Gold Bullion Considered as Collateral by International Clearing House

Commodities / Gold and Silver 2011 Feb 08, 2011 - 08:37 AM GMTBy: GoldCore

Gold is higher in most currencies today except for the Aussie and Kiwi dollars; silver has risen by some 1% in US dollars and is higher against all currencies. Asian equities were mixed with the Nikkei higher (+0.41%) and the Hang Seng lower (-0.29%). European equities are mixed with tentative gains being seen in the BE 500 and the Stoxx 50.

Gold is higher in most currencies today except for the Aussie and Kiwi dollars; silver has risen by some 1% in US dollars and is higher against all currencies. Asian equities were mixed with the Nikkei higher (+0.41%) and the Hang Seng lower (-0.29%). European equities are mixed with tentative gains being seen in the BE 500 and the Stoxx 50.

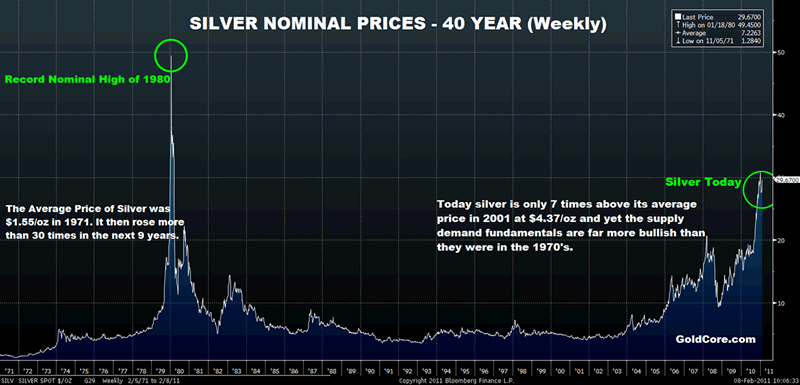

Silver U.S. Dollars – 40 Year (Weekly)

European sovereign debt yields are flat but Greek 10 year debt has risen 8 basis points to 10.88%. The Japanese 10 year rose 3 basis points overnight but remains near historic lows at 1.32%.

Commodities are also mixed with NYMEX crude oil down 0.25% to $87.27 and Brent up 0.28% to $99.47 a barrel.

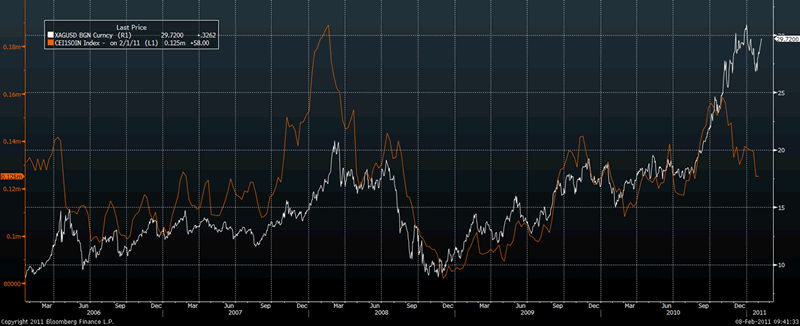

Silver Spot (USD) and CFTC CEI Silver Total Open Interest/ Futures Only – 5 Years (Daily)

Gold Bullion Considered as Collateral by International Clearing House – LCH.Clearnet

A further sign of how gold bullion is increasingly seen as not only a safe haven asset and a currency but also a financial asset, is news that the LCH.Clearnet is giving further consideration to a plan to accept gold bullion as collateral. They may accept gold bullion as collateral against margin positions on a range of asset classes and derivatives in the international financial markets.

LCH.Clearnet have been considering allowing gold as collateral since October 2009 and the move by the CME and JP Morgan to allow physical gold as collateral may have made their plans in this regard more concrete. "We’re looking at it closely,” David Farrar, LCH.Clearnet Director of Commodities told CNBC (see News). “It’s something that, subject to regulatory approval, we’d look to introduce later this year."

