Asset Speculation and Capital Destruction, The Cost Of 0% Money

Interest-Rates / US Interest Rates Dec 29, 2010 - 02:49 PM GMTBy: Jim_Willie_CB

Since the early 1990 decade, the nation's maestros have promulgated the notion that cheap money is a beneficial factor for the sustenance of wealth, for economic development, for the standard of living, for the robust industries, in general for the American society. Nothing could be further from the truth, but even today the reckless US economists from the Keynesian Camp and their controllers from Wall Street have convinced the multitudes that cheap money is a good thing. Cheap money comes with a deadly ultimate cost. The inept professor occupying the US Federal Reserve Chairman post has gone on record claiming the US banking sector has a secret weapon in the Printing Pre$$ that it can use with zero cost, in its electronic form.

Since the early 1990 decade, the nation's maestros have promulgated the notion that cheap money is a beneficial factor for the sustenance of wealth, for economic development, for the standard of living, for the robust industries, in general for the American society. Nothing could be further from the truth, but even today the reckless US economists from the Keynesian Camp and their controllers from Wall Street have convinced the multitudes that cheap money is a good thing. Cheap money comes with a deadly ultimate cost. The inept professor occupying the US Federal Reserve Chairman post has gone on record claiming the US banking sector has a secret weapon in the Printing Pre$$ that it can use with zero cost, in its electronic form.

Nothing could be further from the truth. The Clinton & Rubin team began the distortion of the Consumer Price Index, ostensibly to reduce Social Security and USGovt pension benefits in cost of living raises. They wanted to cause a massive USTreasury Bond bull market, and succeeded in doing so. They wished also to bring down the USTreasury Bond yields. The infamous Fed Valuation Model dictated that as rates rose, stocks fell. So the scheme to manipulate the bond market began with the venerable craftsmen of rigged markets, ruined engines, and mega-fraud schemes. They taught from their high priest pulpits that cheap money was good for the financial markets. Nothing could be further from the truth.

Many analysts have sought the underlying root cause for the systemic failure of the USEconomy, the US Banks, and the USFed itself. One can start in pursuit of answers by looking at the cause being a sequence of costly wars and the ensuing monetary inflation, followed by lost industry to globalization and price inflation. The Vietnam War had a powerful consequence of inducing Nixon to exit the Gold Standard, a linkage few if any economists or even gold analysts make. But the true singlemost cause of wreckage is the artificial low forced cost of money, the near zero cost of usury. The subtitle to that billboard is that CAPITAL IS TRASH. Imagine in a nation that developed, promoted, and exploited the fullest riches of capitalism, embarked upon a path to destroy capital without even the recognition by its best brain trusts. Their mental chambers have been totally corrupted by the justification that inflation is a positive force that must be managed. Nothing could be further from the truth. The consequences of artificially cheap money, the wrecked pricing of usury, ultimately is capital destruction and economic failure.

POX ON HUMANITY

My friend and colleague Rob Kirby calls the artificially low cost of money, the cost of usury, to be the pox on humanity. It is actually a pox on the entire economy, in which humanity resides. The Jackass calls it acidic paper mixed in the cauldron to dissolve capital. The points of this article expose the most glaring blind spots of USEconomic and USBanking, a mindboggling failure that has delivered the United States of America to the doorstep of the Third World. The sins committed are almost precisely what Banana Republics have done, and faced ruin. The annual $1.5 trillion USGovt deficits are proof positive of the failure. Those deficits are grossly under-stated when hidden costs of war are factored, and when hidden costs of nationalized acid pits like Fannie Mae and AIG are factored. Leave alone the costs of endless war and its seamy motives. Consider the many sides to free money, the forcibly low cost of usury.

The 0% usury cost has destroyed capital, with the recent destruction seen as in an accelerated phase. The 0% money encouraged asset speculation, not business investment. The steady stream of nonsensical labels to the USEconomy are comical. The Macro Economy ten years ago fizzled. The Asset Economy six years ago fizzled. The bylines of a Jobless Recovery offer insult to one's intelligence. Nothing could be further from the truth, since no such contraption exists. The 0% money even encouraged drainage of real assets, like gold. The Clinton-Rubin gang altered the gold lease rate toward 0% in an experiment. Almost the entire gold inventory was drained from the USTreasury and its secure storage facility at Fort Knox. It was essentially stolen from the front door using official trucks. In defiance, the USFed and USDept Treasury continue to refuse an independent audit. With artificially low rates come complete destruction of capital formation, as economic laws have all been commandeered. The outcome features a shortage of everything valuable and a climax of central planning to manage the destruction. Witness the stream of nationalized failures, whether financial firms or critical industrial firms. Now General Motors (Govt Motors) produces an electric car twice the price of Toyota, rotten fruit. Witness the Home Buyer Tax Credit which has ended. The USFed as central bank has a bloated ruined balance sheet. The last remaining question for the august USFed is whether they will declare bankruptcy and liquidate, since their net value is between minus $700 billion and $1.2 trillion, OR whether they will attempt to purchase the remaining few $trillion of home loans from Fannie Mae and take property title to 30% to 35% of American homes. That would serve as a Fascist Manifesto of collectivism in a sense.

