This Simple Indicator Could Spell Disaster in the Stock Market

Stock-Markets / Stock Markets 2011 Jan 15, 2011 - 01:59 PM GMTBy: Jared_Levy

In the 15 years I have been trading the financial markets, I have utilized a plethora of indicators, everything from drawing simple moving averages on charts to finding the correlation between two or more assets, to find an early warning for a rally or sell-off.

In the 15 years I have been trading the financial markets, I have utilized a plethora of indicators, everything from drawing simple moving averages on charts to finding the correlation between two or more assets, to find an early warning for a rally or sell-off.

The truth is that there is no one magic bullet for timing the market, but at the same time, one simple indicator can be an excellent gauge for market sentiment and short-term changes in financial market direction.

Stock Volume

A good majority of the "tools" used by many technical analysts are based on stock volume or a combination of price and volume together. If you didn't know, a "technical analyst" is one who looks at the price charts of stocks (along with volume and other indicators) to find levels of support and resistance and find trends in a stock's price.

You can take stock volume data and crunch it, combine it with price, look at upticks and downticks and come up with some really complex formulas. Now, I am not going to say that I am not a believer in some of the more complex volume-related indicators, but just like we do at Smart Investing Daily, I will focus on a simple, overlooked indicator that's giving us a strong signal in the S&P 500. More on that in a minute.

We often fail to notice what is staring us right in the face because deep down, we think it can't be that easy.

A friend of mine used to say, "Volume is the cause, and price is the effect." He couldn't have said it better. Until someone actually steps in and buys or sells a share of stock, a trade can't be made and price will NOT really change.

This rule applies to many facets of our lives, including our houses, cars, etc. When someone in your neighborhood sells their home (which is similar to yours) for $20,000 more than what you thought it was worth, they set a precedent and price at which you can now base your "value" off of. They could have asked any price they wanted for their home, but until someone pays it, that value is not real!

Back in the stock market, it works the same way, only at warp speed. Tens of thousands of transactions are taking place every second, finding value at that moment. Here's the key point: Stock volume trends can tell us about the strength or weakness of that value. If the price is moving slowly higher, but volume keeps dropping off, it's like a housing bubble that is coming to an end -- a correction in price may be imminent.

The S&P 500 Volume Trends Show Lack of Conviction

Take a look at the intra-day chart above of the SPDRs S&P 500 ETF (SPY:NYSE). This ETF that trades like a stock: Each of the subtle vertical lines represents a day. Notice how the bulk of the volume spikes (bottom) are in red (a red volume bar means the price is moving lower, green vice-versa). Also note that the volume at the end of the day on positive days is abysmal on average and on down days, much more pronounced. This is a clear lack of conviction for the bulls as of late.

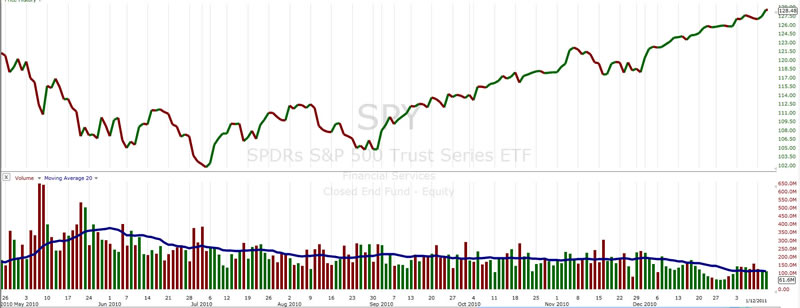

Now let's look at a daily chart of the same ETF, with the price on top and volume with a 20-day volume simple moving average in blue on the bottom.

Look at how the volume is just continuing to dry up. The blue moving average really displays this diminishing trend nicely. In addition, not many bullish days have eclipsed the 20-day moving average when it comes to volume. This tells me that the market's bullish trend is weakening.

(Investing doesn't have to be complicated. Sign up for Smart Investing Daily and let me and my fellow editor Sara Nunnally simplify the stock market for you with our easy-to-understand investment articles.)

Now to be fair, there are indicators (and experts) that show money has been obviously flowing into the marketplace, and it's common for volume to be lower when financial markets are rising. But my argument is that it may be the "retail" investors who have been waiting for the new year and maybe the start of earnings season to begin throwing more dollars in, feeling like they may have missed out. But unfortunately, many "retail" investors are usually the last to buy in before the financial market sells off.

Now, this data doesn't mean the Dow (DIA), Nasdaq (NDQ) and the S&P 500 (SPX) indexes will crash, but I wouldn't be surprised if we saw at least a 4-5% correction in the next couple of weeks. If you recall last January, when we were in a similar bull run, stocks corrected about 5% before resuming their runs in early February.

If the volume is looking like there is no one left to buy, use caution if you are thinking about buying for yourself. While volume is not a faultless indicator, I don't consider it a real party unless there are people there, and the market's New Year's celebration seems to be emptying out.

Lastly, an important chart for the S&P 500 Index itself...

If the market indeed moves lower, perhaps triggered by a bad earnings report, look for support at 1,255 and 1,225 (marked in green). Use the 50-day simple moving average (rising blue line) as your trend indicator. If the S&P breaks below it, the bullish trend we are in may be reversing course.

Editor's Note: Has the current economy got you feeling like you drew the "short straw"? Then you need to know how to become a "Short Straw Millionaire." The fact is, hard economic times can provide the best wealth-building opportunities available... if you know where to look. Don't miss out on strategies that can turn hard times into financial independence. Follow this link to learn more...

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/tpg/smart-investing-daily/smart-investing-011411.html

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2011, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.