China Drought Global Food Crisis to Trigger Many More Egypts

Commodities / Food Crisis Feb 10, 2011 - 06:14 AM GMTBy: Justin_John

The Chinese government has reportedly decided to spend $1 billion to battle the drought plaguing huge areas in the north, as wheat prices continued their climb and the UN warned of serious consequences for the winter harvest.

The Chinese government has reportedly decided to spend $1 billion to battle the drought plaguing huge areas in the north, as wheat prices continued their climb and the UN warned of serious consequences for the winter harvest.

The drought is the worst in six decades in many areas, and has left a swathe of grain-producing regions reeling from a lack of any significant rainfall in more than three months.

The money will be spent to divert water to affected areas, construct emergency wells and irrigation facilities, and take other measures, the State Council, or the Cabinet, said in a statement on Wednesday after an executive meeting chaired by Premier Wen Jiabao.

The move was included in a 10-measure package to spur grain production and tackle the persisting drought, which poses a grave threat to wheat production.

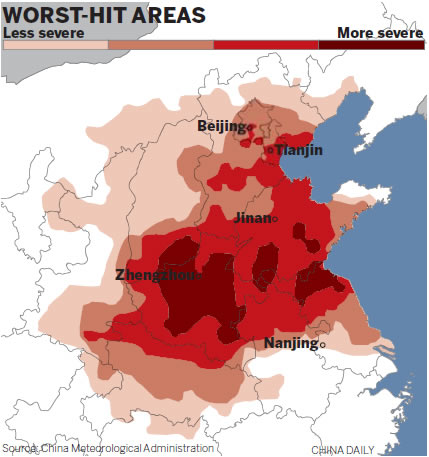

The worst affected areas are shown below:

Eight major grain-producing provinces, including Shandong, Jiangsu, Henan, Hebei and Shanxi, have been affected. Together they produce more than 80 percent of China’s winter wheat. By Wednesday, a total of 7.8 million hectares of winter wheat had been affected by the drought in the eight provinces, accounting for 42.4 percent of their total wheat-sown area, according to the Ministry of Agriculture.

The State Council warned the situation could worsen, saying rainfall across northern China for the foreseeable future would remain “persistently below normal levels and major rivers will continue to be generally dry”. Some 2.57 million people and 2.79 million livestock are suffering from drinking water shortages, official figures showed. The UN’s Food and Agriculture Organization (FAO) also issued a warning on Tuesday over the impact on the winter wheat crop.

The situation in the regions could become critical if temperatures dropped further this month and a spring drought followed the winter one, the FAO said. Footage from CCTV on Wednesday showed withered crops in parched farmland in Shandong. Wheat prices in China have also been rising rapidly in the last few months. Average flour prices in the country rose more than 8 percent in January from the previous two months, the FAO said.

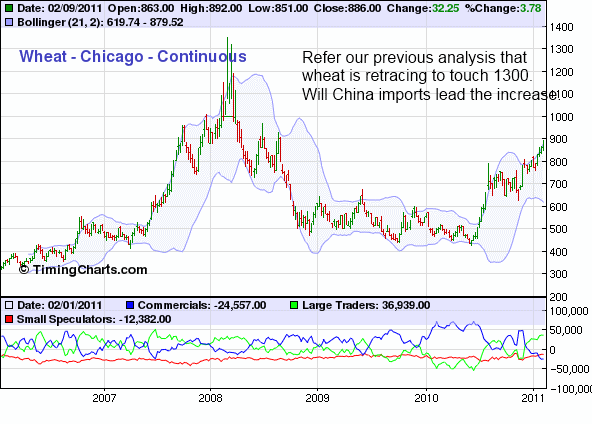

Wheat Prices on the boil here:

Wheat futures have started to rise and a near 50,000 long positions have been built up which is a 6 monthly high. Refer our post : Food inflation: The story of 2011 where we analysed that Wheat will retrace and touch 1300 once again. The fundamentals drivers behind Wheat are very strong and will drive prices.

