Japan and Euro Problems, But Crude Oil Has No Problem

Stock-Markets / Financial Markets 2010 Dec 22, 2010 - 05:11 AM GMTBy: Bari_Baig

The Difficult Japanese Politics: We normally discuss about the popularity graph of the Japanese prime minister here at “marketprojection” that as time passes the slope of the curve almost always points lower but today however we discuss something different. Today it is the probable scandal issue which is turning the things for the worse in the ruling party.

The Difficult Japanese Politics: We normally discuss about the popularity graph of the Japanese prime minister here at “marketprojection” that as time passes the slope of the curve almost always points lower but today however we discuss something different. Today it is the probable scandal issue which is turning the things for the worse in the ruling party.

Interestingly Mr. Ozawa who less than two months ago put Mr. Kan to task for the leadership of DJP or should we say essentially for the Prime Minister-ship which he eventually lost but has had his eyes set on for the longest time imaginable. The new scandal doesn’t only revolve around Mr. Ozawa but also Mr. Kan which is new as we’ve known Mr. Ozawa has had many “Funding” related scandals in the past.

We have a Prime Minister and then we have Mr. Ozawa as mentioned above Mr. Ozawa has had his eyes set on the Prime Minister-ship for the longest time. What happens now? Who testifies? Surely Mr. Kan the Prime Minister wants Mr. Ozawa to testify but Mr. Ozawa has clearly turned his back on it and more interestingly is now threatening to pull out several members of Diet whom owe their careers to Mr. Ozawa from the DJP which would essentially bring down the party and with that Mr. Kan [but] the word of focus is [but] the reason Mr. Kan is still in office is not because Mr. Ozawa won’t pull the stop out but because the opposition support in Japanese public is even lower than the support level that Mr. Kan enjoys. Simply put, the government might linger on as the public deems the sitting government to be the lesser evil.

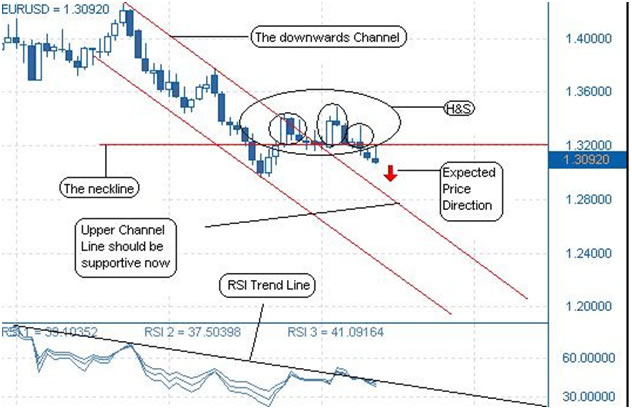

Revisit of [Is this the week which brings “bad” fortune to Euro]: Since we wrote yesterday a lot happened, something which seemed material enough that Euro bulls staged a rather impressive rally to just over the neckline region we earmarked on the chart at 1.3200. Today’s high then was 1.32022. We wrote yesterday that “What is even more interesting is a possible HnS formation with a neckline already broken on Friday as the neckline stood at 1.3200 and the pair closed at 1.3185s which to us a confirmation in itself.” So, we took it as a confirmation and now we have a second confirmation as today’s high after the apparent [Big] news from Beijing which was Chinese extending their support to Europe regarding the debt crisis! Firstly, what is interesting is that it seems like a re-run of what China did in the past. If our memory serves us write, and as we mentioned recently that during the time of Greek bailout, the number of visits by Chinese delegates to Greece increased and eventually China declared support for Greece! But that support was based on trade terms! China has now extended support to all of Europe and that too in a similar fashion, so how is this any different from what happened several months ago? In our opinion, it is absolutely the same which means nothing shall be done.

