Silver Monster Move in the Making

Commodities / Gold and Silver 2010 Dec 14, 2010 - 10:02 AM GMTBy: Ronald_Rosen

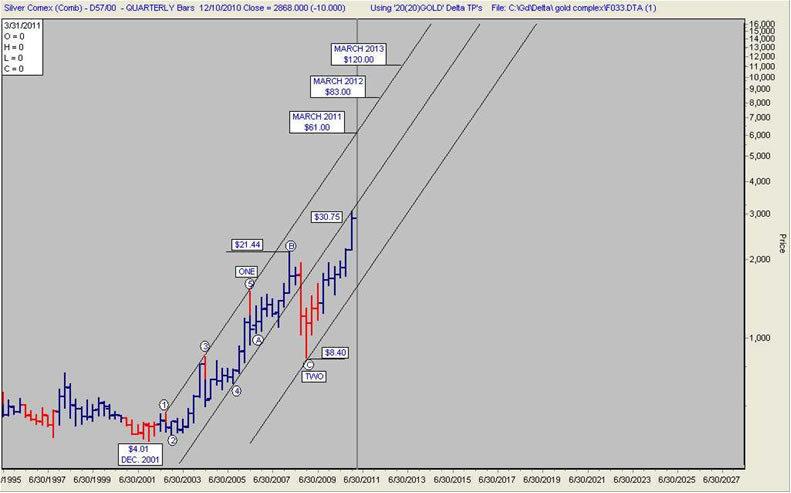

We don’t often see a chart that promises us a monster move. When we finally discover one it usually comes with a number of ifs. This quarterly logarithmic silver chart, although promising us a monster move, is no exception to the rule of ifs. The ifs are clearly outlined. Will the price of silver close over the mid trend line? If the price of silver does close over the mid trend line will it have a 5 wave move as did Major Wave One?

We don’t often see a chart that promises us a monster move. When we finally discover one it usually comes with a number of ifs. This quarterly logarithmic silver chart, although promising us a monster move, is no exception to the rule of ifs. The ifs are clearly outlined. Will the price of silver close over the mid trend line? If the price of silver does close over the mid trend line will it have a 5 wave move as did Major Wave One?

If silver does have a 5 wave move once it closes over the mid trend line, will minor waves 1, 3, and 5 peak at the upper trend line? If minor waves 1, 3, and 5 peak at the upper trend line will their peaks be key reversals? If their peaks are key reversals will the corrections that follow bottom above the mid trend line? We won’t know the answers to those questions ahead of time. However, I can say that of all the thousands of charts I have viewed over the years none have compared to the elegant simplicity of this silver quarterly logarithmic chart. It is telling us that the past will repeat in the future. Now all it has to do is deliver on its promise.

SILVER QUARTERLY LOGARITHMIC CHART

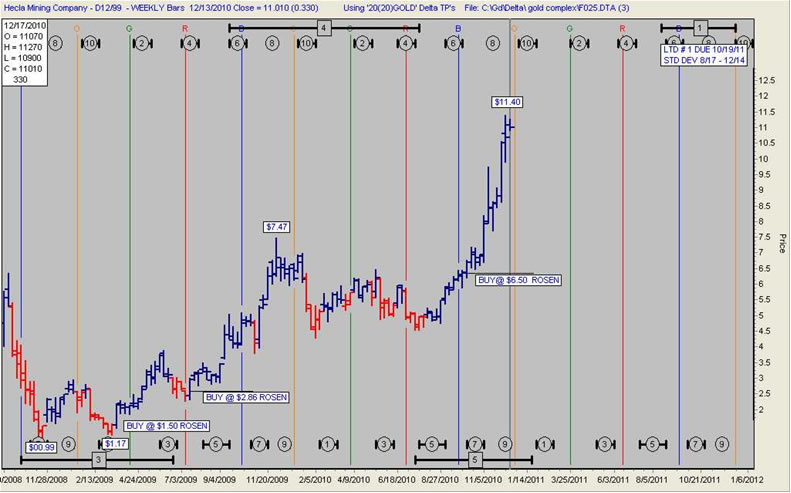

Participating in this monster move in silver without having to endure violent moves in the commodity contract is a problem. I believe that owning Hecla Mining is a reasonably conservative way to participate and still have potentially large gains if what I described does become reality. Of course there are other silver stocks. Owning three or four is a safer and more conservative approach. I own Hecla Mining and no others. Please be aware that when owning mining shares your investment is always subject to various mining disasters, i.e. floods, explosions, cave ins. etc. For more information about Hecla Mining see REPORT dated May 6, 2009 or visit their web site at www.heclamining.com

Hecla Mining was recommended as a buy at $1.50, $2.86, and $6.50. It is still a major buy.

HECLA MINING WEEKLY

For continuous updating on the potential “Monster Move” for silver, silver shares, and the precious metals complex a subscription to THE ROSEN MARKET TIMING LETTER may be obtained at www.deltasociety.com

HECLA MINING QUARTERLY

Stay well,

Ron Rosen

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.