The tragedy is that the USEconomy has chronically suffered from an absence of capital investment. Some analysts point to a prohibitive US corporate tax structure. With a recent Japanese decision going into effect, the USGovt takes the top spot with a 39.5% corporate tax rate. The European nations range between 24.0% and 30.2% by comparison. Rather, the Jackass submits, the more pressing and acute problem is the 0% usury rate. It is common between the US and European Union, which faces a fracture. The United States shipped most of its factories to China, in an abandonment of capital structures and their legitimate wealth engines. The US economists applauded the move, calling it a Low Cost Solution. It was in fact a ruinous movement, one that replaced wealth engines with debt burdens. The climax is coming, with a higher cost structure across the USEconomy, and shortages where prices are kept down artificially. US businesses see little prospect in capital investment, at least not within the United States. They sit on cash, and see little usage for it. So they speculate with it, a contradiction that capitalism exists in the US at all. In the next chapter, future price inflation will be called economic growth, the next travesty!!

Look for an increase in empty sections of supermarket shelves for food, and gasoline stations shut down. It will be an end symptom. Look for a collapse of Municipal Bonds, as the states and cities are in a late stage of implosion. The impact of the semi-permanent housing bear market has local impact. Even banks have far less money in ATMs, a signal of the supply chain being interrupted. That is as much a sign of a supply chain problem as a solvency problem for the big banks. The ultimate problems are the cost of money, control of governments, the coordination of central bank policy, and the control system that enables the entire fiat system to perpetuate and continue. The desperate response has been to throw 0% money into the system, primarily the big US banks, $trillions of worthless money, and expecting to produce a remedy. It is folly on the stage in global view. Rob Kirby summed it up, as he said "It is like taking 100 gallons of water into the desert and pouring it into the sand to promote growth. Nothing happens, nothing grows, and people die of thirst." It is the climax folly of the Keynesian attempts, something in fact that Keynes himself never advocated.

EXTREME BRUTE FORCE TO MAINTAIN

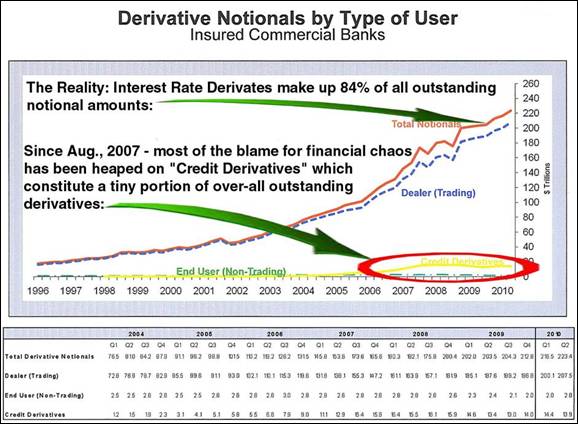

For the 0% cost of usury to be enforced, all connected financial structures must be attuned, distorted, and brought in line with the artificially priced markets. The enforced long-term rates are managed by means of Interest Rate Swap contracts. Their volume went in overdrive. The Interest Rate Swaps have inherent embedded USTBonds built inside them. The IRSwaps produce therefore huge USTBond demand, enough artificial demand to enable the finance of unlimited USGovt deficits. The maestros are not stupid, just corrupt. In fact, 84% of all credit derivatives have no end user, an exercise of pure bond market control. The portion of the credit derivatives with bonafide end users is negligible. Another $150 trillion in total credit derivatives from bank holding companies does not show up in the graph, which is from commercial banks. Recall Goldman Sachs changed their status to holding company, partly to conceal their credit derivative holdings, but also to qualify for USGovt slush funds in the TARP Fund program.

