EURO, USD and Equities in light of No decision from FOMC

Stock-Markets / Financial Markets 2010 Dec 14, 2010 - 01:25 PM GMTBy: Bari_Baig

We had the OPEC meeting which went almost unnoticed and today we have the FOMC. Would there be any policy change or let’s just say would the post meeting communiqué shed light on any possibility of tightening? The answer is a resounding No! And anyone anywhere expecting otherwise has gotten it totally wrong. Same could also be said about further easing therefore at best this meeting shall be one where committee members meet, have a brief discussion session and then call it a day, as if it was a “get together”.

We had the OPEC meeting which went almost unnoticed and today we have the FOMC. Would there be any policy change or let’s just say would the post meeting communiqué shed light on any possibility of tightening? The answer is a resounding No! And anyone anywhere expecting otherwise has gotten it totally wrong. Same could also be said about further easing therefore at best this meeting shall be one where committee members meet, have a brief discussion session and then call it a day, as if it was a “get together”.

We for one are glad that the meeting shall have minimal effect on the “Green Back” which came under serious nailing yesterday from all quarters. It was Moody’s who said if the tax and unemployment packages go through in the current form then it would have no choice but to cut U.S rating or for initially add a negative outlook. This along with lesser liquidity played to green back’s disadvantage.

Euro was perhaps amongst the biggest gainers as it triggered stop after stop to push higher and from 1.318s pushed up relentlessly as if that wasn’t enough, today with the exception of Asian trading when the pair was awfully quiet, moving in a 30 pips range however, in European trading, Euro took to the upside and posted a high of 1.349s almost knocked at the door of 1.3500s. This is serious! And we mean it. We are not discounting the fact that Euro had plenty of days to break to the downside as we had thought would be the course of action nonetheless the Euro bulls be it speculative in nature managed to flip the coin.

What we find interesting is that the strong statements from German officials on Sunday showing support for Euro didn’t single handedly push euro higher, rather the pair seemed to dwindle and it wasn’t until Moody’s news which sent the green back lower that Euro became strong. So, as we have said before not once, not twice but a number of times regarding Euro strength that it is in essence U.S Dollar weakness that pushes Euro higher. Do we expect U.S to be downgraded? No, and even if the outlook is made negative it would be months before the rating might be downgraded because what Moody expects, first needs to be validated. What [might] happen has already in near term done considerable damage to the green back as absolutely no decision from FOMC might be taken slightly negatively by the street and some more pressure could be felt by the green back but this shall only be temporary. Euro has big problems at hand which for some reason aren’t being publicized as much as they were two weeks ago. Could it be the calm before the storm? That is what it seems like. Belgium underwent a downgrade by Standard and Poor’s, some other ought to be in the pipeline. Comparing Euro’s chart to Dollar Index we find, Euro to have a slight edge over the U.S Dollar index.

“If” Dollar Index is making a topside top then looking at Euro’s chart we see a downside top forming. Dollar index is currently trading at 79.2s from where it reversed twice as can be seen in the chart. A close below would surely put a dent in the trend and give more credence to the plausible top right now.

They say a cat has nine lives, and to us it seems Euro is using those cat lives fast. The overall trend remains bearish, the weakness of U.S Dollar cannot be accredited to Euros bullishness, and it is only an adjustment in the price wars for now.

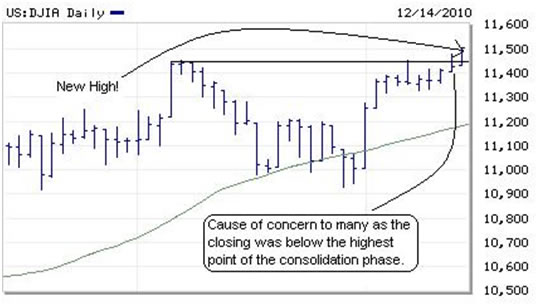

Now, turning our attention to the equity markets. Dow has broken the peak of November 9th and is on its way to new highs. Yesterday Dow traded to mere fractions of the peak but in last half hour turned lower. What we found interesting was the sudden rush of pessimism that came in from all direction as U.S equities turned lower that perhaps everyone got it wrong! We were bullish before the breakout took place and we remain bullish of U.S equities and most other global equities. As we write Dow has inched ahead to 11,500. We wrote yesterday that “Dow might experience jitters between the previous peak and 11,550 and once the jitters are settled then a move upward to 11,700 would take place”. For now everything seems to be going rather smoothly. No jitters and everything seem calm but the FOMC’s statement is due out today and that could cause some unrest to the equities for some time and breaking their rather smooth assent.

Looking at the chart above we can see what caused the street to panic as Dow started to ease off from the highs. Many thought it was a bull trap but they have been proven wrong thus far. New highs lie ahead as we maintain 11,750s a near term target for Dow.

The economic data out of U.S was good as the commerce department showed an increase in retail sales by 0.8% which was better than the consensus of the economist. The Business inventories came at 0.7% where as the streets guesstimates were of 1%. We are glad that the number was lower and not beyond 1% or that would be a cause of concern for the economy because that would reflect sales are that much weaker. Retail sales are ahead and that shall further strengthen the view and give more

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.