Crude Oil Trend Remains Positve

Commodities / Crude Oil Feb 09, 2011 - 04:15 AM GMTBy: Donald_W_Dony

Oil prices have pulled back recently triggering suspicion that this movement is the start of a deeper correction. In reality, the supportive trends from key securities indicates just the opposite. Oil prices remain in a solid upward path.

Oil prices have pulled back recently triggering suspicion that this movement is the start of a deeper correction. In reality, the supportive trends from key securities indicates just the opposite. Oil prices remain in a solid upward path.

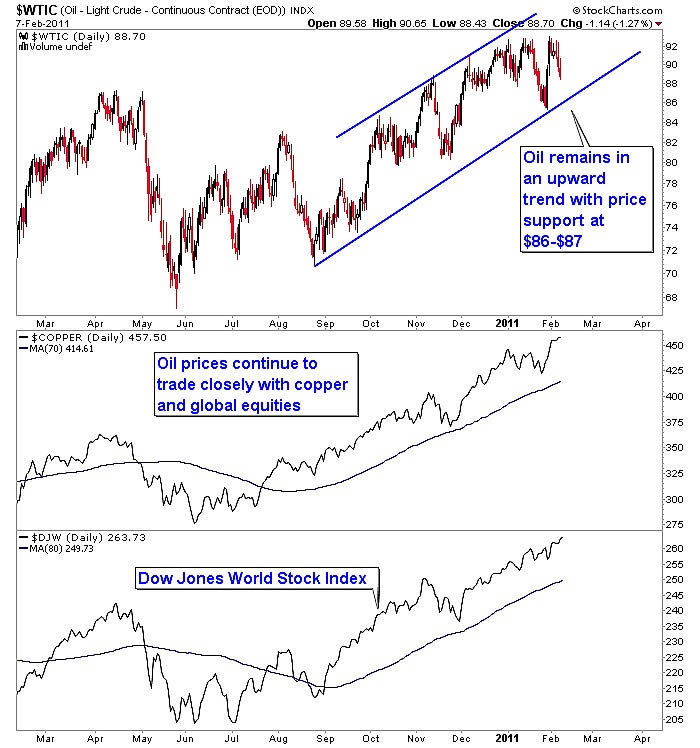

Copper prices and world stock markets have been trading in lock step with oil for many years. The reason is largely linked to growth. As global economies expand, there is an improvement in corporate earnings which is beneficial to stock prices. The growth in the world economies also creates higher demand for elements such as copper and energy. Chart 1 illustrates this connection.

A deeper correction in oil prices would likely also have to contain a significant drop in copper and world stock prices. There is no evidence of this development.

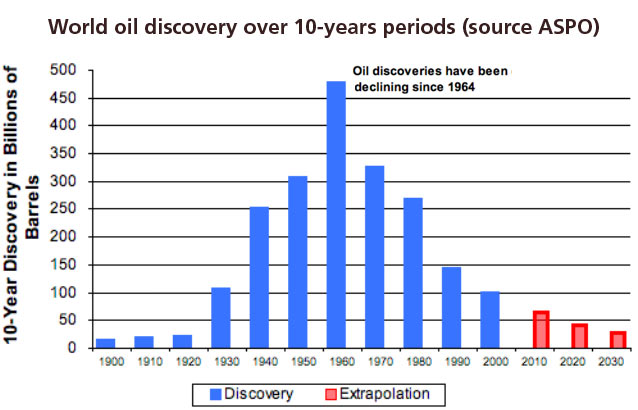

Longer term, the fundamentals of reduced supply (Chart 2) and mounting world demand underpins the broader picture for higher oil prices in 2011. The 1st target remains at $105.

Bottom line: Oil prices are trading in near parallel paths with copper and global equity indexes. Economic growth is driving all three securities. As the outlook for world stock markets continues to improve, so does the expectation for higher copper and oil prices.

Investment approach: A significant correction in oil would require the commodity to trade below the $87-$86 support level. It would also likely trigger copper to decline under $4.20 and the Dow Jones World Stock Index to fall through the 250 line. As oil prices move in close tandem with these other two significant assets, monitoring all three would provide a more conclusive picture verses just reviewing the actions of oil.

More research is available in the February Newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2011 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.