Stock Market Crash Warning, FTSE World Equities BubbleOmics

Stock-Markets / Financial Crash Jan 30, 2011 - 07:16 AM GMTBy: Andrew_Butter

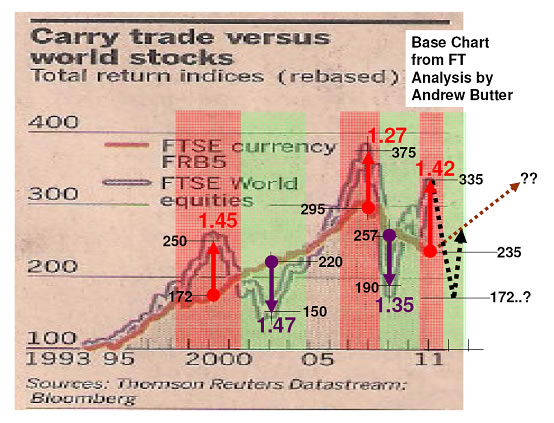

Intriguing to see John Authers’ chart in an article about the “Carry Trade” in this weekend’s Financial Times, had all the hallmarks of classical BubbleOmics.

Intriguing to see John Authers’ chart in an article about the “Carry Trade” in this weekend’s Financial Times, had all the hallmarks of classical BubbleOmics.

By way of explanation, there are two lines (1) FTSE World Equities which I looked up and couldn’t find a definition of, although since the article is mainly about emerging markets presumably it is weighted towards those?

The other line is a complicated construct that has something to do with the carry trade and currencies and I’m sure John Authers explains what that is all about better than I ever can.

The point there, even though I’m not completely clear what precisely the lines mean, what’s interesting is that it looks, on first inspection, that for some reason (which I haven’t even attempted to understand), the FRB5 line might define the fundamental for the equities line.

How come, is simply BubbleOmics, because that says the departure above the fundamental in a bubble, is mirrored in the departure below the fundamental in the bust that invariably follows, both in terms of amplitude, and time.

So, from the top:

>>In 2000 there was a bubble, the market got 42% overpriced (i.e. 1.45 above the “fundamental”…if that’s what it is).

>>Then there was a bust, and the Equities Index fell to 1/1.47 below the supposed “fundamental”.

Like Err…SNAP!! And the timing gels too (Red Shade compared to green Shade)!!

OK, that could be coincidence, like in January 2009 when I wrote that the S&P 500 would bottom at 675 (which it did in March 2009), that could have been a coincidence…and there have been a lot of “coincidences” since then.

>>Then in 2007 there was another bubble (you can spot those quite easily after the fact because there was a bust afterwards, which is always a good clue). That time by this rule-of-thumb-eyeballing-methodology, the market got 27%over-priced.

>>Then BOOM, and back again; to 1/1.37.

OK I admit 1.35 is more than 1.27, but remember there was talk that the world as we know it was going to end at that time, so let’s say it was “in the ball-park”.

NOW:

According to that line of logic the Index (whatever it precisely is), is 42% out of “equilibrium” , due partially due to the FRB5 line (whatever that is), dropping.

That sort of makes sense if the “Index” reflects the countries that have been the recipients of Ben’s “Hot Money” (we all know that “Hot Money” causes bubbles just like “loose-talk costs lives”).

If that logic is right, then at some point (perhaps quite soon since when 1.4 is breached that appears to be a “sign”), there will be a reversal, and if the FRB5 really reflects a fundamental then expect a bottom at 172 in the “Index” shortly after.

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2011 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.