Gold at EUR1,000/oz - Strong Physical Demand Leading to Illiquid Conditions

Commodities / Gold and Silver 2011 Feb 09, 2011 - 08:45 AM GMTBy: GoldCore

Gold and silver are marginally lower against most currencies after yesterday’s 1% and 3% rise respectively. Gold rose above €1,000/oz again yesterday and remains just below the €1,000/oz level today despite the euro being stronger versus other currencies. Silver is back above the important $30/oz psychological level and €22/oz.

Gold and silver are marginally lower against most currencies after yesterday’s 1% and 3% rise respectively. Gold rose above €1,000/oz again yesterday and remains just below the €1,000/oz level today despite the euro being stronger versus other currencies. Silver is back above the important $30/oz psychological level and €22/oz.

Despite the gains on Wall Street yesterday, Asian equities were weaker overnight (except for the ASX 200 and NZX 50) and European equities are mixed with small gains being seen in the BE 500 and the Stoxx 50. The sell off in Asia is being attributed to the Chinese interest rate rise but concerns about inflation and the robustness of the global economic recovery may be more pertinent.

European sovereign debt yields are flat after yesterday’s rises which were particularly noticeable in the US where Treasury yields rose sharply, extending their run of losses for seven straight sessions. The 10 year was up 6 bp to 3.69% and is currently trading at 3.72%.

Commodities were weaker yesterday but are slightly stronger today. NYMEX crude is up 0.84% to $87.67 and Brent up 0.78% to $100.70 a barrel.

Strong Physical Demand Leading to Illiquid Conditions

Gold’s fundamentals remain strong with robust demand internationally; particularly in Asia where inflation is taking hold. Strong demand can be seen in the premiums being paid for gold bars in various parts of Asia, especially in India, Vietnam and China.

Indian ex-duty premiums for the London AM and PM fix were $6.81 and $4.72 respectively yesterday, showing that Indian buyers are active at these price levels.

Vietnam gold markets were open for the first time since last Tuesday. Vietnamese gold stood at a premium of $40.49 to world gold of $1,351.15.

Reuters reports that Asian kilo bar premiums remain firm and near 7 year highs with premiums of $1.50/90 $1.90/3.00 in Singapore and $3.00/$3.00 $3.00/4.00 in Hong Kong. Japanese demand has also picked up of late and premiums in Tokyo were $1.50/2.00.

While Chinese demand is not expected to be at the record breaking levels seen in late 2010 and January 2011, it is expected to remain robust due to inflation and negative real interest rates in China (and most of the rest of the world).

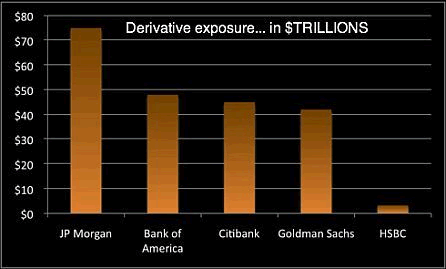

With the physical gold market remaining very small when compared to the futures and paper gold market (futures, CFDs etc) there are increasing concerns of illiquidity due to the scale of demand and lack of supply. Pertinently, the size of the physical gold and silver bullion markets is tiny compared to the size of international equity, bond and currency markets. Not to mention the hard to fathom humongous international derivatives market (see chart below).

The gold market remains one of the most liquid markets in the world. The market is more liquid than many government bond markets in Europe, with daily trading volumes normally exceeding $100 billion.

Yet, it is important to make the distinction between the gold market (speculators, hedgers etc. in the paper gold market) and the bullion market (generally jewelers and passive investment and store of value buyers).

UBS wrote about “illiquid conditions” in the gold market this morning. They did not clarify but they may have meant illiquidity in the physical gold bullion market.

Gold trading volumes in the financial markets dwarf the size of actual above ground refined investment grade product (coins and bars). Investment demand for coins and bars, along with the gradual move to allocated accounts on behalf of retail investors, hedge funds and institutions, is leading to a lack of liquidity in the market.

This is a recipe for higher prices in the coming months of 2011.

GOLD

Gold is trading at $1,363.00/oz, €999.49/oz and £848.90/oz.

SILVER

Silver is trading at $30.16/oz, €22.12/oz and £18.78/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,860.00/oz, palladium at $832.50/oz and rhodium at $2,450/oz.

NEWS

(AP) -- Gold, Silver Rise on Inflation Worry

PRECIOUS METALS: Gold and silver prices rose after China increased interest rates to curb inflation and slow economic growth. The two precious metals are considered hedges against inflation and slow growth.

INFLATION FEARS: This is the third time China has raised interest rates since October. Government leaders fear a sharp rise in prices for things like food and fuel could trigger unrest. Investors are concerned about inflation rising globally.

MIXED BAG: Wheat and soybeans rose while corn fell. Energy contracts were mixed.

(Bloomberg) -- Gold May Gain as China Rate Increase Stokes Inflation Concerns

Gold may advance for a third day on speculation China’s interest-rate increase will fuel concerns about the pace of inflation, boosting demand for the metal as a store of value.

