Chinese Silver Demand Surges Incredible Four Fold in Just One Year

Commodities / Gold and Silver 2011 Jan 21, 2011 - 08:24 AM GMTBy: GoldCore

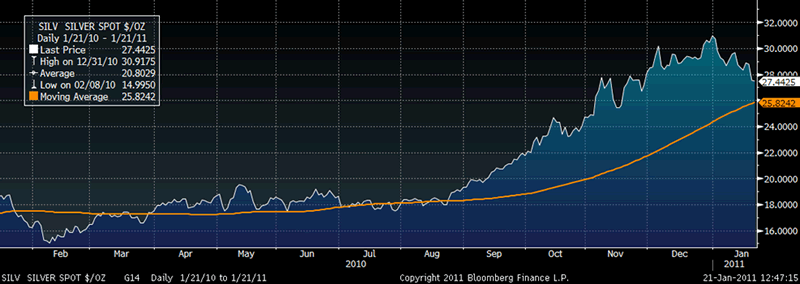

Gold is flat and silver marginally lower despite dollar weakness this morning. Some market participants are blaming the precious metal sell off on speculation that China may take more monetary action to curb surging inflation. This is unlikely to be the reason for the sharp selloff, rather it looks like another paper driven sell off in the futures market by leveraged players on Wall Street with various motives.

Gold is flat and silver marginally lower despite dollar weakness this morning. Some market participants are blaming the precious metal sell off on speculation that China may take more monetary action to curb surging inflation. This is unlikely to be the reason for the sharp selloff, rather it looks like another paper driven sell off in the futures market by leveraged players on Wall Street with various motives.

The fact that silver is again in backwardation at the front end of the curve suggests that tightness in the physical bullion market continues and may even be deepening. Indeed, the massive increase in silver bullion demand from China (confirmed overnight - see below) suggests that silver’s bull market remains very much intact despite becoming overvalued in the short term towards the end of 2010.

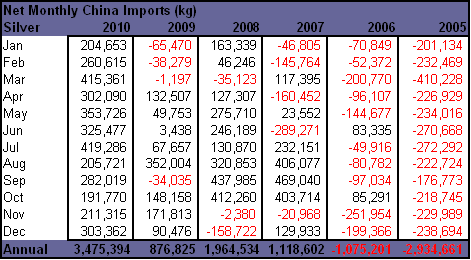

Table Courtesy of Mitsui

Surging inflation in China, India, wider Asia and much of the world is of course positive for gold and silver as it will likely lead to an even greater appetite for the precious metals in order to protect against the ravages of inflation and the further depreciation of paper currencies.

China, Gold, Silver and the Western Financial and Monetary System

A theme we have written about for many years is China’s growing importance to global financial markets and the global economy. As the most populous and largest creditor nation in the world, China’s influence and power continues to grow. Chinese power is being seen in currency, bond, commodity and other financial markets.

It is particularly seen in China’s huge appetite for precious metals and this is only being appreciated gradually. Many in western markets and finance continue to not realise the profound changes and long term ramifications of China’s emergence as a global superpower.

The world has changed and we are not reverting to the financial, economic and geopolitical conditions of the late 20th Century.

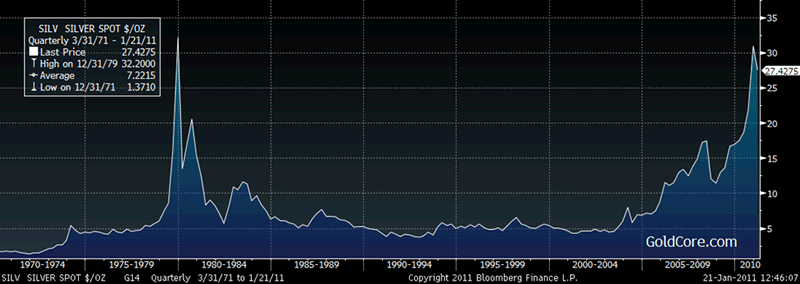

Silver in US Dollars – 40 Years (Quarterly)

China’s influence and massive appetite for precious metals is important both from a monetary and a geopolitical perspective. We warned of this some years ago – specifically writing about how the Chinese would gradually attempt to position the yuan as the global versus reserve currency, thereby replacing the petrodollar. We also wrote how the Chinese could use precious metals, and gold in particular, as a geopolitical weapon against the US and the west. Recently analysts, including the respected Jim Rikards, have eloquently outlined this real and growing risk.

China’s impact on the gold and silver markets will likely have ramifications for the western monetary and financial system and that is why China’s impact on the silver market is increasingly important. This is something we have wrote about for some time and one of the important factors driving silver’s bull market (see Money Week, August, 2007 article 'Why the Silver Price is Set to Soar'.

Silver’s Supply and Demand in China

Importantly and unknown to most analysts and people in the world is the fact that China was a net exporter of silver for many years – indeed China was a major component of global silver supply. This changed in 2007 when China became a net importer of silver.

The demand figures released by the General Administration of Customs in China overnight show the massive turnaround in China from large silver exporter to large silver importer.

China has gross exports of 1,575 tons of silver last year, down 58 percent from a year earlier, said customs. China’s gross imports of silver increased 15 percent to 5,159 tons in 2010, the customs agency said.

A longer term perspective is as ever important as are the net figures.