LCH.Clearnet (previously known as the London Clearing House and the Paris based Clearnet) is an independent financial clearing house, serving major international exchanges and trading platforms, as well as a range of OTC markets. Its main business is in Europe and it is the largest over-the-counter interest rate swap clearer. In December 2009, LCH.Clearnet began guaranteeing trades between banks and their buy side clients in the $342 trillion interest-rate swaps market.

LCH.Clearnet clears for a large number of commodity, derivative and equity exchanges. It clears a broad range of asset classes including securities, exchange traded derivatives, energy, freight, interbank interest rate swaps, and euro and sterling denominated bonds and repos.

The nominal value of European government bond and repo trades cleared by the LCH.Clearnet group in 2010 increased by 28% year on year, a record fuelled by increased demand as banks seek to manage their counterparty risk exposures. The total nominal value of fixed income trades alone cleared by LCH.Clearnet during 2010 reached EUR137 trillion, equating to over EUR500 billion in nominal value cleared daily.

Also in 2010, LCH.Clearnet launched the first clearing service for under pressure Spanish government bonds and repos. A notional value close to EUR700 billion was cleared during the year.

John Burke, director and head of fixed income at LCH.Clearnet said recently that “at times of market stress, clearing becomes increasingly important" and that “maintaining liquidity and managing collateral are top of the list of priorities for banks.”

With counterparty and sovereign risk remaining elevated, gold is no longer being seen simply as a commodity. Rather, it is increasingly viewed by market participants as an important asset and a currency with no counterparty risk. We are gradually seeing the monetisation and indeed the ’financialisation’ of gold, as gold is gradually being reincorporated into the modern financial and monetary system.

Keynes’s ‘barbaric relic’ is becoming less barbaric by the day. However, the man in the street remains completely unaware of this trend as it continues to be ignored by mainstream media and its implications not realised.

GOLD

Gold is trading at $1,352.64/oz, €990.15/oz and £839.11/oz.

SILVER

Silver is trading at $29.39/oz, €21.51/oz and £18.24/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,840.00/oz, palladium at $819/oz and rhodium at $2,450/oz.

NEWS

(South China Morning Post) -- The Chinese Gold & Silver Exchange Society may trade Hong Kong's first-ever yuan denominated gold contracts next month, said its president Haywood Cheung.

(Xinhua via COMTEX) -- Gold price closes higher in Hong Kong

The gold price in Hong Kong closed up 48 HK dollars at 12,563 HK dollars per tael on Tuesday, according to the Chinese Gold and Silver Exchange Society.

The price is equivalent to 1,355.30 U.S. dollars, up 5.17 U.S. dollars a troy ounce at latest exchange rate of one U.S. dollar against 7.781 HK dollars.

(Bloomberg) -- China could be the “next big buyer” of gold driven by both institutional and retail investors, Credit Suisse Group AG analyst Tom Kendall said in a speech in Cape Town today.

“If you’re sitting there in China with money in a deposit account, you’re losing between 1-2 percent a year through inflation,” he said. “But if you look at the growth of gold in renminbi terms, there are clearly some strong reasons for Chinese to be buyers of gold.”

(Bloomberg) -- Gold-Silver Ratio Drops to Lowest Since December 2006

The ratio of gold to silver dropped to the lowest level since December 2006 as speculation the global economic recovery is strengthening eroded demand for the yellow metal as a protector of wealth.

One ounce of gold bought as little as 45.88 ounces of silver today, according to Bloomberg News calculations. Bullion for immediate delivery was little changed at $1,350.97 an ounce at 12:34 p.m. in Singapore after fluctuating between a gain of 0.2 percent and a loss of 0.2 percent. Silver traded at $29.405.

