Consumer Inflation – Likely to Trend Higher in the Months Ahead and Multi-Family Housing Starts Plunge

Economics / US Economy Oct 19, 2007 - 01:30 PM GMTBy: Paul_L_Kasriel

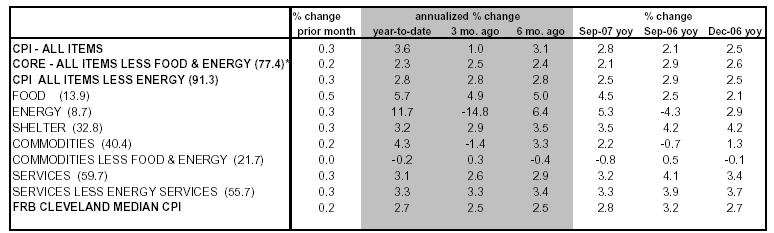

After being relatively benign in the previous four months, the increase in the CPI flared up in September, increasing 0.3% month-to-month and 2.8% year-over-year. In August, the year-over-year increase was only 2.0%. After having fallen for three consecutive months, the energy component of the CPI increased 0.3% in September. Food prices continued their steady monthly increases, rising 0.5% in September. Unless there is a sharp drop in energy prices, year-over-year increases in the CPI are likely to climb even higher as energy prices now are considerably higher than they were in the fourth quarter of last year.

After being relatively benign in the previous four months, the increase in the CPI flared up in September, increasing 0.3% month-to-month and 2.8% year-over-year. In August, the year-over-year increase was only 2.0%. After having fallen for three consecutive months, the energy component of the CPI increased 0.3% in September. Food prices continued their steady monthly increases, rising 0.5% in September. Unless there is a sharp drop in energy prices, year-over-year increases in the CPI are likely to climb even higher as energy prices now are considerably higher than they were in the fourth quarter of last year.

The core CPI, which excludes food and energy components, increased by 0.2% in September, close to what has been doing on a monthly basis all year. On a year-over-year basis, the core CPI was up 2.1% in September, the same as in August. The biggest upside threat to core consumer inflation comes from the weaker dollar. The rate of increase in the prices of imported consumer goods is now trending higher. Although I have my doubts that retailers will be able to pass through their higher costs of goods sold given the weak consumer demand I see in the coming quarters, the risk is that they will try to. With regard to Fed policy, I do not think the FOMC is comfortable with the inflation environment, but I don't think they are uncomfortable enough that it would prevent further interest rate cuts if a recession looks imminent. An October 31 FOMC rate cut still is a coin toss in my estimation.

HIGHLIGHTS OF THE CPI - SEPTEMBER 2007

Housing Construction - It's Multi-Family's Time to Plunge

Total housing starts plunged 10.3% in September to an annualized rate of 1.191 million units - the lowest level of starts since March 1993. Whereas much of the weakness in starts had been concentrated in the single-family segment of the home-building market, it was the multi-family segment that took it on the chin in September. Multi-family starts fell 34.3% in September whereas single-family starts were down only 1.7%. In terms of permits, the September declines were more evenly distributed - multi-family permits down 7.7% month-to-month in September and single-family permits down 7.1%. Single-family construction is much easier to turn off or on in response to changing demand conditions than is multi-family construction. Given the expectations of weak housing demand as far as the eye can see and given the glut of empty condos around the country, my bet is that the September weakness in multi-family starts will become the norm over the next 12 months.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.