The group of big banks have total derivatives greater than the global GDP, which should offer a warning signal to economists, but instead they refer to it as providing stability in an unstable world. The USFed claims that the bond market determines long-term rates, but it does NOT. The Interest Rate Swap contract serves as a powerful mechanism to control long-term rates, using leverage from the more easily enforced short-term side of the USTreasury Bill market where the USFed exerts daily control with Fed Funds. Note the skyrocketing interest rate derivative tally, which is 84% of all credit derivative contracts. Note the miniscule volume of credit derivatives with actual end users, in the lower flatline. This is the smoking gun of ruined financial markets, in particular the bond market whose job it is to set the cost of usury!! Thanks to Rob Kirby for a fine graph.

In a recent interview, a fool on a financial network recommended JPMorgan as a stock investment, claiming the firm would benefit from rising interest rates. The level of ignorant recklessness is without bounds. As the 10-year USTreasury and the 30-year USTreasury yields have risen markedly in the last six weeks, the stress to JPMorgan has been so acute that some astute financial analysts like Jim Rickards have suggested that JPMorgan is burning money at an unprecedented clip, and at great risk. The enforcement of 0% money by IRSwaps has become extremely costly, as the leverage has backfired in JPMorgan's face. It is a reflection of the burned capital.

Take a walk down history. Clinton made a deal with the Wall Street devils. In the Clinton Admin, from January 1993 to January 1995, Robert Rubin set the stage, did the spade work, and made the necessary preparations. During that time, he served in the White House as Assistant to the President for Economic Policy. In that capacity, he directed the National Economic Council, a creation by Clinton after his coronation in the presidency. With his squire Lawrence Summers, they developed the Gibson Paradox at the USDept Treasury. That provided the high priest ideological dogma required to alter the cost of usury. Many recall Rubin as the Goldman Sachs superstar of currency trading desks. He was also head of their gold trading desk in London through the 1980 decade. He became Treasury Secretary in the Clinton Admin in January 1995, succeeding caretaker Lloyd Bentsen. From this important privileged post, he prepared to raid the national gold inventory for private Wall Street benefit. The volume of credit derivative growth accelerated in the Clinton-Rubin years, only to skyrocket since. The chart is proof. That unbridled growth occurred at the same time as the Tech-Telecom Boom & Bust, the Housing-Mortgage Boom & Bust, and the climax of ruin when the US banking sector died in September 2008. It will no more be revived than a dead man in a morgue will be revived from massive blood transfusions. The US banking sector has no pulse. Blood from large scale transfusions continues to collect in the form of Excess Bank Reserves held at the USFed, obscene bank executive bonuses, each a major eyesore never seen before in US history.

ALL MARKETS BADLY DISTORTED

Speculation became the norm, not capital investment. The ugly response has been heavy asset speculation, not investment in capital intensive industry. A clear consequence of 0% usury cost is the massive distortion of all financial markets. The trend has been for US industry to leave the nation, and seek lower labor costs, less federal regulatory obstacles, to lands where capital is valued and industrial output is held in the highest regard. The steady stream of wrecked markets will be written about in US journals for a generation. Witness the mortgage bond market and its ruin. Its pathogenesis includes a particular Wall Street specialty with leveraged Collateralized Debt Obligations useful to hasten to vanishing act of capital. This was financial engineering at its finest. A typical CDO bond that lost 15% rendered the bond holder with a total wipeout, a complete loss. The housing market led the decline in mortgage bonds, as collateral was eliminated, as revenue stream was eliminated, as bank portfolios suddenly saw a climb in the REO bank owned properties taken in foreclosure. The homes clutter the bank balance sheets more with each passing month in a heap of fetid rot. The control mechanisms to maintain desired price ranges for bonds, stocks, energy, and currencies were available. However, the property market failed on the maestros since Fannie Mae & Freddie Mac were forced to show financials on their balance sheet. The Chinese were actually a key player in the housing & mortgage blowup, as they abandoned the GSE Bonds. In doing so, they forced the issue and urgently pressured the USGovt to indeed prove they backed the Fannie Mae Mortgage Bonds, the so-called USAgency Bonds.