Gold for immediate delivery was little changed at $1,363.88 an ounce at 1:57 p.m. in Singapore. The People’s Bank of China yesterday raised the one-year lending rate by a quarter point to 6.06 percent and the one-year deposit rate an equivalent amount to 3 percent.

“The interest-rate hike does reflect a certain degree of fear over inflationary pressure, which is a key factor attracting investor interest in gold,” Yingxi Yu, Singapore- based commodity analyst with Barclays Capital, said by phone today. “We do believe that there’s further upside for gold in the next few months.”

China joined India, Indonesia, Thailand and South Korea in boosting interest rates this year as Asian policy makers sought to cool the economies leading a global rebound. A report in China is forecast to show inflation in the country expanded at the fastest pace in 30 months. World food prices rose to a record in January and probably will remain elevated, the United Nations said last week.

Bullion, which has dropped 4.7 percent since climbing to an all-time high of $1,431.25 on Dec. 7, will rebound on investor demand, Alan Heap, a commodity analyst with Citigroup Inc., said today in an interview with Bloomberg UTV.

(Bloomberg) -- Citigroup Is ‘Still Wary’ of Saying That Gold Rally Has Ended

Citigroup Inc. said it’s “still wary” of calling gold’s decade-long rally over, even after figures showed holdings of bullion in exchange-traded funds fell in January. “We think that there are enough problems out there (including with the U.S. fiscal/debt situation) to ensure that gold will remain well bid for some time yet,” the bank said in a report dated yesterday.

(PTI) -- Reliance MF launches Gold Savings Fund

Anil Ambani group firm Reliance Mutual Fund today launched a new Gold Savings Fund, a first-of -its-kind investment scheme focused on gold, to tap a market that it expects to become bigger than even equity mutual funds.

The new fund, which is different from gold ETFs (Exchange Traded Funds) that require subscribers to have a demat account, will also offer investors the option to invest as little as Rs 100 per month, the company said here.

The company said that its Reliance Gold Savings Fund will enable investments in gold without any locker or demat account -- a first in the country.

Announcing the launch of the New Fund Offer -- which will be open from February 14-28 -- Reliance Capital Asset Management CEO Sundeep Sikka said: "We expect this gold investment industry to surpass equity MFs in the next three years."

Sikka said the gold investment opportunity in India was not optimally tapped and the new product will offer a simple, affordable and investor-friendly solution for investing in gold to the masses.

"Indians are known for their love for gold. However, with low demat penetration in India, a lot of investors have not been able to participate in this safe mode of investment.

"This product will create a new avenue for pure gold investments for the retail investor without the need of having a demat account or a locker," he added.

The scheme's performance will be benchmarked against the price of physical gold.

The company said the new fund will enable investors to avail long-term taxation benefits from the first year itself, unlike physical gold, wherein long-term taxation can only be availed after three years.

The investors will not be charged any entry load on the fund, though there would be a 2 per cent exit load if redeemed before completion of the first year.

A part of Anil Ambani group's financial services arm Reliance Capital, Reliance Capital Asset Management is the country's largest fund house and manages assets worth USD 24 billion across mutual funds, pension funds, managed accounts and hedge funds.

(Wall Street Journal) -- Silver Streak: Poor Man’s Gold Keeps Surging

Hi-yo Silver, away!* Old Yeller’s less precious cousin is continuing its recent tear, with Silver for February delivery surging more than 3% on the Comex to close at $30.27/oz. Silver has gained about 13% since Jan. 25 and its close above $30 is considered technically promising. Silver has been up four straight sessions and seven of the last eight. Meanwhile, the barbarous relic has had a tougher time of late. Gold for February delivery did manage to gain 1.2% on the Comex to close at $1363.40, snapping a two-session win streak. As noted yesterday, silver continues to outperform gold. Over the past 52 weeks, gold is up an impressive 26.6%. Silver is up an eye-watering 96.2% over that same period. Precious metals are benefiting from rising inflation fears and increased concerns about weakening currencies. Gold has gotten too dear for some, leading to greater interest in so-called “poor man’s gold.” Silver does have more industrial uses than gold, but it still has a strong hold on those who are deeply concerned about the future and want to have a dependable store of value. The U.S. Mint’s silver coin selling program reflects the rising interest in silver. In January, the Mint said it sold 6.4 million American Eagle one-ounce silver bullion coins – about 50% higher than any prior month of sales, according to Mineweb.

*I always thought it was Hi-Ho Silver, Away, but the fan sites and other historical outlets insist that it is Hi-Yo.

(Financial Times) -- Long-term investors shun Treasuries sale

US Treasury yields rose sharply on Tuesday, extending their run of losses for seven straight sessions, after a substantial drop in demand from long-term investors for the sale of new three-year paper. Treasury dealers were left holding 62.3 per cent of the $32bn three-year sale, their highest stake since January 2009, as investors, including foreign central banks, backed away from buying. Long-term investors bought 27.6 per cent of the auction, their lowest take since May 2007 and down from the average share of 37 per cent for the past six sales.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.