Address Structural Economic Problems of Unemployment, Debt, and Inflation With Chicanery

Economics / US Economy Feb 21, 2011 - 08:55 AM GMTBy: D_Sherman_Okst

Structural Economic Problem #1: Unemployment

Structural Economic Problem #1: Unemployment

Seventy percent of our economy is driven from private sector employment:

- Without consumers the economy is finished

- Without jobs and with maxed out debt loads the consumer is finished

A fourth grader can connect these two dots and conclude: “It’s the jobs stupid.”

Our current chicanery “fix” for high unemployment?

- Reporting the unemployment rate at 9.4% - not the actual 23%- as if reporting 9.4% will put the other 13.6% back to work.

- Dump money out there in a “willy-nilly” manner and call it “Stimulus” or “Job Creation Money.”

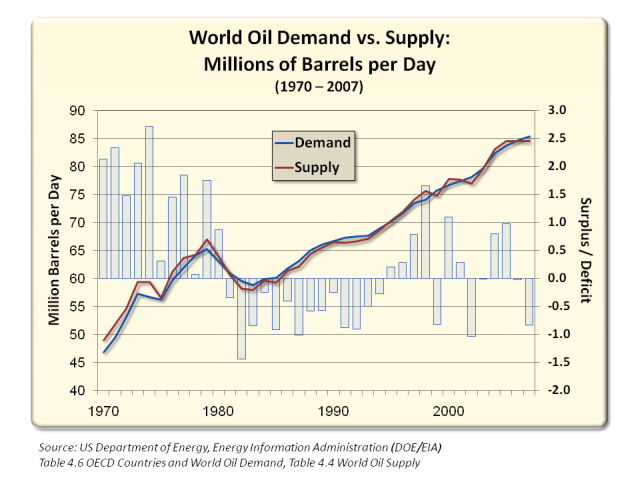

Given our entire situation, which I’ll address in a second, I don’t believe that “Stimulus” will stimulate job creation or the economy. If they had taken Chris Martenson’s idea of insulating homes I might think differently about this. I say this for two reasons: first, 1 in 6 jobs were housing related—that is the sector that needs the most help. Second, global oil demand has recently out paced global oil production. A plan that would reduce oil demand and global oil stress should be the focus of any stimulus. Oil is an integral part of everything from fertilizer used in farming to the energy that our economy needs to produce and transport the goods and services we rely on.

That being said our economic engineers have come up with and implemented ideas that would make even the most ardent objector of workplace drug screening reconsider his or her view. Case in point #1: National Institutes of Health (NIH) spent $823,200.00 of economic stimulus funds in 2009 on a study by a UCLA research team to teach uncircumcised African men how to wash their genitals after having sex. The good news is that didn’t increase oil demand. The bad news is it didn’t do anything to create jobs here.

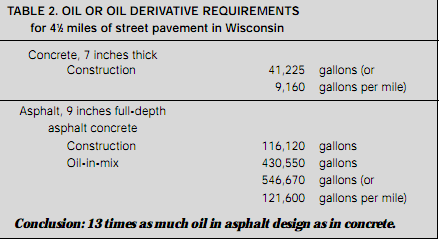

Case in point #2: It takes 121,600 gallons of oil to pave 1 mile of road. Last year Government Motors sold more cars in China than in the US. China bought 13.7 million passenger vehicles FY2010, up 33% from FY2009. The bottom line is our highway stimulus will do nothing but drive oil prices higher. China is rushing to get their highway system built to accommodate their new drivers.

While I respect the idea that confidence and psychology affect consumerism, the reality is that a 23% unemployment figure is a depressionary red flag. This tells us that the “Great Recession” has neither ended, nor was it “just” a recession. I know it is hard to dispute the National Bureau of Economic Research (NBER) - after all they were only 9 months late in noticing and calling the greatest economic downturn in history.

The fact remains: We are in a depression and failing to address the structural unemployment problems will make matters worse not better. The first step to fixing a problem is of course admitting that we have one. We’ve squandered valuable time and in doing so we’ve greatly exacerbated the situation.

