Investors Accumulate Gold but Be Cautious on Silver

Commodities / Gold and Silver 2011 Feb 16, 2011 - 03:11 PM GMTBy: Jordan_Roy_Byrne

Why is Silver continuing to outperform Gold? The Silver/Gold ratio tends to lead or follow the stock market. Risk assets are outperforming. Silver is outperforming Gold as a risk asset. It is not outperforming for monetary reasons. That occurs when both Gold and Silver advance but Silver outperforms Gold. This is one of several reasons why bugs should be wary of Silver in the near-term.

Why is Silver continuing to outperform Gold? The Silver/Gold ratio tends to lead or follow the stock market. Risk assets are outperforming. Silver is outperforming Gold as a risk asset. It is not outperforming for monetary reasons. That occurs when both Gold and Silver advance but Silver outperforms Gold. This is one of several reasons why bugs should be wary of Silver in the near-term.

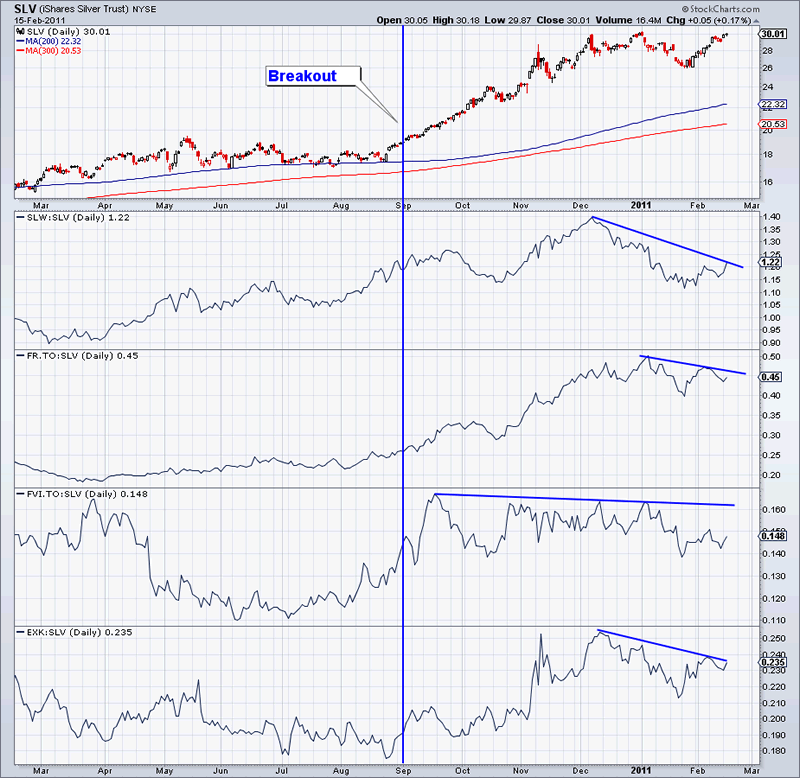

Typically the stocks will lead the commodity. Relative weakness of stocks against the commodity is always a warning sign. Remember 2007-2008 (to use an example)? In the chart below, we show SLV along with four silver stocks charted against SLV. Prior to the big breakout at the end of the summer three of the four stocks were outperforming Silver. Today, Silver is within a hair of its high yet the stocks are badly lagging.

There are other reasons to be cautious. Silver remains a whopping 34% above its 200-day moving average. Sentimentrader.com reports that public opinion (as of last week) was 71% bulls. That is likely even higher now. Does this all sound like a precursor for another breakout in Silver? In four and a half months Silver gained over 70%. The market will digest that move before beginning another impulsive but sustainable advance.

Gold on the other hand has a better risk-reward setup over the medium term.

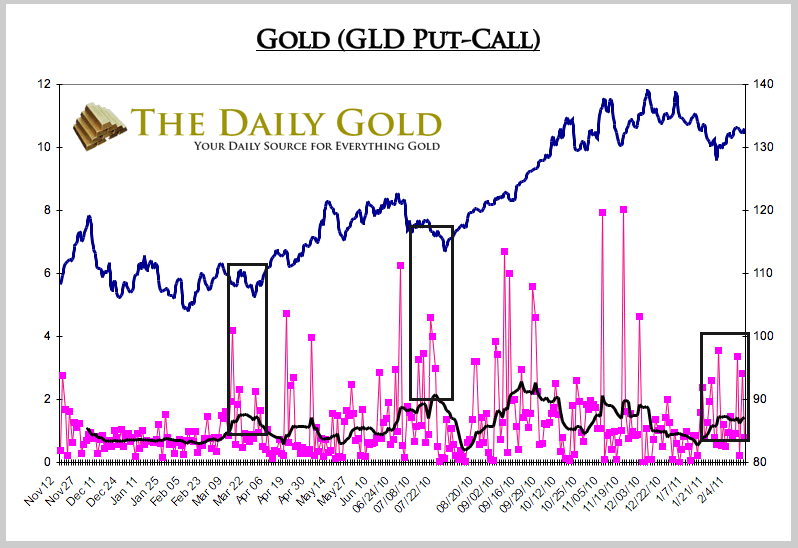

Various sentiment indicators suggest there is very limited downside. The recent Commitment of Traders Report showed that open interest was 26% below its recent high while the speculative long (non-commercial) position was 31% off its high. A few weeks ago we saw that the Central Gold Trust (GTU) Premium to NAV was negative. Finally, consider the GLD put-call (data from ISE.com) which we track in our premium service. The 10-day put-call MA is at a two-month high and rising. This shows some skepticism in the market. By the way, we don’t see this in SLV.

Gold is underperforming because it has taken a back seat to risk assets. With stocks performing well the mainstream can ignore Gold. Yet, when stocks begin to hit resistance, Gold will regain leadership and outperform both stocks and Silver. That may not happen in the next week or month but we believe it is coming soon.

Meanwhile, Silver has rebounded nicely but our work shows that short-term risk is increasing while the odds of a sustained breakout are low. Yes, physical supply is very tight and yes there is manipulation in the market. Yes, there is backwardation and yes Comex inventory is low. However, what is the market saying about that?

Silver has yet to make a new high and the silver stocks are skeptical. Perhaps these bullish fundamentals were priced in months ago, during Silver’s monstrous advance? Those who ignored the market in 2008 got killed. Those who are banking on an immediate breakout and move to $40+ are likely to be disappointed.

Let it be known that I believe Silver will outperform Gold over the long-term. Most of the stocks we hold in our model portfolio are silver stocks. Check the archives of this website and you will find several articles from us touting Silver and silver stocks in 2010.

In our premium service we have reduced our risk by exiting non-core Silver positions and building cash. In the meantime, we are researching and patiently waiting for opportunities to accumulate gold and silver juniors which can rise substantially in the next year or two. Consider a free 14-day trial to our service and find out more about our near and long-term strategy.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.