Refer our previous articles on food inflation where we have dealt with Wheat futures, below:

The coming shock

Food inflation: The story of 2011

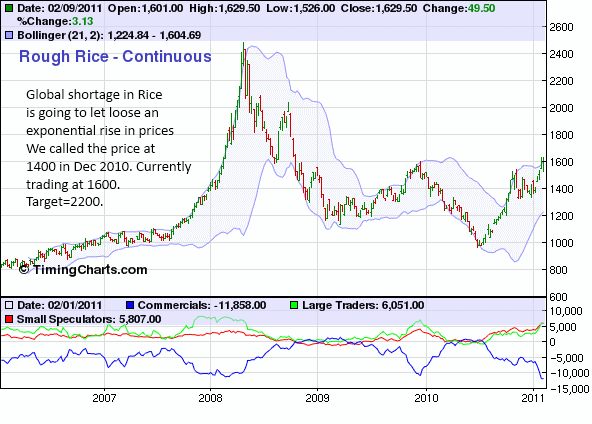

Rice: Ready for a move

Rice Charts: Rise looking imminent

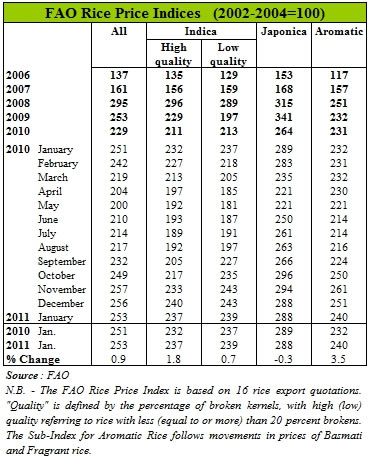

Rice has been a major worry as prices have expanded triggered by short supply from Brazil and South East Asia. COT position imply rising trader position for a rise in prices. FAO recently has though opined that there has been a moderation in prices in January but it can be attributed to a mere consolidation before further rise

All Rice index has marginally corrected to 253 in Jan 2011 from 256 in Dec 2010 but we expect 290 levels in 2011.

Egypt was all about food prices

Political unrest has broken out in Tunisia, Yemen, Egypt and other Arab countries and the underlying reasons for it has been the rising food prices. The Food and Agriculture Organization of the United Nations says its global food price index is at a record high, above even where it stood during the last food crisis three years ago.

Rising prices are “leading to riots, demonstrations and political instability,” New York University economics professor Nouriel Roubini said during a panel discussion. “It’s really something that can topple regimes, as we have seen in the Middle East.”

While traditionally, food-price crisis reflects the simple law of supply and demand. The supply of food has been diminished by bad weather in many crucial crop-growing areas of the world. Russia, Ukraine and Argentina have had severe droughts, while Pakistan and Australia have had massive flooding. This when combined with the fact that demand has been growing in south asia, have let food prices rise. Adding fuel to fire has been the US FED which with their ultra loose monetary policies have allowed capital to flood the markets allowing food and all commodities priced in dollar to be rising in prices.

In the long run, economists say the only real solution will be to increase the supply of affordable food.

Will China spur another Egypt? This time in US?

Given the drought in China, Chinese authorities are then planning to import Wheat and Rice to feed its billions. China has the purchasing power and can move in fast to deplete world supply in a very short period of time. This will act like dynamite to volatile food trading market which can potentially rise very fast.

Expect further traction in food prices in 2011 and 2012 even with FAO suggesting higher Wheat and Rice production.

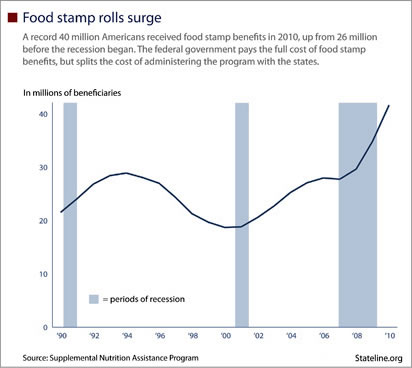

More than 41 million US citizens depend on food stamps which is nearly 12% of the population of the country.

A staggering 42,389,619 now use food stamps, up 58.5 percent from August 2007, according to U.S. Department of Agriculture data from August.

The findings translate into nearly 14 percent of American households are still relying on government assistance to buy food as the economy continues to falter. The total was up 1.3 percent from July.

A historical on US food stamps:

The demand for food stamps is expected to remain high throughout the country as the unemployment rate hovers near 9 percent in 2011, gradually falling to 8.2 percent by late 2012 and reaching the “natural rate” of 5.3 percent only in 2016, according to the Congressional Budget Office.

With rising prices, the numbers on food stamps are only going to rise and forcing government to procure even more. Only a matter of time before we see the system break and riots to break out in the US. A Greece and an Egypt are going to come to the US. While Greece represents the debt rollover issue while Egypt will be the citizens revolt against a wild and mediocre government.

Source: http://dawnwires.com/investment-news/china-drought-will-this-be-the-next-trigger-for-more-egypts/

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2011 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.