Gold Correction Continues Despite Chinese New Year

Commodities / Gold and Silver 2011 Jan 07, 2011 - 07:57 AM GMTBy: GoldCore

Gold’s New Year correction continues and it has fallen another 0.7% today and 4% since the start of the year. This most recent correction is due to profit taking initially, increased risk appetite due to some positive economic data and the dollar’s recent strength.

Gold’s New Year correction continues and it has fallen another 0.7% today and 4% since the start of the year. This most recent correction is due to profit taking initially, increased risk appetite due to some positive economic data and the dollar’s recent strength.

Gold in USD – 1 Year (Daily)

The short term technicals have deteriorated but the 100 day moving average at $1,340/oz should offer support as it has done in recent months. Gold is now back at prices seen in October and the last three months look like another period of consolidation prior to challenging higher levels in 2011.

Gold in EUR – 1 Year (Daily)

While the technicals have deteriorated in dollar terms, it is important to note that gold has remained robust in euros due to concerns about the continuing sovereign debt crisis and the long term existential threat to the euro itself. Gold in euros has also now had a long period of consolidation and prices are now near the prices reached last June (see chart above).

The fundamentals remain sound with significant demand particularly out of India, China and wider Asia. This is clearly seen in the premiums being paid for gold bars in Mumbai, Singapore, Hong Kong and Shanghai. Chinese New Year is on February 4th this year and jewelers and bullion dealers continue to stock up to cater for the growing demand of some 1.3 billion Chinese people. This year inflation has taken off in China and inflation concerns may lead to record demand again this year.

There were many important news stories this week including the Tesco Gold Exchange news and Federal Reserve President Koenig’s comments that the gold standard was a “legitimate system” (see our News and Commentary sections).

The “Tesco Gold Exchange” story shows that the international ‘cash for gold’ phenomenon continues and that the man and woman in the street continue to be sellers of gold rather than buyers of gold.

From a contrarian perspective this would suggest that gold’s bull market will continue. If Tesco starts selling gold coins and bars to the public (as one Harrods shop and a handful of gold ATMs internationally are now doing) then it will be time to sell gold or reduce allocations to gold.

Tesco customers who sell gold jewellery will have their accounts credited with cash showing that gold is again becoming a means of exchange. This is very significant.

Koenig’s remarks allied to those of World Bank President Zoellicks after Bernanke’s QE2 announcement suggest that gold is being remonetised and is increasingly being seen in elite banking circles internationally as a currency rather than a commodity.

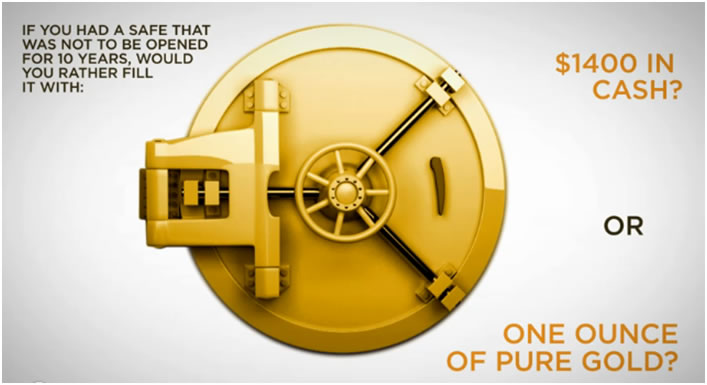

GoldNomics 'Gold Bullion or Cash' Video

Our GoldNomics 'Gold Bullion or Cash' video has been very well received. It looks at gold in its historical context, at gold as money and looks at some of the fundamental drivers of supply and demand today.

The video can be watched on our home page or here

http://www.goldcore.com/goldcore_blog/goldcore-launch-goldnomics-video-educate-about-gold

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.