the zeroes were added onto the bills’ as inflation skyrocketed, Paul says.” Clearly, Paul sees inflation as a potential threat to the economy and it’s one reason for his fight against the Fed’s attempts at re-inflating through its quantitative easing program. Many of his followers – millions of working class Americans who have witnessed the decline in the U.S. standard of living in recent years – also fear the return of hyper inflation.

Rep. Paul isn’t the only one in Congress who is actively campaigning against the Fed’s attempts at re-inflating the economy. His son, Rand Paul of Kentucky, recently won a seat in the U.S. Senate and won on a platform of campaigning against the central bank. Another congressman, Rep. Mike Pence, accused the Fed of “masking our fundamental problems by artificially creating inflation.” Another popular figure within the Tea Party wing of the GOP, Sarah Palin, demanded that Fed chairman Ben Bernanke stop his “pump-priming addiction” before it brings “permanently higher inflation.” Clearly, the fear of inflation is another point of agreement among the burgeoning Tea Party movement.

Setting aside the political rhetoric surrounding the inflation/deflation debate, let’s examine the problem of inflation from strictly an economic standpoint. Inflation assumes a rather strong level of monetary, population and industrial growth. Two of the classic benchmarks of true economic inflation are rising wages and rising interest rates. The U.S. has seen neither in recent years; in fact the opposite holds true. Rep. Paul would be the first to admit that America’s industrial base is in the midst of a long-term decline and the country’s demographic trend isn’t conducive for inflation since the number of retirees is increasing relative to the number of workers.

The deflationary phase of the economic long wave has been underway for the last 10 years, greatly undercutting the standard of living for middle and lower class working Americans. While opportunities still abound for the rich, the middle class is finding itself increasingly devoid of the chance for economic advancement thanks to the falling wages and diminishing industrial base which are part and parcel of long wave deflation. Evan Thomas, writing in the Dec. 13 issue of Newsweek, points out that in 1970, the richest 1 percent made 9 percent of the nation’s income. They now make close to 25 percent. He also notes that CEOs who once made 50 times the average worker’s salary made more than 500 times as much as by 2001. “The gap between rich and poor,” he observes, “is growing in ways that mock middle-class egalitarianism.”

It’s the growing disparity between the “haves” and the “have-nots” that is, in part, fueling the grassroots movement against government spending and the central bank’s efforts to re-inflate the economy. A common worry is that further efforts at creating money will result in debasement of the currency and perhaps an outright dollar destruction. Many leaders within the anti-Fed movement are old enough to remember the high inflation rates of the U.S. experienced in the 1970s, which culminated with a double-digit interest rate in 1981. Memories of that chaotic, inflationary era are still fresh in their minds and motivate them to oppose the Fed at every turn. To them, inflation is always just around the corner.

This abiding fear of inflation is understandable in view of the government’s attempts at increasing consumer prices. This artificial inflation of retail prices is to be distinguished from the economic phenomenon of inflation. True inflation can only occur when there is a large and vigorous working population. It’s normally accompanied by a higher birth rate, i.e. well above the replacement level (in developed countries) of 2.1 births per woman. True inflation, as stated elsewhere, is characterized by rising industrial output, rising wages and rising interest rates.

The phenomenon we’re now witnessing in the U.S. – a preview of which occurred in 2003-2007 – is something I’ve previously termed “retroflation.” Retroflation is a byproduct of the globally integrated economy. Emerging countries like China, India and the Indonesian economy are experiencing something akin to true inflation which comes with high levels of industrial output. Because those countries have a high demand for oil, metals and other industrial and agricultural commodities, they are effectively driving up the prices of commodities, which in turn increases the cost of goods and services in the developed world. A rising PPI and CPI can easily be confused with true inflation, but without the economic underpinning of inflation (which the U.S. doesn’t have) this can’t be called inflation.

Retroflation occurs in countries experiencing systemic deflation (i.e. falling birth rates and declining industrial output). Deflation is at root a demographic phenomenon and retroflation occurs in countries like the present day U.S. when demographic trends aren’t favorable for a long wave economic boom, yet there is just enough productive output to justify rising retail prices. Retroflation is the point along the economic long wave just prior to the beginning of hyper deflation, at which point prices begin to decline vigorously along with falling demand.

As an aside, an email I received from a colleague recently underscores the importance played by demographic trends in the deflationary phase of the long wave. “Its no secret,” he writes, “that certainly the Lost Decade of Japan is one of the worthwhile comparisons to consider for the present USA. Two qualitative similarities to today’s America are: Crony capitalism and distrust of government was rampant in the Japanese lost decade, and declining demographics commenced with Japan’s lost decade.”

Retroflation inevitably ends in a deflationary collapse. This is owing to the fact that the overall demand level of a country in demographic/industrial decline is in a downward trend and this falling demand level must eventually bring pressure to bear on rising prices. We got a rather graphic preview of this during the deflationary collapse of late 2008. It should happen again in a more sustained fashion between the years 2012-2014 when the final “hard down” phase of the Kress 120-year cycle is underway.

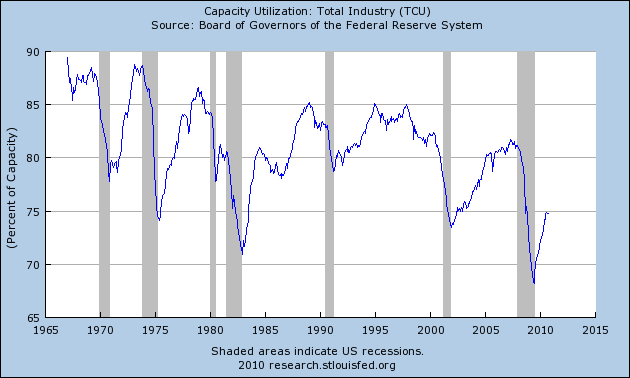

The long wave deflationary trend in the U.S. can also be seen in the graph showing capacity utilization. A distinctive downward trend of lower highs and lower lows is visible in this chart. The declining trend in capacity utilization, moreover, closely corresponds to the demographic peak and subsequent decline the U.S. experienced beginning around the late 1960s. In the last 40+ years covered by this graph, capacity utilization has dipped below 75% on four separate occasions: 1974, when the 40-year cycle bottomed; 1982, near the peak of the 60-year inflation/deflation cycle; 2002, when the Kress 12-year cycle was bottoming; and 2008-9, as a result of the credit crash. A capacity utilization reading below 75% is considered to be deflationary and such readings are typically seen at the depths of recessions. A straight-forward reading of the Kress long-term cycle series suggests that by 2014 we will see a capacity utilization reading below that of last year’s multi-decade low reading.

In the interim period between now and late 2011 when the last of the important yearly Kress cycles is scheduled to peak (the 6-year cycle), there is a good chance that the Fed’s re-inflation efforts will succeed in temporarily staving off the effects of deflation in the U.S. The year ahead will present perhaps the last opportunity of the post World War II expansionary era for individuals and corporations to shore up their balance sheets, buy gold on any dips or corrections, and prepare for the hard deflationary winter ahead in 2012-2014.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn’t matter when so many pundits dispense conflicting advice in the financial media. This amounts to “analysis into paralysis” and results in the typical investor being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won’t find a more straight forward and easy-to-follow system that actually works than the one explained in “Gold & Gold Stock Trading Simplified.”

The technical trading system revealed in “Gold & Gold Stock Trading Simplified” by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You’ll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold Strategies Review newsletter. Published each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.