The big US banks continue to speculate, and not lend much to businesses. The 0% usury cost is like a flesh eating disease. It causes gross negligence on asset management. It causes financial counselors to suggest speculative investment portfolios. All things become a grand carry trade game. The big US banks prefer to play the USTreasury carry trade, than to engage in business lending. Capital controls keep the money in the bank casinos. Even the stock market has been exposed as a fraudulent private game. The shock in May to the stock market exposed the role of Flash Trading. The culprits were not prosecuted for either market rigging or insider trading. They continue to ply their trade. The flash trading mechanisms control the stock market similarly, like Interest Rate Swaps do with bonds. In the aftermath, it was revealed that ten stocks can dominate half the daily trading volume. It was revealed that the average time held for stocks is minutes, not months, in a grand Round Robin of Wall Street firms buying and selling stocks to themselves, thus propping stock prices. It was revealed that over 80% of stock trading volume was from the empty chamber of Flash Trading. Another ruined market, verified by almost 30 consecutive weeks of outflows from US stock funds. The American public has wised up.

VEHICLES TO ACCELERATE THE DESTRUCTION

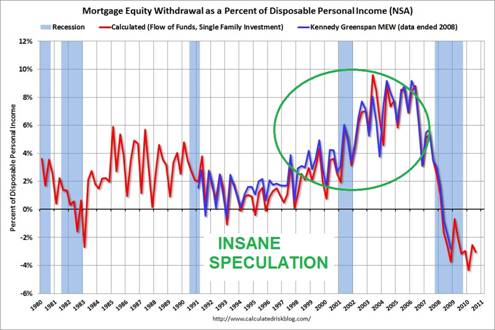

In the United States, the destruction of capital is so widespread, so universal, so perverse, that the maestros encouraged the development of vehicles extremely useful to accelerate the destruction. An addictive American mentality helped the process, fresh off the Me Generation. Recall in 2001 when USFed Chairman Greenspan showed open frustration with the bond market. Greenspan openly urged the long-term interest rates to come down, so that housing prices would rise and support the consumer society. He attempted (and succeeded for five years) to prevent the natural course of a major stock market plunge to be followed by a major housing market decline, as history would have dictated. He knew it would have been the end of the US financial structures, with big US banks going bust. That is whey he resigned in late 2005. He did not wish to preside over his handiwork disaster. He did not want to reap the harvest of the seeds of destruction he sewed. Greenspan essentially assured the USTreasury Bond market that the vigilantes would be killed off, and enlisted the aid of JPMorgan with Interest Rate Swap contracts. Notice the acceleration in the above graph after 2003.

The housing market boom ensued. It was unique. This time around, second mortgages were easy. Home equity lines of credit were easy. Origination fees (points as closing costs) were held down. Some people refinanced every 12 to 18 months. People without income had home loans approved. A street bum in St Petersburg Florida owned four properties bought with nothing down before he died. Income and asset verification became an annoying irrelevance. The end result was that the entire US housing market morphed into a gigantic ATM machine. Cheap money overbuilt the homes (MacMansions) and brought the 2nd and 3rd homes into play. From the year 2000 to 2007, the amount of mortgage equity removed from assets was astonishing. People ate capital in a veritable frenzy. The graph shown here is of equity withdrawal as a percentage of disposal income. From 2% to 8%, the trend was revealed as a quadruple. The trend was cheered by USFed Chairman Greenspan. With the home price declines came a new American phenomenon, negative home equity. The current figure is 23% of Americans owe more in their home loans than their homes are worth on the market. They are prisoners of capitalism gone awry. The ruin of the US homeowners is the symbol of the US systemic failure. So are food stamps and tent cities.

The trend turned to tragedy. Instead of investment in capital equipment, factories, and providing the fertile ground for robust job growth with legitimate income, the nation did the opposite. Investment instead was made in the $trillions on devices to drain capital, namely homes, shopping malls, and big box retail stores. The nation turned into a consumption engine whereby 70% of the US Gross Domestic Product was devoted to consumption. In a sense, the nation ate their homes and shopped until they croaked. Following the binge, came the current trend with mortgage defaults, home foreclosures, and bankruptcies. Lest one forget, the tent cities of homeless. To think that a collection of homes could supplant a collection of factories to drive economic progress and sustain a standard of living is the greatest folly in the history of the USEconomy. It is the last chapter of failed Keynesian policy. Remember well, it was blessed by Greenspan as good and wholesome and legitimate. He also blessed as sophisticated, legitimate, and robust the entire offload of debt risk with credit derivatives. THE GREENSPAN LEGACY IS OF RUIN, but in particular ruin from 0% usury cost as its root disease.

