I Figured Out How to Get Bullish on Stocks!

Stock-Markets / Financial Markets 2010 Dec 22, 2010 - 05:23 AM GMTBy: PhilStockWorld

Just read the Wall Street Journal. On the front page we have "Nuclear Pact Adds Backers" above the fold along with a fluff piece on the weather in Europe. There are 3 other featured articles on the front page of the World’s most widely-read financial paper and one is a fluff piece on the Jimmy Stewart museum, one is on the obscure concept of betting people are going to die (very fun and interesting but "The World’s biggest financial paper"?) and the last is on the SEC looking into Mark Hurd’s exit from HP. On the left is "What’s News" with about 30 summaries of articles in the paper so one would think you could look this over and have a really good idea of what’s going on in the World.

Just read the Wall Street Journal. On the front page we have "Nuclear Pact Adds Backers" above the fold along with a fluff piece on the weather in Europe. There are 3 other featured articles on the front page of the World’s most widely-read financial paper and one is a fluff piece on the Jimmy Stewart museum, one is on the obscure concept of betting people are going to die (very fun and interesting but "The World’s biggest financial paper"?) and the last is on the SEC looking into Mark Hurd’s exit from HP. On the left is "What’s News" with about 30 summaries of articles in the paper so one would think you could look this over and have a really good idea of what’s going on in the World.

I see that "Spain said its regional governments are on track to meet their budget targets" and Dow component Boeing (who fell off yesterday) announced a "$1 Billion commercial satellite deal with the Mexican Government" and Blackstone is starting a $15Bn fund and TD is buying Chrysler Financial for $6.3Bn and (and this is a real XMas gift to Wall Street) "A Senate deal to fund the federal government until early March doesn’t include money to enact the health-care overhaul or stepped up regulation of Wall Street" and also that North Korea held their fire during a South Korean artillery drill. Wow! All seems right with the World, doesn’t it?

I see that "Spain said its regional governments are on track to meet their budget targets" and Dow component Boeing (who fell off yesterday) announced a "$1 Billion commercial satellite deal with the Mexican Government" and Blackstone is starting a $15Bn fund and TD is buying Chrysler Financial for $6.3Bn and (and this is a real XMas gift to Wall Street) "A Senate deal to fund the federal government until early March doesn’t include money to enact the health-care overhaul or stepped up regulation of Wall Street" and also that North Korea held their fire during a South Korean artillery drill. Wow! All seems right with the World, doesn’t it?

If I just read the WSJ, I find no reason to be bearish at all. Certainly there is no mention of Spanish Bond Yields rising 37% in a month to 5.5%at today’s $4Bn bond auction. There is no mention of China’s Vice Chairman of National Development saying that China "needs to prepare for a long- term fight against inflation" or that oil imports into China are expected to fall off next year as their economy cools down. You would think the fact that BAC, JPM and four other lenders facing a suspension of foreclosure activity under court order in New Jersey would be a news story or perhaps some mention of the 29-year high in sugar prices would be of interest to investors along with the limit-up trading in cotton to record highs for no particular reason other than the fact that it’s a commodity and speculators will buy pretty much anything in the current frenzy.

Gold is up for the third consecutive day, China’s money-market rates jumped to a 2-year high as banks raised their reserve ratios (this one didn’t even make the WSJ’s on-line Asia section, but you can real all about the World’s most expensive noodles!). Pimco said "Untenable Policies Will Lead to Eurozone Break-Up" according to the London Telegraph with Andrew Bosomworth stating: "Greece, Ireland and Portugal cannot get back on their feet without either their own currency or large transfer payments. The euro crisis is not over by a long shot. Market tensions will continue into 2011. The mechanism comes far too late."

Of course that’s nothing compared to Meredith Whitney’s dire warning of a financial meltdown driven by the collapse of US municipal bond auctions – a topic we discussed last Wednesday. And Meredith is just full of holiday cheer compared to David Rosenberg, who puts a fair value on the S&P at no more than 1,120 and makes many excellent points that the market is now 10% overvalued and gives "10 Signs that the Holiday Retail Season is Going Worse Than People Realize" or John Hussman, who has certainly channeled his inner Phil with "Things I Believe" too!

We are, then, getting to the root of my problem – I read too much! I wake up early every morning and read my various papers and web sites and, from that, I formulate a short-term and long-term investing premise. Perhaps I have forgotten what the Great Emancipator once said:

You can fool some of the people all of the time, and all of the people some of the time, but you can not fool all of the people all of the time.