“With the recent bout of economic optimism in the markets, demand for gold as a hedge against uncertainty is reduced,” said Ong Yi Ling, Singapore-based investment analyst with Phillip Futures Pte. “Hence, gains in gold could be capped. On the other hand, silver may benefit more from the economic recovery” as industrial use increases.

Hedge-fund managers and other large speculators decreased net-long positions in New York gold futures in the week ended Feb. 1, U.S. Commodity Futures Trading Commission data showed.

Speculative long positions, or bets prices will rise, outnumbered short positions by 151,194 contracts on the Comex division of the New York Mercantile Exchange, the commission said in its Commitments of Traders report. Net-long positions fell by 9,395 contracts, or 6 percent, from a week earlier.

Asian stocks gained after U.S. consumer borrowing rose in December for a third consecutive month. Adding to further evidence of economic recovery, Japan’s current account surplus widened in December, the Finance Ministry said in Tokyo today.

(Reuters) - Anglogold says $1,500 gold possible in 2011

Top African gold producer Anglogold Ashanti expects record gold prices to be sustained in 2011, with the precious metal between $1,300 and $1,500 an ounce, its chief executive said on Monday. "I certainly believe they are sustainable. The fundamentals are very strong," Mark Cutifani told Reuters on the sidelines of an African mining conference in Cape Town. "I believe it will trade north of $1,300 and there is a good chance it will go through $1,400 and even possibly $1,500. The $1,300-$1,500 an ounce range would be the most likely outcome this year," he said.

(Bloomberg) -- Austrian Mint Stops Selling 5 Euro Coin On High Silver Price

The Austrian Mint has stopped selling its 5-euro silver coin because of the high price for the metal, it said on its website.

The mint’s 5-euro circulation coin, whose December issuance shows the “Pummerin” bell of Vienna’s St. Stephen’s Cathedral, contains 8 grams of silver.

Based on the spot price of $29.47 per troy ounce, the market value of the metal used for the coin is $7.58, or 5.56 euros, exceeding the coin’s face value, according to Bloomberg calculations.

(Bloomberg) -- S. Africa May Consider ‘Use It Or Lose It’ Mine Rights Approach

South Africa’s Mines Minister Susan Shabangu said she may consider “a use it or lose it” approach to mine exploration rights because of inadequate exploration despite the issue of a large number of rights.

Shabangu spoke at the Mining Indaba conference in Cape Town today.

(CNBC) -- London Clearing House Considers Gold as Collateral

LCH.Clearnet, a leading independent clearing house, is considering a plan to accept gold bullion as collateral against margined positions. London is the world’s largest market for over-the-counter gold trading.

"We’re looking at it closely,” confirms David Farrar, LCH.Clearnet Director of Commodities. “It’s something that, subject to regulatory approval, we’d look to introduce later this year." The Financial Services Authority (FSA) is the regulator of the financial services industry in the UK. A source, close to the situation, tells CNBC that nothing is currently pending before the FSA at this time on this matter.

This follows an announcement by J.P. Morgan that it will become “ ... the only tri-party collateral manager to accept physical gold as collateral to satisfy securities lending and repo obligations with counterparties.” And according to spokesman Chris Grams, the CME accepts allocated gold at the JP Morgan vault in London as collateral against any asset class position an investor might have at the CME.

Why is this move important? Market watchers say it adds credibility to the argument that gold is an alternative asset, a type of alternative currency.

Banks are always looking at their scarce resources including, cash and gold. Leveraging an increasingly valuable gold inventory would be a natural next step, and likely welcome extension of that process.

“There will be a substantive benefit for all firms active with gold bullion and / or LME registered warrants,” says Mike Frawley, Newedge Group Global Head of Metals. “It is the direction of the overall market to use warehouse receipts and / or bullion for margin purposes.”

And, he says as the London Metals Exchange (LME) gets closer to launching its over-the counter (OTC) contracts for gold traded in London, it will be important for the gold community to lever its existing stores for margin purposes. And perhaps in the process, ease the transition to a more transparent, over-the-counter gold market.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.