U.S. Real Statistical Economic Recovery, Bubble Complacency

Economics / US Economy Jan 30, 2011 - 10:27 AM GMTBy: John_Mauldin

The Recent GDP Numbers – A Real Statistical Recovery

The Recent GDP Numbers – A Real Statistical Recovery

Consumer Spending Rose? Where Was the Income?

A Bubble in Complacency

Egypt

This week I had the privilege of being on the same panel with former Comptroller General David Walker and former Majority Leader (and presidential candidate) Richard Gephardt. A Democrat to the left of me and a self-declared nonpartisan to the right, stuck in the middle and not knowing where the unrehearsed conversation would take us. As it turned out, to a very interesting conclusion, which is the topic of this week's letter. By way of introduction to those not familiar with them, David M. Walker (born 1951) served as United States Comptroller General from 1998 to 2008, and is now the Founder and CEO of the Comeback America Initiative. Gephardt served in Congress for 28 years, was House Majority Leader from 1989 to 1995 and Minority Leader from 1995 to 2003, running for president in 1988 and 2004.

Some housekeeping first. We have posted my recent conversation with George Friedman on the Conversations with John Mauldin web site. And on Saturday we will post the Conversation and transcript I just did with David Rosenberg and Lacy Hunt, which I think is one of the more interesting (and informative!) ones I have done. You can learn more about how to get your copy and the rest of the year's Conversations (I have some really powerful ones lined up) by going to www.johnmauldin.com/conversations. Use the code "conv" to get a discount to $149 from the regular price of $199. (If you recently subscribed at $199 we will extend your subscription proportionately. Fair is fair.)

And go to www.johnmauldin.com to contribute comments on this letter. I do read them!

The Recent GDP Numbers - A Real Statistical Recovery

Now, before we get into our panel discussion (and the meeting afterward), let me comment on the GDP number that came in yesterday. This is what Moody's Analytics told us:

"Real GDP grew 3.2% at an annualized pace in the fourth quarter of 2010. This was below the consensus estimate for 3.6% growth and was an improvement from the 2.6% pace in the third quarter. Private inventories were an enormous drag on growth, subtracting 3.7 percentage points; this bodes very well for the near-term outlook and means that current demand is very strong. Consumer spending, investment and trade were all positives for growth in the fourth quarter; government was a slight negative. The economy will see very strong growth in 2011 as the tax and spending deal passed in December stimulates demand and the labor market picks up, creating a self-sustaining expansion."

This 3.2% followed a 1.7% in the second quarter and a 2.6% in the third quarter. The trend is your friend.

Well, maybe not so much. That inventory number seemed odd to me, and looking into it with Lacy Hunt, it turns out there is more than the headline number. For some of you, this is going to be a little like "inside baseball;" but the way they calculate the GDP number can have some odd effects every now and then. And this quarter the effect was way more than normal. This is going to be somewhat counterintuitive, but hang in there with me as I try to make it simple.

You remember our old friendly equation:

GDP = C + I + G + (Net Exports) or

Gross Domestic Product is the combination of domestic Consumption (both consumer and business) plus Investments plus Government Expenditure plus Net Exports (exports minus imports). This latter category has been negative for quite some time, as imports, especially oil, have been larger than exports.

Now to get Real GDP (actual GDP after inflation) you have to take away the effects of inflation/deflation. This is done by the use of a deflator built in for each category. But the deflator for exports/imports is a little tricky at times.

Moody's correctly noted that "private inventories were an enormous drag on growth" and concluded that this was a good thing, in that they assumed that meant inventories went down and thus inventory rebuilding in future quarters will add to GDP growth. And that is where you have to look at the numbers, and there we find our anomaly. There really wasn't that big a drop in inventories. It was in large part in the statistics, not in the warehouse.

Oil in the 4th quarter rose from roughly $81 to $89, or about 10%. On an annualized basis, this is 40%. Inventory investment is equal to the change in book value of the inventories, minus what is known as the IVA, or inventory valuation adjustment, which is used to correct for prices going up or down. Because the value of oil rose and thus cost more to acquire, the accounting requires that you reduce the value of the current inventories. Thus "real" imports fell at a 13% annual rate. Why? Because the deflator rose by 19%, largely because of the rise in the price of oil.

I know, I know, I just wrote that because the price of oil went up, the "real" value of imports went down, as well as inventories. Some of you are getting economic whiplash right about now.

