Newmont Buys Out Fronteer, What’s Next In The Gold Mining Sector?

Commodities / Gold and Silver 2011 Feb 05, 2011 - 04:37 AM GMTBy: Jeb_Handwerger

Even though January 2011 brought a lot of profit-taking to mining stocks and precious metals, the leadership of Newmont (NEM) has used this pullback in prices to purchase one of my long-term favorite recommendations, Fronteer Gold (FRG). I believed Fronteer was a great candidate for a takeout. Newmont has gone straight ahead believing in Fronteer’s three major projects in Nevada and buying Fronteer out for a 37% premium. Newmont believes that the gold prices is moving much higher and they are using their large cash position to find growth. It is much cheaper to buy a quality asset rather than go out and find it yourself.

Even though January 2011 brought a lot of profit-taking to mining stocks and precious metals, the leadership of Newmont (NEM) has used this pullback in prices to purchase one of my long-term favorite recommendations, Fronteer Gold (FRG). I believed Fronteer was a great candidate for a takeout. Newmont has gone straight ahead believing in Fronteer’s three major projects in Nevada and buying Fronteer out for a 37% premium. Newmont believes that the gold prices is moving much higher and they are using their large cash position to find growth. It is much cheaper to buy a quality asset rather than go out and find it yourself.

Now Newmont has really made a huge transition to have high grades assets. Some of the other Nevada companies to monitor in light of this buyout are other miners with significant Nevada gold resources such as U.S. Gold (UXG), Allied Nevada (ANV), Timberline Resources (TLR) and Midway Gold (MDW). From Fronteer’s position the valuation was very reasonable and this deal was valued similarly to Andean deal with Goldcorp and Redback’s deal with Kinross(KGC).

Newmont and Fronteer were partners on their Sandman project and needed to make a production decision later this year on that project. They have worked closely before and Newmont was well aware of the high-quality portfolio and the incredible growth of Long Canyon both in grade and size. Newmont is convinced that this mine could be a monster, similar to some of the great mines in the Carlin Trend. Even though Newmont has huge operations in Nevada, it didn't have similar high-grade open-pit assets like Fronteer has at Long Canyon and Northumberland, and what Barrick (ABX) has at Goldstrike and Cortez.

This moves Newmont to have the top high-grade, low-cash cost mines in Nevada, which may begin receiving a premium as emerging-market risk rises. Newmont has close to 50 years of production in the state and is the right company to get these mines into production. This definitely puts some pressure on the other majors to look for high-grade growth in Nevada.

A high-grade, low-cash cost mine near infrastructure and in a mining-friendly jurisdiction is rare and a no-brainer for majors, yet over the past few weeks Fronteer presented to investors a rare opportunity. There is an old saying that opportunities are not always labeled. I disagree, opportunities are sometimes labeled as shakeouts.

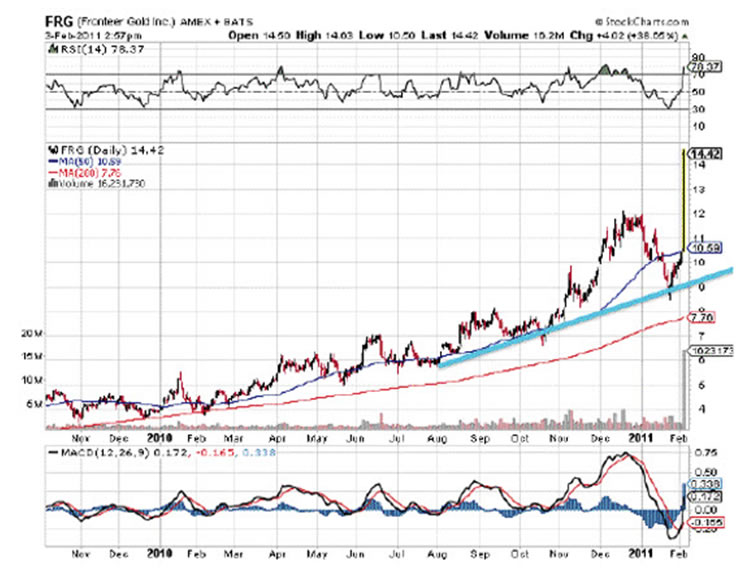

Fronteer has provided four opportunities to buy at long-term support over the past year. Early October, August, May and February of 2010 had similar technical conditions. I believed the end of January was a great long-term entry and just a healthy shakeout. Fronteer is leading the sector and may be teaching mining investors what the majors are looking for.

The bounce has occurred in Fronteer and may be just beginning across the sector. This time should be used to build major positions in first-class mining stocks as it's a rare bargain opportunity in a secular bull trend. What we saw in January is a classic run on the retail investor and trader to force capitulation. These times should be regarded as major buying opportunities. These short runs occur often in the commodity markets where the speculative traders are forced to capitulate. I will sit tight and look to add to oversold positions at these levels as a reversal in many mining stocks is imminent. Those who have been taking profits both in bullion and in mining stocks as it reached targets in November as the trade was overbought should be reinitiating positions. It is important to note that institutions sell into rising markets and euphoria and buy into declining markets and fear. We must master to do the same.

There are certain characteristics that great mining stocks have and Fronteer fit that bill with some of the highest grade and fastest growing assets in Nevada. The old majors such as Barrick, Goldcorp (GG), and Newmont are looking for growth with limited risk. I am very concerned of emerging-market credit and currency risk as evidenced by events in the Middle East and believe it may spread to North Africa and continue throughout the Middle East. North American miners should be gaining interest as geopolitical risks increase internationally especially in Nevada and Alaska which has some current exciting discoveries and major mines being developed.

Newmont's recent $2.3 billion dollar purchase of Fronteer’s three major projects in Nevada -- Long Canyon, Northumberland, and Sandman -- has positioned Newmont to be in an incredible growth position in Nevada. The consolidations are beginning and these are the three things I learned from Fronteer:

1. High Grade/Low Cash Costs

2. Mining Friendly Jurisdiction/North America

3. Blue Sky Potential

With the devalued dollar I believe there will be less and less mining-friendly jurisdictions as inflation is felt hardest in developing and emerging countries. U.S. gold assets may be given a premium in this environment.

Grab your free 30 day trial to my premium service at http://goldstocktrades.com/premium-service-trial

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.