The perversity is so deep that home builders have often morphed into arbitrage outfits, who purchase wrecked development project homes and sell them to Fannie Mae. Even PIMCO has become a major buyer of wrecked housing portfolios with hopes to unload them onto Fannie Mae. Even big US banks have made the rules for home loan modification so twisted, that huge 25% profits can be snagged by merely forcing foreclosure, then sending the wreckage through the FDIC. The rules have been changed to favor the banks. Other arbitrage funds have sprung up to deal with mortgage backed bonds, as the vibrant funds have turned into processors of ruined capital. Regard these all as recyclers, no different than scrap metal, scrap paper, and scrap plastic processors that we are familiar with. The nation has not only created vehicles to drain and deplete capital, it has created recyling process plants to handle the wrecked capital. For the unrecoverable toxic waste paper, go to Fannie Mae. So the investment trend enabled accelerated depletion of capital, the shortage of factories, and the removal of legitimate wealth engines. It is like making bread without wheat.

FREE LICENSE FOR FRAUD

Few if any analysts make the connection that 0% usury costs and heavy speculation instead of capital investment go hand in hand with the fraud strewn about from the Fascist Business Model. Put aside the war machine, its missing $2.2 trillion in defense appropriations, its missing $50 billion from the Iraq Reconstruction Fund, its annual sacred defense budgets that surpass the entire world combined. Focus instead on the bank fraud, centered upon mortgage bond fraud, Municipal Bond fraud, Treasury Bond fraud, and the diverse counterfeit of same. See the packaging of quickly ruined mortgage bonds as unqualified buyers rendered the bonds worthless in double quick time. Then the ruined mortgage bonds as housing market declines rendered the bonds worthless (or badly impaired) despite the buyers having good credit. See the auction bond fraud for Muni Bonds across the land. See the naked shorting of USTreasury Bonds in order to supply operational funds that kept financial firms humming, made evident by Failures to Deliver. Not one prosecution has taken place against a Wall Street bank. The civil cases all result in a settlement that later proved to be bland. The license to fraud has become a mere cost of doing business for the large corporations, led by the big US banks.

The 0% usury cost is the business card to the national fascism umbilical cord to the USGovt from the banking sector. It enabled the development of the Syndicate, and its flourish. The economists have been reduced to carrying clipboards to track the fraud as they utter mindless drivel about the justification of Too Big To Fail. The slogans should be TOO BIG TO SAVE and SO BIG, SO CORRUPT. The extraordinary efforts and attempts to save the big US banks will be the precise policy that leads to systemic failure and the USTreasury Bond default, all in time. The corrupted financial markets are the province of the Syndicate in charge, which rules over the SEC, the CFTC, the FDIC, and the debt rating agencies. They also control the USCongress, painfully evident in the outcome of the Financial Regulatory Bill that enhanced their power. They rule from their exalted perch at the USDept Treasury, where Goldman Sachs has presided since 1995. They and the USFed have strangled the nation with a 0% usury noose.

LIGHT A FIRE UNDER GOLD & SILVER

The US economists and the US bank brain trust provide many lousy analysts. They are good propaganda artisans, a craft developed in the 1930 decade in a land not so far away. Their repeated lies are echoed by the obedient US press and financial networks. The current drivel they spew is that Gold is in a bubble. Nothing could be further from the truth, since the USTreasury Bond market is the global gigantic bubble. Gold cannot be in a bubble since gold is money. Money is never in a bubble, since, well, it is money. Gold might someday be subject to downdraft pressures, if and when the paper asset world is so incredibly depressed that the value of bonds goes below the cost of producing the embossed raised print colorful bond certificates. A precedent can be drawn from in the housing market, where in some areas the price of houses has gone 15% below construction costs. When USTBonds are valued less than their printing costs, let me know then and only then about a gold bubble. The US economists and the US bank brain trust are lousy analysts because they miss, overlook, and ignore the four primary driving forces behind the gold & silver bull markets:

1) When the price of money is well below the inflation rate, gold rises and silver soars

2) When government deficits go far beyond the ability of bond markets to finance, gold rises

3) The global monetary system has been exposed as faulty, supported by debt, so gold rises

4) No restructure or remedy is permitted, only gigantic bank welfare, so gold rises.

These are four principal foundations to the valuation of Gold within the fiat money system. The truth is that Gold is constant, and the USDollar and other paper instruments like assorted types of bonds vary in value relative to gold. The mindset of the US public and European also is so twisted that they believe Gold varies in price. It is fixed. The USDollar and various US$-based bonds are losing value so fast that Gold appears to be rising in a breakout in all major currencies (US$, Euro, Pound, Yen). The USDollar and USTreasurys are in a powerful bubble, at risk of puncture. That puncture is the USTreasury default, with the associated declaration that the USDollar is no longer valid legal tender to purchase imported products in the world market. Think of the USEconomy bidding up a currency in order to purchase crude oil. With each successive month, the USDollar would go lower in order to supply the crucial supply of oil to the USEconomy. The USDollar will someday not be legitimate to satisfy commercial trade contracts. That day will see the United States slide into the Third World. It is moving quickly in transition through the Second World with its tagline of Jobless Recovery.