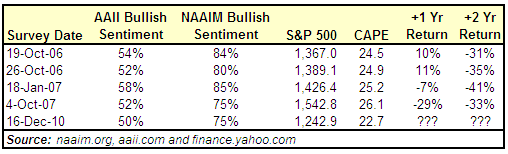

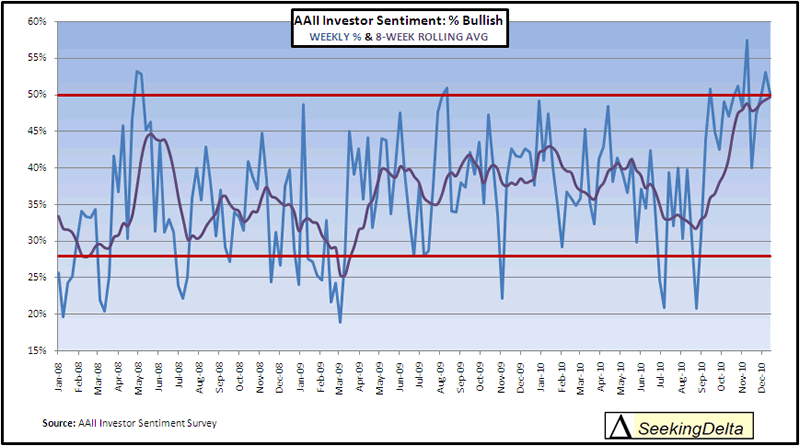

I keep fixating on the last part but it’s that first part that Murdoch and Company thrive on. You CAN fool some of the people some of the time and even all of the people some of the time. Currently, it seems, we are either fooling all of the people (as bullish sentiment is currently the 5th highest on record) or some of the people – the kind of people who tend to read the Wall Street Journal and then watch Fox for another point of view – have enough money to be fool enough for everyone. Of course we all know that the market’s biggest fool is the one with the printing press as The Bernank pumps about $30Bn PER WEEK into his pet Financials, which they can then lever 10:1 buying stocks and commodities using, of course, the greater fool theory which they can be comfortable with as the greatest fool of them all, the US Government, has already stated flat out and demonstrated through action that the Banksters are "too big to fail" and, therefore, they are free to gamble at will knowing that they either win and make Billions or lose and get bailed out so they can roll those dice again.

For those of us who like to read and, dare I say, think – it’s an annoying market. Just last night, Jimmy Cramer said the 233% run in NFLX with a market cap of $9.5Bn on $113M in 2009 profits and a FORWARD p/e of 47 "is too cheap." That’s the sign we were waiting for to short NFLX again – after Cramer’s sheeple pile in, of course. AMZN is another Cramer fave with a current p/e of 74 that should drop down to 52 next year if they grow earnings the 40% analysts expect. This would be truly amazing as they "only" grew 25% this year from last and last year was a pretty easy comp to beat but hey, 36 analysts follow AMZN and just 3 have them at underperform or sell. That’s what we call pretty much "all of the people, some of the time."

Now we can wait for our 3 holdouts to join the crowd or perhaps work our way into a short position on AMZN. At $183, it’s just too tempting not to and we’ll certainly try to figure our a trade on them depending on how the day goes. In the bigger picture, we’re still waiting for the Dow to confirm a breakout by holding 11,500 finally but yesterday afternoon, in Member Chat, I put up this chart and we’ll have to watch this channel very carefully because, if the Dow does fail – I very much doubt the other indexes will be able to float on their own.

The Dow finished the day at 11,478, pretty much right on the line but we have a big pre-market push as they put an unbelievable hit on the Dollar last night, dropping it all the way down to 80.57 (from 81.09) at 2am. That sent the Yen up to 83.80 at 3:30 but they knocked it back down real fast. Didn’t matter though as rumors were flying about China somehow bailing out Europe but all China’s Vice Premier Wang Qishan said was that "China supports the measures taken by European officials to combat the sovereign debt crisis." Mr. Wang didn’t comment on whether China may be interested in purchasing further European debt, but the euro still climbed sharply, by a total of 0.6% against the dollar.

Also killing the dollar and boosting the Euro is the Fed’s extension through August 1, 2011, of its "temporary" U.S. dollar liquidity swap arrangements with the Bank of Canada, the Bank of England, the European Central Bank, the Bank of Japan, and the Swiss National Bank. The swap arrangements, established in May 2010, had been authorized through January 2011. Yay, MORE FREE MONEY!!!

Also killing the dollar and boosting the Euro is the Fed’s extension through August 1, 2011, of its "temporary" U.S. dollar liquidity swap arrangements with the Bank of Canada, the Bank of England, the European Central Bank, the Bank of Japan, and the Swiss National Bank. The swap arrangements, established in May 2010, had been authorized through January 2011. Yay, MORE FREE MONEY!!!

Spain’s $4Bn note auction went very well, although at higher rates, of course. Moody’s warned on Portugal but everyone is bored with them downgrading Europe already. The Euro tested $1.32, which is pretty pathetic as they were $1.51 a year ago. Think about it, the Dollar is down 10% off it’s recent highs but the Euro is down 14% against the Dollar – no wonder everyone has commodity fever – except in Japan, where the Yen is UP 50% since early 2008… Gold is only up 20% against the Yen since early 2008 and oil is 25% lower - no wonder they have deflation – it’s all relative!

Ho, ho, ho – that’s right, all we can do is laugh…

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.