Insights from Q&A of Bernanke’s Testimony

Interest-Rates / US Interest Rates Feb 10, 2011 - 02:50 AM GMTBy: Paul_L_Kasriel

Chairman Bernanke's testimony today was a repetition of the February 3, 2011 speech at the National Press Club. He stressed that the unemployment rate was unacceptably high and inflation was low. In Q&A session, Representative Ryan questioned Chairman Bernanke about whether the Fed is monetizing debt. Bernanke explained that "debt monetization" stands for a permanent change in money supply to finance the debt. He went on to add that the Fed plans to reverse course, thus it is not debt monetization. Money supply grew 4.2% from a year ago during the week ended January 24 (see Chart 1), which is hardly indicative of impending inflationary pressures.

Chairman Bernanke's testimony today was a repetition of the February 3, 2011 speech at the National Press Club. He stressed that the unemployment rate was unacceptably high and inflation was low. In Q&A session, Representative Ryan questioned Chairman Bernanke about whether the Fed is monetizing debt. Bernanke explained that "debt monetization" stands for a permanent change in money supply to finance the debt. He went on to add that the Fed plans to reverse course, thus it is not debt monetization. Money supply grew 4.2% from a year ago during the week ended January 24 (see Chart 1), which is hardly indicative of impending inflationary pressures.

Another noteworthy question pertained to how the Fed would determine if QE3 will be necessary. Bernanke noted that if the recovery is on a sustainable path and inflation is low and stable, it will not be necessary. He was also asked under what circumstances the Fed would reverse QE2, which is currently underway. Bernanke indicated that rapid economic growth and rising risk of inflation would be necessary to reverse the current plan to purchase $600 billion of Treasury securities by June 2011.

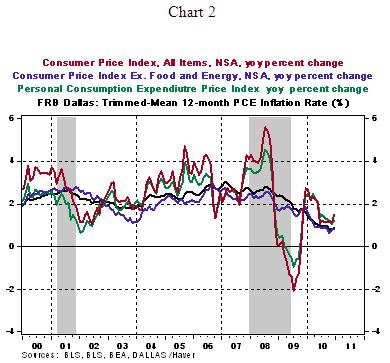

Bernanke reiterated that inflation in the U.S is "very very low" (Inflation measures are in Chart 2). This comment was in response to Representative Ryan citing a Wall Street Journal story "Inflation Worries Spread," published today. The Chairman implied that inflation in emerging markets requires responses from their respective central bankers. It is important to bear in mind that the dual speed world economy (slow growth in advanced economies vs. strong growth in emerging markets) will entail different monetary policy responses such that it is suitable to the economic status of each economy.

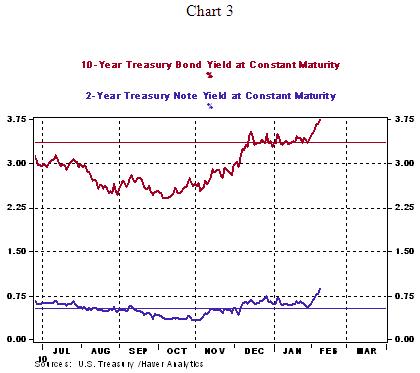

Bernanke's opinion about the recent upward trend of bond yields was also sought. The Chairman replied that it reflects "increasing optimism about the U.S. economy." The 2-year and 10-year Treasury note yields were trading at 0.80% and 3.65%, respectively, as of this writing. The recent lows were 0.54% and 3.36%, respectively, for 2-year and 10-year Treasury note yield as of January 28 (see Chart 3).

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.