A Different Kind of US Recession - Nominal Vs Real Decline in GDP

Economics / US Economy Oct 26, 2007 - 02:27 PM GMTBy: Andy_Sutton

In a recent interview with Britain's Telegraph newspaper, Jim Rogers, the world-renowned investor declared the United States to be in recession. He didn't stop there. He has taken the next step and rid himself of the downtrodden US Dollar in favor of Chinese Yuan, Japanese Yen and the Swiss Franc. A bold move? A lone voice in a sea of complacency? Not so; Rogers is just the latest in a growing line of credible voices to abandon the US and its struggling currency.

In a recent interview with Britain's Telegraph newspaper, Jim Rogers, the world-renowned investor declared the United States to be in recession. He didn't stop there. He has taken the next step and rid himself of the downtrodden US Dollar in favor of Chinese Yuan, Japanese Yen and the Swiss Franc. A bold move? A lone voice in a sea of complacency? Not so; Rogers is just the latest in a growing line of credible voices to abandon the US and its struggling currency.

The one thing that is puzzling is why there are so many folks who claim we are in a recession, yet there are even more who say things have never been better. How can there be such a dichotomy when a recession is clearly defined as two consecutive quarters of negative GDP growth? Once again we find ourselves staring the riddle of nominal vs. real directly in the face.

Prior recessions, particularly those in the 20 th century have typically been consumer-centered. Inflation led to overproduction and misinterpretation of false demand. Eventually some crisis or trigger would lead to a wholesale reinterpretation of supply and demand dynamics. Consumers would react by retreating. Meaning consumers spent less money, increased savings, and which resulted in a contraction in GDP.

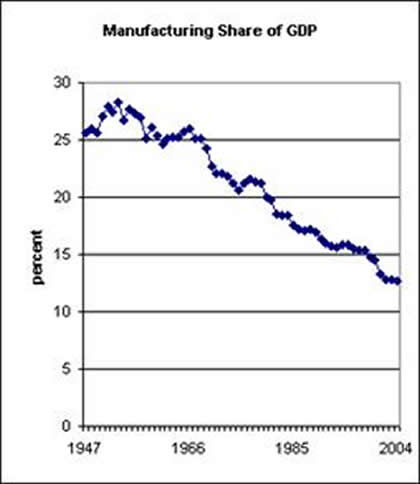

So far in the 21st century, we've seen plenty of inflation, but the overproduction this time is largely abroad. Our domination of manufacturing has been over for nearly two decades now. This means that any snap adjustments in demand cause problems abroad with mounting inventories as opposed to wreaking havoc on our economy.

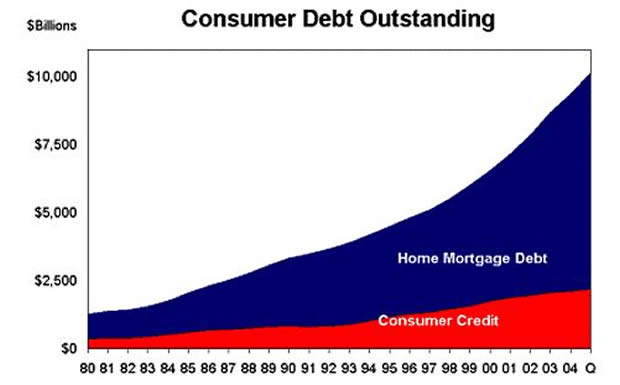

Additionally, what has really served to distort things is the nearly direct manner in which money has been placed into the hands of the consumer. Rising home prices were the perfect vehicle for creating additional (albeit fictitious) credit. Most people view their home as their biggest asset even though they may actually own a very small percentage of it. This illusion of wealth made many consumers willing to take on additional debt that was poured into the economy vis a vis consumer spending. Total consumer debt has exploded in the US since the beginning of the 21 st century:

Given this information it is easy to see why so many have predicted a recession. After all, it makes perfect sense. The consumer's ATM has been turned off right? Or has it? Consumers have continued to spend even in light of housing numbers that border on downright awful. Prices are stagnant in most areas and are falling in many key markets. Where is the money coming from? These obvious conclusions rooted in common sense have led most to think that the end of the consumption bubble is near. However, the dynamics have changed quite a bit and the rules have changed along with them. This certainly isn't to say that they no longer apply, but we need to understand that this isn't our father's economy. This is not a consumer-led recession. That doesn't mean that it can't feel the same.

Sector-based inflation leads to sector-based recessions

Like a tug of war, some areas of the economy are still doing reasonably well while others languish. Housing, manufacturing and the financial services industry are among those struggling while as a whole the service economy continues to do reasonably well. This aids in the confusion and the continued existence of the dichotomy. Ironically or perhaps not, the sectors of the economy that have seen the brunt of the last wave of inflation are now suffering the consequences. Housing and financial services are pretty obvious candidates, but manufacturing? Inflation has made it very difficult for domestic manufacturers to compete in this country. Consequently, manufacturing as a percentage of GDP has fallen concurrently:

So this recession is quite a bit different than anything we've seen before it. I am convinced that we are in it, in real terms. The average middle class consumer is in their very own personal recession. Wall Street, however, despite some less than stellar earnings, is not. Washington, despite a larger than reported budget deficit, is not. Whether or not we are in a recession depends not on numbers reported, but on which side of the street you happen to be. Beauty or lack thereof is clearly in the eye of the beholder.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. He currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.