In 2005, China was a net exporter of nearly 3,000 tonnes (3 million kilogrammes) of silver. Last year, in 2010, China imported more than 3,500 tonnes of silver.

Incredibly, Chinese net imports of silver surged four fold in just one year from 2009 to 2010 (see table above).

Demand for silver in China has risen sharply in recent months and years. Growing middle classes and savers in China, India and other Asian countries have been turning to “poor man’s gold” and using silver as a store of value. Gold has risen above its historical nominal high in local currency terms internationally and silver is seen by many as a cheaper alternative.

Today buyers in China, Asia and internationally can buy some 50 ounces of silver for every one ounce of gold. The gold silver ratio today is 49.3 (gold at $1,342 per ounce divide by silver at $27.20 per ounce) meaning that 49.3 ounces of silver can be bought with every one ounce of gold.

Gold is increasingly unaffordable to the “man in the street” in China and wider Asia and this is leading to increased purchases of silver as a store of value, rather than gold. With the price of gold set to remain high in the coming years, this will continue.

Chinese and most Asians have experienced the decimation of their life savings through currency debasement and hyperinflation and unlike westerners understand the importance of owning gold and silver.

Besides huge demand for silver as a savings vehicle and a store of value in China, there is also very significant industrial demand in China and internationally.

There remain a huge range of industrial applications for silver. While demand from the photography sector has declined, demand from the medical, solar energy, water purification and many other sectors continue to rise significantly.

Today industrial uses account for 44% of worldwide silver consumption and in conjunction with investment and store of value demand, industrial demand continues to grow.

Conclusion

Investors and savers in the western world should familiarise themselves with monetary history and why paper currencies always depreciate over the long term and why gold (and also silver) are vital in order to protect and preserve savings and wealth over the long term.

The ‘GoldNomics Cash or Gold Bullion?’ video is a valuable tool in this regard.

It has gone viral with over 55,000 Views in just over two weeks. It is the most watched YouTube video on gold bullion in 2011.

News

(Bloomberg) – Silver in Backwardation on Bets Futures Will Decline

Silver for February delivery rose above the March contract on speculation that a run up in prices has caused investors to liquidate contracts that are further from expiration.

The February contract was $27.29 an ounce earlier today on the Comex in New York, higher than March futures at $27.21 an ounce, a so-called backwardation market, which may signal rising demand for immediate-delivery metal or weaker interest in futures contracts.

“We’re seeing a selling of forward contracts,” said Dan Smith, an analyst with Standard Chartered Bank in London. “This suggests people think silver has been a bit overdone. You get people selling forward when they think it’s looking like a good price, and they take profits and protect themselves from downside risks.”

The February contract fell 28.9 cents, or 1.1 percent, to $27.17 an ounce at 6:36 a.m. on the Comex in New York. March futures dropped 1 percent to $27.20 an ounce.

(Bloomberg) - Platinum Imports by China Jump in 2010 on Car Sales; Silver Exports Drop

Platinum imports by China, the biggest car market, jumped 40 percent in 2010 as robust vehicle sales fueled demand for the precious metal. Silver exports fell on rising domestic consumption.

Shipments of platinum climbed to 75.9 metric tons last year, the General Administration of Customs said in an e-mailed report today. Imports last month were 9 tons, it said. Platinum is used in jewelry and in pollution-control devices.

Prices of platinum this week advanced to the highest since July 2008, extending a 21 percent rally last year, on expectations demand will gain alongside rising car sales.

“Demand from industries such as auto and glass more than compensated for the loss in jewelry sales because of the price gain,” Patrick Huang, official at Platinum Guild International, said by phone from Shanghai today.

China’s vehicle sales will grow 10 percent to 15 percent this year after jumping 32 percent to 18.06 million vehicles in 2010, the China Association of Automobile Manufacturers forecast.

Platinum is used for about 75 percent of catalysts in diesel devices, according to Johnson Matthey, which produces a third of the world’s autocatalysts. The metal traded at $1,809.75 an ounce at 4:31 p.m. Singapore time.

Silver Exports

Silver exports from China fell for the second year in 2010 as domestic demand rose and local prices gained. China exported 1,575 tons of silver last year, down 58 percent from a year earlier, said customs.

“It’s not a viable business these days to export silver, given that domestic prices are higher than overseas ones,” Liu Yangyi, analyst at Sinogem Jewelry Import and Export Co. said today by phone from Beijing.

The metal for immediate delivery touched $31.2375 an ounce on Jan. 3, the highest price since September 1980, extending an 83 percent gain from last year. It traded at $27.2944 at 3:57 p.m. in Singapore.

Taurus Funds Management Pty sold all of the silver holdings in its $200 million precious-metals fund this month, saying the metal’s rally has been excessive, co-Manager Brenton Saunders said in an interview today.

Silver may retreat as much as 20 percent this year as soaring demand for physical metal signals a “crowded” trade, Barry James, chief executive officer of James Investment Research Inc., has said. James oversees $2.4 billion.

China raised export quotas for silver, tungsten and antimony for 2011, the Ministry of Commerce said on Oct. 28. The country may export a maximum of 5,670 tons of silver this year, compared with a maximum of 5,100 tons allowed in 2010, it said.

China’s (gross) imports of silver increased 15 percent to 5,159 tons in 2010, the customs agency said.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.