Euro is the 2nd largest reserve currency in the book of People Bank of China. The dilemma is Chinese officials are not bullish on either the U.S Dollar or the Euros therefore must be in the tightest of the fixes one could imagine because neither of the currencies are holding well and weakness in them directly reflects on the reserves therefore China has no option but to show its support to Europe and also U.S.

So, that is that and packed only enough muscle to put a bid to test the neckline and give a secondary confirmation that 1.3200 is now essentially a top. However, only a few hours later, news of Moody’s reviewing Portugal’s rating was enough to bring prices lower from the high and keep it that way for several hours before in the last ditch effort Euro pushed back atop to near highs before succumbing to the pressures and gave way. As we write Euro has bounce from the lows of 1.30732 and is now trading only 20 pips above the low. Nothing significant, nothing material rather what is “Most” interesting is that the 200 dma moving average which lies at 1.3090 euro is getting cold feet even testing it now as it has broken below it.

All eyes now seem to be set upon 1.3000 and the big question is whether Euro would hold it. Looking at the daily chart below we can see the drop to within the downward channel would surely be met with support at the upper trend line. The recent lows of 1.297s now don’t seem very far all of a sudden and looking at the RSI we can also see that its slope is pointing downwards and has only now tipped into the oversold territory therefore it could easily press on.

We maintain our stance of Euro hitting just below 1.25s in the near term regardless of the fact that Spain’s Economic Minister Mr. Salgado said today that “Not going to have debt financing problems next year!” had we been in living in a fairy tale Mr. Salgado’s comment might have made sense to us but we do not know of a magic wand that could solve this issue this “quick”. Secondly we had EU’s Junker pull out all the stops and say “Euro is not in a crisis and speculation that it is in danger is [unfounded]”. Again we ask, first it was the High Officials from Germany showing their “utmost” support for Euro and now others are too wouldn’t it raise a flag even in the minds of one’s whom don’t know that something does not seem right? Well, it surely does raise a big flag for us and 1.25 just might have to be revisited and adjusted severely for the downside. We’d keep our options open until then.

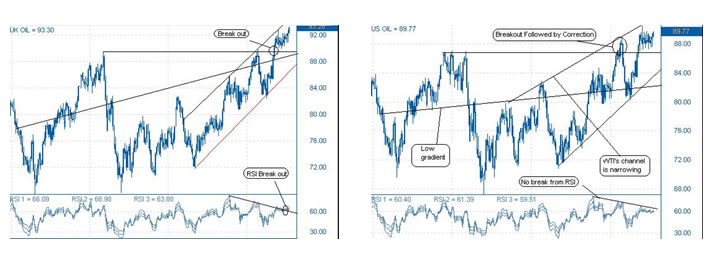

All might seem wrong but Crude has a different Story: It is awfully cold in much of United States and need we boost more about the near shut down of London or much of Europe due to heavy “Snow”. Well fact of the matter is, Crude has weather on its side and this alone is strong enough to put a bid on Crude and thus push it outside the consolidation phase it has been stuck in since beginning of December.

Okay, weather is one factor but the second most important factor is the spread between Brent and WTI. Brent is now in backwardation whereas WTI is not and its contango is marginally widening but what we have paid great heed to is the spread of both the blends. WTI is now nearly at a discount of $3.51 which is huge! Either Brent is too expensive or WTI is deeply discounted to the closely matched British blend of crude.

We can see clearly on the daily chart above that Brent has broken far above the highs posted in May and is trading nearly $4 above those highs and the chart seems to say it all as the movement is clearly from the lower left to upper right. Whereas comparing the chart of WTI with Brent, one thing is obvious WTI is missing a significant portion of the gradient that Brent has on its side. We have in the past argued that Brent will eventually replace WTI for one simple reason WTI is priced for delivery at Cushing Oklahoma which is in land whereas Brent isn’t.

Nevertheless, the switch wouldn’t be carried out in short term therefore WTI must follow as it has a long lead to capture. Price shall head higher and we mince our words at that.

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.