Investors Should Bet on Uranium for 2011

Commodities / Uranium Jan 21, 2011 - 04:48 AM GMTBy: Jordan_Roy_Byrne

The spot price of Uranium as reported by UXC.com, just hit $68/lb. It is up nearly 70% since June, but remains only half the level of its peak back in 2008. In the early phase of the commodity bull market, Uranium ran from $7/lb to $140/lb. Interest in uranium and the uranium stocks is picking up after a nearly 3-year long bear market. Uranium is an intriguing bet for 2011 and beyond because of the supply/demand situation and because of the value at the current price.

The spot price of Uranium as reported by UXC.com, just hit $68/lb. It is up nearly 70% since June, but remains only half the level of its peak back in 2008. In the early phase of the commodity bull market, Uranium ran from $7/lb to $140/lb. Interest in uranium and the uranium stocks is picking up after a nearly 3-year long bear market. Uranium is an intriguing bet for 2011 and beyond because of the supply/demand situation and because of the value at the current price.

Many analysts talk about demand as the driving force for higher commodity prices. While this is true in some cases, it is a lack of supply or production that usually drives the biggest gains in individual commodities. Uranium is a great example.

As a result of the Cold War, uranium supply was hugely plentiful and so prices fell for many years. This practically “nuked” the industry as there were only a handful of companies around in the late 1990s. Stockpiles only last for so long and so the price had to rise to attract new production. Despite the previous cyclical bull market, the uranium market looks to be in a deficit starting in 2013, which is the end of the HEU agreement between Russia and the US. This agreement has provided supply to the uranium market.

Most of the current uranium production is high grade and comes out at a low cost. However, as the cost curve below shows, additional production is barely economic at present prices. Note, 90,000 tonnes equals about 200 million pounds. According to the above chart, production in 2011 should hit about 150 million pounds. In 2014, production will need to be about 185 million pounds.

Now you can understand why some commodity analysts and prominent investors feel Uranium has the strongest fundamentals among any commodity for the next five years. Lucky for you and I, the Uranium sector has turned up nicely but is still trading well off its high, which was in 2007.

The following chart shows Uranium Participation Corp (U.to, URPTF), which is the de-facto Uranium ETF. It follows the spot price of Uranium fairly closely. The shares have cleared a key level and look likely to head to $10 fairly soon. Also, note the ratios at the bottom which show URPTF against Commodities and against energy commodities.

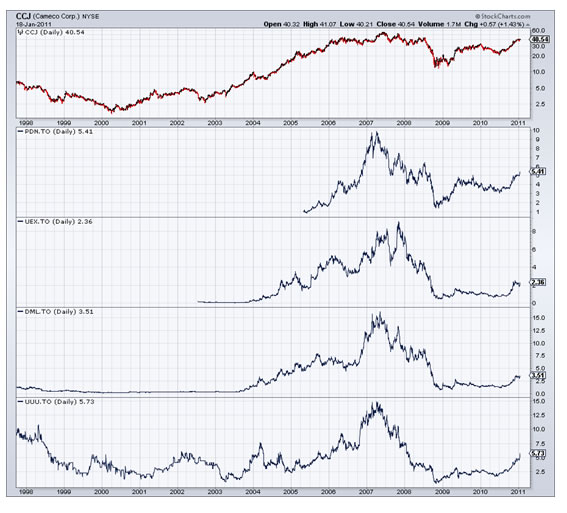

While uranium is recovering, it has barely recovered in “real” terms. In other words, relative to commodities and energy commodities, uranium is cheap. Furthermore, while the stocks have recovered, they are trading well off their highs. From top to bottom, the following chart shows Cameco (NYSE:CCJ), Paladin (PINK:PALAF), UEX (PINK:UEXCF), Denison (AMEX:DNN), and Uranium One (PINK:SXRZF).

Another way to play the sector is through the new ETF, NYSE:URA, which tracks the large uranium companies.

In our commodities service, we have acknowledged the uranium sector as one of the best bets for 2011. The junior uranium sector has only been in a bull market for six months and the energy sector typically peaks after the stock market. If you want to be invested in stocks but are wary of a market top, consider uranium.

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.