Globalization was an absolute unmitigated, disastrous failure. The only thing it did was temporally boost stocks and allow some CEOs to make 400 times what their wage-earners made. While the economy appeared to be doing well - it was bubble driven credit binging - not organic spending that was fueling it. One economic blogger who is a CPA and works as a comptroller for an Ivy League college did what no other economist I know did - he investigated where consumers were getting their money from. Something Starbucks Coffee’s economist should have done. Nine billion Home Equity Line of Credit borrowed dollars were spent on 4 dollar coffees at Starbucks. The HELOC rush caused 900 Starbuck stores to close.

Yet, our Federal Reserve’s Federal Open Market Committee (Fed FOMC) minutes from FY2005 indicate that exploiting globalization is funny stuff: “But the common concern coming from the retailers, the rails, the shippers, the shipbuilders, and so on, was the following: Everyone I’ve talked to continues to try to figure out ways to exploit globalization. Each of them, from the IT [information technology] guys to the big box retailers to the specialty chemical firms to the service firms, wants to have offshore supply. One of the CEOs said, “We have a long way to go in exploiting China.” We’ve heard that forever. And one of my favorites was the comment, “China, India, and Indonesia can make Italian ceramics better than Italians can now or could 200 years ago.” [Laughter]”

In the 1950s 28% of our job base was from manufacturing. In 2000 it was 14% and today it is 11%. Water (wages) will slosh around until they stabilize at water level. In other words, our wages will move down towards 2 dollars a day and China’s will move up towards ours, they will meet somewhere in the middle. The bottom line: This is why American workers are stuck at circa 1970s wages and have no money to consume or support our economy.

The laugh is on the American consumer and the American economy. We’ve exploited ourselves and our economy with “thinking” like this. Giving African’s borrowed American tax payer dollars for genital washing after sex, our lying about unemployment rates, and driving up oil demand (or laughing about exploiting workers) won’t fix serious structural economic problems - it'll make it a lot worse.

Structural Economic Problem #2: Absolutely Unmanageable Debt

Watching the House Budget Committee hearing was a surreal mix of fact and fantasy, but mostly fantasy. The fact was that our biggest problem, on a consumer, local, state, federal and global problem is debt.

When businesses or individuals get in over their heads with unserviceable debt levels they make cuts and they borrow. When that fails and they are left taking in and borrowing less than their obligations - they declare bankruptcy, reorganize and move on.

The two options I heard during the hearings?

- Default.

- Raise the debt ceiling and counterfeit, (print more money). Basically: Debt is the problem so lets add more debt?!?!

What I didn’t hear mentioned was even more troubling. There are a million “millions” to a trillion. But the 14 trillion dollar public debt is an iota of our debt. Hidden off balance sheet we have 14.6 trillion in Social Security debt, 76.4 trillion in Medicare debt, 19.6 trillion in Prescription Drugs and about 3 trillion in GSE debt. We make Enron look honest. All toll our debt is roughly 128 trillion. Then we can add to that the state debt and local government debt.

Governor Christie will soon learn that cuts won’t fix too much debt. When your debt to income ratio becomes insanely unmanageable the only solution is to shed the debt.

Add up sales tax, phone bill tax, building permit fees, utility taxes, automobile registration, tolls, parking, automobile inspections, airline taxes, hotel taxes, property taxes and the all the rest and you will soon realize that the consumer works 8 full months for the local, state and federal governments. Paying our fair share is great, but is it smart to leave the consumer with 3.5 months of circa 1970s wages to support the economy with?

If we had just one dynamic person in that room during these hearings we’d have heard another option: Restructure. Our currency needs to be re-valued, they need to issue one new dollar which is worth many, many, many old dollars. Back it loosely and temprarily to gold to ensure faith in the new dollar.

Clearly our problem is debt and there is only one historically way to fix too much debt and that is to restructure.