The real price of money is somewhere around minus 7%. Calculate the price inflation as 8% by the Shadow Govt Statistics folks, up from a steady level a smidgeon lower for several months. The true CPI is rising. Subtract 8% from the cost of money at 1%, given generously, tied to the prevailing short-term USTBill yield. So the real price of money is big negative, like in the minus 7% range. Translated, it means generally that paper based financial assets (include housing) are losing 7% per year in value. Long ago, when mortgages dominated in the home valuation process, the home lost its status as a hard asset and became a financial asset adjunct perversion, a proxy. Translated, that means to borrow money and invest in hard assets, one should expect a positive 7% annual return, conservatively speaking. It pays to invest in Gold during such conditions. It always have been profitable to invest in Gold during such conditions. The US economists and the US bank brain trust consistently ignore this important point.

The spiraling USGovt deficits have become a regular fixture, with gaping shortfalls of $1.4 trillion each year. Remember in mid-2008 the nation was told that the $1.4 trillion deficit would be reduced to below $1 trillion easily in 2009. It was not, and repeated the $1.4 trillion. Remember in mid-2009 the nation was told that the previous two $1.4 trillion deficits would be reduced to below $1 trillion easily in 2010. It was not, and repeated the $1.4 trillion. Finally, the USGovt deficits in current projections are estimated to be well above $1 trillion, as reality has struck. The $1T deficits are a permanent fixture. Thus the Quantitative Easing #2 is in place, since the USTreasury does not want the shame from failed auctions to reflect badly on the USDollar or the other galaxy of US$-based paper assets. They masquerade as containing value, when they are largely trash items. They can no longer compete against Gold. If truth be known, Wall Street executives are trashing their corporations and buying gold in private accounts as counter-parties. They will someday dump their corporate losses on the USGovt and ride into the sunset zillionaires. Then comes the USTreasury default.

The global monetary system is crumbling, as all major currencies are mired in deep trouble, stuck in quicksand, pulled down with perennial deficits and extremely sluggish economies. The secret is out, the jig is up, that the major currencies are nothing more than denominated debt coupons. These arguments of a broken monetary system, the search for legitimate safe haven, the colossal aid packages for the banks that broke the system, the corruption within the big US banks (see mortgage bonds and home foreclosures), these factors have been thoroughly discussed in Jackass articles to date. But the topic of 0% usury cost is something that needs to be discussed more widely and fully. The 0% usury cost encourages a war of investment in tangibles led by gold & energy, of investment into tangibles and out of the bank-run financial centers. The fast rising price of gold & energy (silver too) are a vivid screaming report card of failure. Money in the form of gold represents money taken out of the corrupted banking system. Its value rises, or more accurately, the value of all else besides gold falls. Witness the climax of failure.

The fact that the big US banks are in no way even attempting to remedy, reform, and restructure the system is the additional jet assist to Gold & Silver. Any true restructure would begin with their liquidation as corporations, with fire sales of their nearly worthless assets rotting on their balance sheets. They would be forced to cede power and control of the USGovt and its Holy Grail, the USDollar Printing Pre$$. That event will come tragically only during a USTreasury default and assumption by the Receivership Tribunal, already formed. As more phony money is devoted to false fixes, more bank welfare, and wasted goony projects like Clunker Cars, Home Buyer Tax Credits, General Motors buyouts, Fannie Mae nationalization, FDIC home foreclosure processors, TARP Funds, and the many charades that make the USFed a virtual banking system, the Gold & Silver prices will seek their rightful value. Gold will move well past $2000 per ounce, and Silver will move well past $50 per ounce, before June 2012 as my forecast. Then they will double again when the USTreasury default goes face to face with a new global monetary system. The Boyz are soiling their pants with the runup in USTreasury Bond yields, a well-kept secret. So they are trying to paint the tape on the Gold price, trying to keep it down. It will not work. They cannot paint the Silver price tape at all, since it has great industrial demand. It is making new highs, trampling JPMorgan in the process, in a Silver Shetland Pony stampede. The Golden Stallion stampede comes soon enough.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.