HUI, Gold and Silver Storm Flags Warning

Commodities / Gold & Silver Stocks Feb 02, 2011 - 06:53 AM GMTBy: Ronald_Rosen

The storm warning flags should definitely be hoisted for the HUI, gold, and silver.

The storm warning flags should definitely be hoisted for the HUI, gold, and silver.

The HUI is giving a warning loud and clear. Hecla Mining appears to have completed a five wave move and is now apparently ready to correct that move. Many precious metal shares are in the same position as the HUI and Hecla Mining.

If you are trading these shares you may want at the very least to lighten up. As for long term holders prepare to ride out a potential storm. There may still be one more move up for gold and silver before the correction begins but I would not count on it.

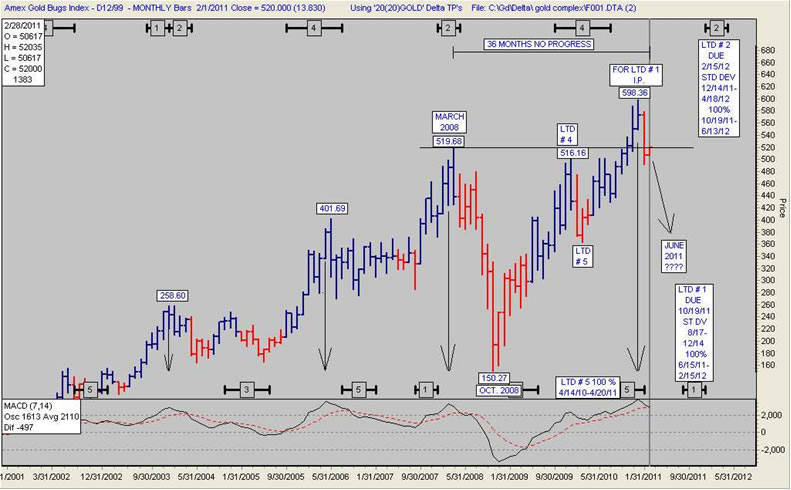

The monthly MACD indicator has peaked one month prior to the top on four occasions since this bull market began. The HUI currently has already passed that point. LTD # 1 has inverted to a low. The earliest it is due is the 100% range of 6/15/2011. (June 15, 2011)

HUI MONTHLY

Hecla Mining has apparently completed a five wave move. We know that silver bullion can experience vicious declines. Hecla is due for a selloff. A normal correction would bottom between wave 3 and 4. However, silver and silver shares do not always act normal.

Please consider this update a warning of a probable imminent correction.

HECLA MINING MONTHLY

If you are interested in knowing when the ALL CLEAR SIGNAL has sounded the ROSEN MARKET TIMING LETTER is available through Welles Wilder’s Delta Society International. Once there click on Products and Services. The cost is modest.

www.deltasociety.com

Stay well,

Ron Rosen

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.