If oil were to go back down this quarter by the same amount, that "growth" could be wiped out. There is no conspiracy here. It is just a statistical necessity, like hedonic measurements, and it is all very clear in the fine print; but when there are wide swings in oil prices over a quarter, and because our imports of oil are so large, you can get these odd accounting factoids. Which the gunslingers on TV (and elsewhere) miss in their urge to be the first to get out a bullish statement!

How much did it change things? Lacy thinks by anywhere from 0.5% to 1%. That means GDP is still a positive number, but there is not a "3" handle at the beginning of it. In the grand scheme of things, no big deal, as it will balance out over the coming quarters and years. But I just wanted to point out (once again) that you have to take some of the numbers we get from our government with a few grains of salt. That's the key takeaway here. And they CERTAINLY should not be traded upon. (Anybody who trades on the employment numbers deserves what they get, which is usually a loss. But back to our story.)

Consumer Spending Rose? Where Was the Income?

The really surprising number you saw the talking heads on TV mention was the growth of consumer spending, at 4.4%. Is the US consumer back? After all, real final sales rose by 7.1%, a number not seen since 1984 and Ronald Reagan. But real income rose a paltry 1.7%. Where did the money that was spent come from? Savings dropped a rather large 0.5% for the quarter. That was part of it. And I can't find the link, but there was an unusual drawdown of money market and investment accounts last quarter, somewhere around 1.5%, if I remember correctly. (David Walker remembered that article as well.) That would just about cover it. But that is not a good thing and is certainly not sustainable.

Let's see what good friend David Rosenberg (more on Rosie below) has to say about those numbers:

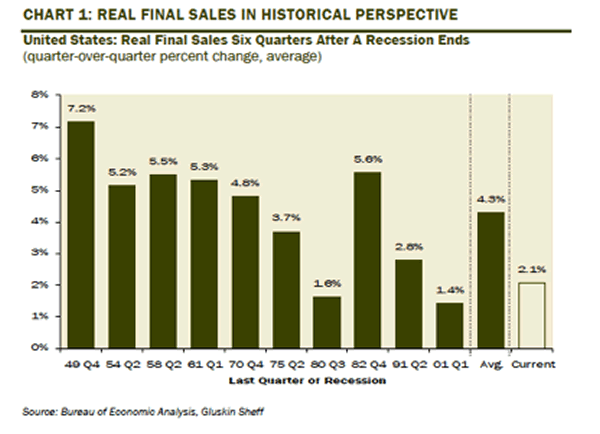

"Even with the Q4 bounce, real final sales have managed to eke out a barely more than 2% annual gain since the recession ended, whereas what is normal at this stage of the cycle is a trend much closer to 4%. Welcome to the new normal.

"There is no doubt that there will be rejoicing in Mudville because real GDP did manage to finally hit a new all-time high in Q4. The recession losses in output have been reversed (though what that means for the 7 million jobs that have to be recouped is another matter). But, before you uncork the champagne, just consider what it has taken just to get the economy back to where it was three years ago:

• The funds rate moved down from 4.5% to zero. • The Fed's balance sheet expanded by more than 1.5 trillion dollars. • The printing of M2 money supply of around 1 trillion dollars (the illusion of prosperity). • Expansion of federal government debt of 4.8 trillion dollars.

"All this heavy lifting just to take the economy back to where it was in the fourth quarter of 2007. As they rejoice in Mudville, the memory is conjured up of Billy Joel bellowing out those famous words 'Is that all you get for your money?'"

"With that being said, the bulls have the upper hand as they have since late August. At this point, the best advice we can give is to remind everyone that we entered 2010 with a 5% real GDP print in our hands. Back then, the most dangerous thing anyone could have done was extrapolate that performance through the winter, spring and summer months, when air pockets in the economic data surfaced, as Fed and federal government stimulus faded, and the equity market rode a wild roller coaster ride until Ben reclaimed his helicopter license."

A Bubble in Complacency

Thursday put me in an introspective mood. It was the annual Tiger 21 conference, and the room held about 150 or so very-high-net-worth participants. The lunch session was Greta van Sustern interviewing Newt Gingrich. And yes, from what I heard he is going to run. I am glad about that, because he will raise the intellectual heft of the debate. I am nothing if not a political realist, having been involved in a lot of campaigns. I know the issues surrounding Newt. But far more important is that we have an honest national conversation that is a few notches above what we got in 2008. We so need more than sound bites and posturing. We need actual plans. There are several people I hope will run on the GOP side, as I think they bring something to the discussion. I will interject a few comments from Newt below.