Don’t get me wrong, “printing”, “counterfeiting”, “monetizing the 1.5 trillion (and rising) of debt our government doesn’t have each year through tax income and borrowing” and “Quantitative Easing” are all one-in-the-same. We are restructuring our debt by re-valuing our currency subvertly, Bernanke et al have just decided to do it “a la Hiroshima style” which will be excruciatingly painful to 99% of all Americans, it will undoubtedly put democracy in harms way and without a backing/anchor to something the new currency will be shunned by the rest of the world. This is not good for a country who doesn't run a trade surplus.

I’ve read just about everything Greenspan has written and said over the years and one of the handful of things he got right was this: “A democratic society requires a stable and effectively functioning economy. I trust that we and our successors at the Federal Reserve will be important contributors to that end.” ~Alan Greenspan

I’m not certain which end he is referring to. The United States is about 234 years old and half of the money supply has been created in this decade. Largely (read: almost entirely) because of what the then Fed Chairman did with interest rates - and the muzzling of Brooksly Born who had the audacious idea of putting measures in place to prevent derivatives from ever becoming a household word.

Which brings us to the next structural economic problem.

Structural Economic Problem #3: The Value of Money & Inflation

The irony here is one of the better explanations of what money is and how inflation works was done by Greenspan in the 1960s when he published a piece that was printed in Ayn Rand’s Capitalism.

He explains what money is:

- A commodity that serves as a medium of exchange. (We all know what happens to the value of a commodity when it is too plentiful - its value decreases greatly)

- Money is a store of value

- A means of savings

- His definition, since written in the 1960s before Nixon slammed the gold window and took us off the quasi-gold standard should be parsed with that in mind

- That limited gold reserves prevented disasters by limiting the over-creation of credit/money

- The recessions were short-lived since the money supply didn’t get out of hand

And then it gets good. Greenspan explains what caused the first Great Depression of our time (too much money):

- “But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline - argued economic interventionists - why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely - it was claimed - there need never be any slumps in business. And so the Federal Reserve System was organized in 1913.”

- “When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage.”

- “The excess credit which the Fed pumped into the economy spilled over into the stock market-triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed.”

Sound familiar?

This is, in a sick sort of way, hysterical, for it was he who created a fantastic speculative tech and housing boom through the creation of too much cheap money pumped into the economy and through the dismantling of Glass-Steagall Act, and the muzzling of the watchdog who wanted to protect us the American public from the derivatives fallout.

He then goes onto define what a welfare state is:

- “...the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state).”

And how the welfare state steals from its productive hard working citizens:

- “Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes.”

- “A substantial part of the confiscation is effected by taxation.”

- “But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.”

Somewhere between 1966 and his term from 1987 to mid 2006 the train left the tracks and kept going.

Thank you Alan for forgetting history and decency. At least know I know to which end you were referring to in your December 5, 2005 speech above.

Without a doubt, with the monetization we have now, we will see hyperinflation as the value of our dollar goes from the current .04 cents to 0.

The Fed in the 1970s, thanks to the Nixon Administration was able to strip out fuel and food from its “Core Inflation" number, something consumers and businesses can’t do. During Clinton’s term Michael Boskin helped tweak inflation by using Hedonics (Greek for feels good), weighting and substitution.

Core inflation and Enron accounting is how they plan on solving inflation. Just remember what the Maestro of Disaster said: The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise.

Rise will be the understatement of the century.

Many people wrongly argue that the money is sitting, that there is no velocity, or that the Fed can do the Paul Volcker and raise rates. Which brings us to our next topic, monetizing debt through “Quantitative Easing.” (Please See Part 2).

By D. Sherman Okst

http://UnveilingTheEconomy.blogspot.com/

Bernardston MA USA

davossherman @ gmail.com

I'm an ex-airline captain with about 15,000 hours and am amazed at all the BS we are taught. Most of my friends still in the business were also taught the wrong aerodynamic principles with respect to what makes planes fly. Aviation or economics, Keynes to Austrian - Bernulli to Newton we've been sold bad goods. It's amazing anything works as backwards as we do things.

© 2011 Copyright D. Sherman Okst - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.