Australia Heading for Economic Crunch as Families Face Financial Collapse

Economics / Austrailia Jan 04, 2011 - 02:25 AM GMTBy: Mike_Shedlock

The party is over in Australia. Many anti-dollar investors and Pollyannas living down under just don't realize it yet. Nonetheless, Australia faces an economic crunch as family finances collapse under the burden of record debts, rising interest rates and utility bills.

The party is over in Australia. Many anti-dollar investors and Pollyannas living down under just don't realize it yet. Nonetheless, Australia faces an economic crunch as family finances collapse under the burden of record debts, rising interest rates and utility bills.

Please consider Australians sinking under debt burden

With banks warning they will be forced to raise mortgage rates by 0.50 per cent in 2011 and Sydney rents forecast to rise by between $160 and $190 a month, according to analysts Residex, householders look set to suffer.

Repossessions and tenant evictions are expected to rise sharply. "It's going to be tough" said Shane Oliver, chief economist at AMP Capital. "Families face many rising costs and while most people have slowed their borrowing, our debt is still growing and that's a big problem."

Despite more cautious spending in recent months, household debt is still up by 5.8 per cent on a year ago and a recent survey by Westpac found only about 20 per cent of people thought paying off debts was the best use of their money. Most households in the US, UK and much of Europe are still busily paying down their borrowings, particularly unsecured debts such as personal loans and credit cards.

"Unlike the rest of the world, Australia has slipped back into its old habits," said Steve Keen, professor of economics at the University of Western Sydney. "We're spending ourselves right back into trouble. With so much extra debt to service, we don't need interest rates to reach anything like the 9.6 per cent they hit in 2008.

"We may find repossessions spiking much more quickly than they did two years ago."

Weekly Living Costs Up $100

Real estate has peaked and so has the shopping center economic model based on the strong Australian dollar. There is no reason here to like either Australian equities or the Australian dollar. Strong commodity prices will no longer help Australia.

Australian real estate has already been hit by rising interest rates and with Weekly living costs up $100, more rate hikes may be coming.

Click Here To Scroll Thru My Recent Post ListFAMILIES face cost-of-living increases that could drain the weekly budget by up to $100 this year.

New data shows Australians are being levelled with record expenses for basic services and Sydney residents are some of the hardest hit in the country.

After floods that have wiped out crops in Queensland and NSW, fruit and vegetable prices are predicted to rise by up to 50 per cent.

Advertisement: Story continues below

Any hope the strong Australian dollar would shield motorists from increases in fuel prices have been dashed - global oil prices are tipped to hit record highs.

This year's price increases will compound the cost pressures already inflicted on households.

The trio of utility costs alone represents an extra yearly burden of about $1000 - or $20 a week - for an average household of four, while grocery bills are set to rise on average by $50 a week, based on a weekly bill of $150.

Housing affordability has taken another dive, with industry figures showing the largest annual decrease in a decade.

A report by the Real Estate Institute of Australia showed the proportion of income required to meet loan repayments increased 5.8 per cent to 34.8 per cent over last year, a 10-year high.

Additionally, the amount of rent people are paying has increased by 18.6 per cent in Sydney over three years, above the national average.

The Bureau of Statistics also identified health costs, communications services and petrol prices as having risen sharply over the year.$AORD - Australian Stock Market Index Monthly

$AORD - Australian Stock Market Index Weekly

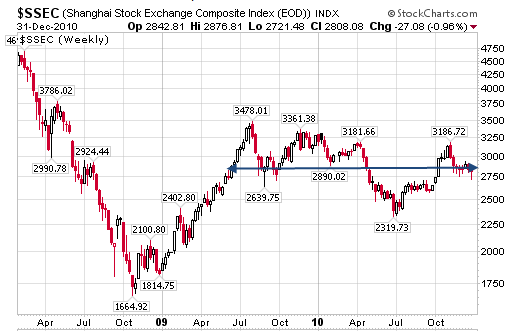

$SSEC - Shanghai Stock Market Index Weekly

Both the Australian stock market and the Chinese stock market have been weak. This is in spite of the fact that commodities have been on fire. Both countries have had overheating economies led by real estate bubbles.

It will be interesting to see how the Reserve Bank of Australia handles this. Failure to hike rates would hurt the Australian dollar and increase the price of imports while hiking rates further will crush the real estate bubble.

China's problem is far more complex. For more on China please see

- Misguided Love Affair with China; China's Massive Monetary Expansion and Crackup Boom

- China Hikes Rates, Ponders Capital Controls to Halt Currency Inflows; Eight Reasons China Faces Hard Landing

There are no good solutions when the central bank lets real estate bubbles get out of hand as has happened in the US, China, Australia, Canada, Ireland, Spain, the UK and numerous other places.

The difference so far is the US, Ireland, and Spain property bubble have popped, while those in Australia, Canada, and China are just now facing the pressure.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Leitmotif

05 Jan 11, 06:38 |

On the turn

looks like the AU$ is on the turn and its a long way back down |