As noted above, I did not have any real idea where we were going with the panel. Clearly, Leader Gephardt was a pro-union, card-carrying Democrat, but he was very obviously concerned about the direction of the country and is very up on the issues. You don't run for president twice without having some personal "mojo." (And for the record, let me say that I really liked him. We three got together in the bar with some good wine after our presentation, waiting for the cars to take us to the airport, we and really got along. How in hell did Kerry beat him?) David Walker has been running around the country for three years telling people that we are on an unsustainable path. I have a book coming out in a month talking about the next and coming crisis (some of which has been the subject matter of this letter).

There was surprising agreement among us (surprising to me, at least). The gist of it is this (and if you have been paying attention this is no surprise):

We (the US) are on an unsustainable path. As Walker noted, cutting the budget (spending) by a few hundred billion dollars does not get us to sustainability. Going back to the 2007 budget level would be helpful but not sufficient.

Did you see the CBO (the more or less independent Congressional Budget Office) estimates of the deficit that came out this week? The CBO said the fiscal 2011 deficit will hit $1.48 trillion, up from last August's $1.07 trillion estimate. Other estimates, not forced to use unrealistic assumptions, are much higher.

And the real world? It is a whole lot uglier. From my friend Bill King at The King Report:

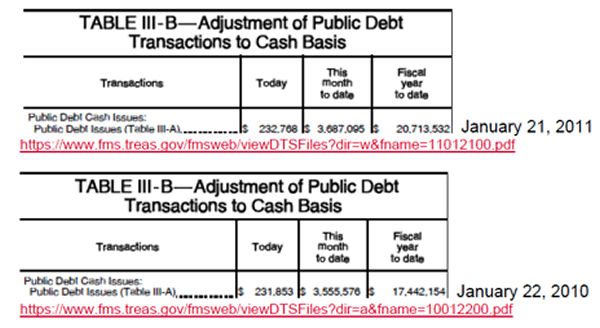

"The following tables from the US Treasury for January 21, 2011 (Friday) and January 22, 2010 (Saturday) show the public debt of the US Treasury has increased from $17.422 trillion to $20.713 trillion, a surge of almost $3.3 trillion in one year. So, the official budget deficit doesn't tell the real US debt story. Please note that the current US 'Public Debt Issues' is 44.75% higher than the $14.3 trillion debt limit because it includes bailouts, Fannie Mae, Freddie Mac, student loans and other off-balance sheet funding.

The simple answer is that no possible resolution of the fiscal deficit that gets us to sustainability (which logic defines as below-nominal GDP, although surpluses would be nice) can be done without real cuts to Medicare entitlements or increased taxes or some combination.

Yes, there is a lot of waste in the medical system. Gingrich pointed out that American Express has about 0.3% fraud and Medicare had 13%. That is a hundred billion or so. American Express runs a real-time system and Medicare is still on paper. He listed other things that can be done. But back to our plot line of controlling the fiscal deficit.

We located the problem. There is about 30% of the electorate that is mad at Obama and the Democrats for not getting a single-payer, full health-care program. They want nothing less than that.

Then there is the 30% or so that are mad about increased taxes, runaway spending, and budget deficits. They will likely punish any Republican who even utters the word "increase" in the same sentence with taxes, unless they are talking about those bad tax-and-spend Democrats.

Right now, neither side seems willing to compromise. Obama has punted on coming up with any real solutions. Offering to freeze spending at today's level is a joke. It is like one of my kids (and this has happened, kind of) getting my credit card, spending a ridiculous amount of money, and then saying, "Ok, Dad, if you'll give me the card again I promise I won't spend more than that!"

But the GOP is saying they want to cut spending around the edges of the budget without dealing with the real elephants in the room, Social Security and Medicare. They have some plans that get us closer, but none that David or I could see that gets us there.

What happens if someone talks about real adjustments to the entitlement programs, or tax increases? Look at what happened to the Deficit Commission and their reports. They were dead on arrival. I thought they had some interesting ideas.

It is hard to get to a real compromise with that level of conversation. But what the three of us on the panel did agree on is that if a compromise is not reached, the end result looks like Greece.

My points were that much of Europe is getting ready to give us a real crisis, sooner rather than later. Great Britain is headed for what looks like a recession and further problems. Japan, as I am wont to say, is a bug in search of a windshield. We are going to get some great real-time lessons on what happens when you don't deal with a problem in time. The longer you wait, the worse the results will be when you are forced to deal with the issues.

The lack of compromise is going to run head on into a bond market that will force one, or raise rates until there is truly a crisis of biblical proportions. If you think high rates were bad in the '70s (and they were, trust me!), think what they would be like in a deflationary environment.

For that is what would happen. We would fall into a severe recession, and recessions are by definition deflationary. And depending on how late we are in getting our act together, it could be worse than a recession. We could drag the whole world down.

Leader Gephardt spoke to the fact that it will take politicians essentially violating what they feel are their core views, for the good (and survival) of the nation. He thinks that there are enough leaders who get it now that a compromise is possible, although he noted that Obama is going to have to back off on some of his main issues. Newt said flat out that he did not think a compromise was possible, as he did not think Obama would reverse. Let's call Walker a skeptical optimist. Me, I think it is 2013 before we get the real changes. I just see a bubble in complacency. The market is going up, so all must be right with the world.

If we don't get those real changes, we will need to start thinking the unthinkable.

Can we last until 2013? Most likely, as we are going to see some cosmetic changes and that should encourage the bond market. But as our leaders watch the problems of the rest of the developed world increase then, depending on what they do, they could cut us a much shorter leash. We are approaching the Endgame. I worry that we could go much beyond that point without serious volatility and market upheaval.

And that is why the GOP primary is so important. There is not going to be much of a debate, if any, in the Democratic primary. Obama will coast to the nomination. All the real debate will be on the Republican side. And that is why we need "idea leaders" to step forward. Philosophy is all well and good, but we are getting ready to encounter a potentially very difficult bond market. There is hope that we can avoid the real hitting of the wall that I think is going to be Japan's fate, but it will take some real solutions to problems, not just words. I want to see budgets. What do you cut? Do you raise taxes? Can we take this opportunity (let no crisis go to waste!) to actually reform the tax code? Maybe move to more of a consumption-based tax? Tax less of the things we need and want (like jobs, exports, and savings!) and more of the things we have less need of? Just a thought. Can we get a thought leader on the debate platform to offer a real restructuring? And make a solid case for it? Actually get the American people to focus on the crisis that is coming if we don't act? (Not to mention those pesky wars, energy policy, the environment, etc. etc.)

Is there a compromise out there? Should there be one? That is the conversation we will have to have.

This national conversation will be the most important in my lifetime (I don't say that lightly). Not just because of whom we elect, but because the bond market vigilantes will be paying attention to what we are saying. If they see the same old rhetoric, we will be in for a very bumpy ride.

Egypt

For those looking for good analysis on Egypt and the Arab world, I commend this video from George Friedman of Stratfor to you, at http://www.stratfor.com/analysis/20110128-agenda-george-friedman-egypt.

Rosie, Las Vegas, Phuket, and Bangkok

Next week is as busy as it gets, crammed with meetings and airports. Non-stop meetings all day Monday, which means I have to get up early to get my reading done, then an evening with the guys. Good friend David Rosenberg is flying in from Toronto, and Darrel Cain and I will take him to the Mavericks game, along with my new Chief Implementation Officer, Peter Mauthe; friend and soon-to-be business partner Barry Habib; and son-in-law Ryan. I see steaks at Nick and Sam's.

The night before I will be with Brad Kroenig, eating fish at Ocean Prime. Google that name and then wonder what the hell we have in common. I met him in Palm Beach. Very smart young man. (Think biotech.)

Off to Vegas on Wednesday for a conference with Steve Blumenthal of CMG, and then Thursday night I board a plane for Hong Kong and then slip over to Bangkok and Phuket. I will play tourist for a few days getting on the time zone, then deliver a longish presentation, and spend the rest of the week in Bangkok, where I am going to take some time to see a city where I have never been. While I will work about four hours a day (the plan now), I really do hope to take some time to enjoy the sights and sounds and food. One of my long-time best friends, Tony Sagami, has graciously offered to show me around, although he says we will not go to restaurants frequented by farang (foreigners). Local favorites only.

It is my intention to write while I am away. Since I seem to be traveling more, I need to get able to keep up. We have switched my main computer to my laptop, so that now I carry my work with me rather than remoting in, which will make it easier to write on the road. I have upgraded to all the latest and great Microsoft, so I have some learning curves ahead of me, and may do a few educational videos on the plane ride. Old dog and new tricks and all that.

I am really excited about Thailand. It is a place I have wanted to visit forever. Tony says I will try and find excuses to go back every chance I get. But then there is Tuscany. I have to go back there this summer.

Life is good. Tiffani and I were talking about how we are literally busier than we have ever been. But I am grateful, as many are not.

Your amazed at how my world has changed analyst,

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.