How To Profit From Copper's Next Wave, Follow The Money

Commodities / Metals & Mining Feb 23, 2011 - 03:28 AM GMTBy: Richard_Mills

Urbanization is a macro-trend, in 1800 two percent of the global population was urban, by 1950 it was 30%. Today half of all the people in the world live in cities. This is an economic migration - historically poverty rates are 4 times higher in rural than urban areas. The UN projects that by the year 2030 there will be 1.5 billion more people living in cities.

Urbanization is a macro-trend, in 1800 two percent of the global population was urban, by 1950 it was 30%. Today half of all the people in the world live in cities. This is an economic migration - historically poverty rates are 4 times higher in rural than urban areas. The UN projects that by the year 2030 there will be 1.5 billion more people living in cities.

Investing in copper might be the simplest way to profit from the ongoing global urbanization.

China has one fifth of the world's population and India has another 1.2 billion people. India's economy expanded at 8.9% in the quarter ended September 30th while China's economy expanded at 9.8% in the quarter ended December 31st.

China and India consume a lot of copper. Key drivers of increased copper consumption in both countries is infrastructure build out - power, construction, energy and transportation.

India's power production needs to rise by 15 to 20 percent annually which means, according to the International Energy Agency (IEA), India needs to invest $1.25 trillion by 2030 into its energy infrastructure. Because of this investment into new infrastructure India's annual copper demand is expected to more than double to nearly 1.5 million tonnes by 2012 - up from a current 600,000 tonnes. India usually exports between 100 and 150,000 tonnes a year, Indian copper exports are likely to cease and indeed Indians might become large copper buyers.

With less than 1/3 of the population India's urban areas generate over 2/3 of the country's GDP and account for 90% of government revenues. A report done by the McKinsey Global Institute called India Urban Awakening predicts that 590 million people or 40% of India's population will live in cities by 2030, up from 340 million today.

China's current urbanization rate of 46 percent is much lower than the average level of 85 percent in developed countries and is lower than the world average of 55 percent. China has set a goal of 65 percent of urbanization rate in 2050. Over the coming 40 years that means 20 percentage points of urban growth per year. This translates into 300 million rural residents becoming urban residents over this time period - last year the disposable income of the Chinese urban population stood at 17,175 yuan per capita while the net income of the rural population was 5,153 yuan per person.

The annual per capita consumption of copper in India is 0.47 kg, China's 5.4 kg and the world average is 2.7 kg. China's urbanization plans and forecast GDP is expected to drive Chinese copper consumption from the current 5.4 kg/capita to an astounding 10 kg/capita by the end of the decade.

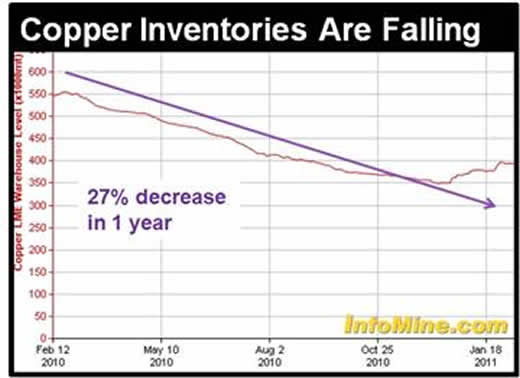

Australian equity research firm Resource Capital Research (RCR) said it expects the copper market to move from a small surplus in 2010 to a deficit of around 400,000 tonnes by 2011. According to JPMorgan Securities Ltd, the world refined copper market will have a 500,000-metric-ton deficit in 2011. The International Copper Study Group said global demand for copper will rise by 4.49% in 2011. Supply disruptions have cancelled out modest mine supply growth.

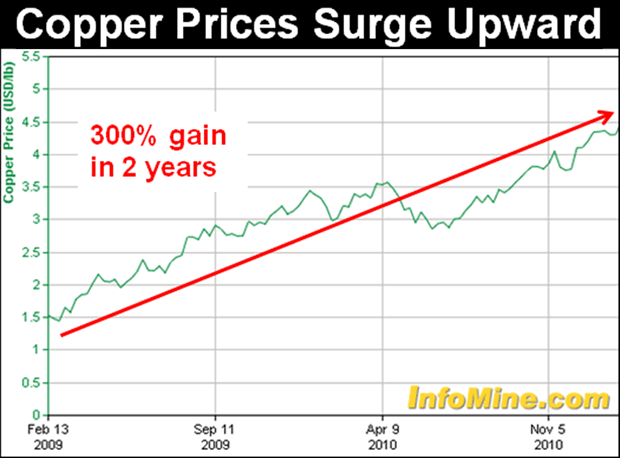

A glance at the following two charts confirms the growing demand for copper while inventory levels at the London Metal Exchange hint at the supply deficit.

With metal analysts calling for a 10-30% rise in the 2011 copper spot price, you could probably make money buying shares of JJC-iPath - an index composed of copper futures contracts traded on the New York Commodities Exchange (JJC is up 50% in the last 6 months).

Or you could buy shares in one of the big multi-national copper miners. Freeport McMoran (FCX-NYSE), BHP Billiton (BHP-ASX) or Xstrata (XTA-LSE) are up a collective 58% in the last year.

But to make the big gains, you have to get in ahead of the money flow. Potash has recently given us an excellent example on how to do that and what signals investors should watch for as the process plays out.

Potash is the primary ingredient in fertilizer, it's also a mined resource with global demand being driven by a macro trend. What's been happening is a trickledown effect and is a three phase process:

PHASE#1: a barrage of bullish headlines in the mainstream media: "Potash Profits Up" "Spike In Food Prices Bullish For Potash" "Potash Export Prices Rising" etc.

PHASE#2: a flood of investment dollars into the senior potash companies. Potash Corp (POT-NYSE), Agrium (AGU-NYSE) and MOSAIC (MOS-NYSE) are all up about 120% in the last 12 months.

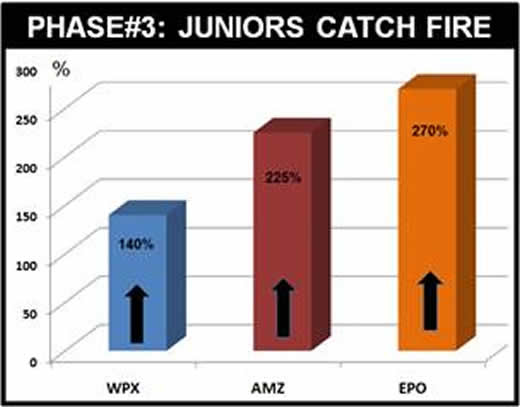

PHASE#3: Snowballing investor interest in the "junior" (smaller cap) explorers. This third phase is typically riskier and more profitable than phase #2.

Nine months after the potash majors began their climb, Amazon Mining (AMZ-TSX.V), Encanto Potash (EPO-TSX.V) and Western Potash (WPX-TSX.V) all caught fire - catalyzed by news stories of food price inflation. In the last three months all three aheadoftheherd.com sponsor companies have seen stock price increases an average of plus 200%.

"You're seeing a catch-up phase, there's capital flowing into the sector and it's moving down into smaller-cap names." Robert Winslow, Wellington West Capital Markets

Copper has just completed phase #1 (a barrage of bullish headlines), and phase #2 (the majors have had their run).

Phase #3 is about to begin.

VMS Ventures, Copper Fox, Far West Mining, Hana Mining, Nevada Copper, Redhawk Resources and Western Copper are all good companies seemingly well positioned to benefit from this next phase.

Catalyst Copper

I am going to single out one company, Catalyst Copper TSX.V - CCY, that appears to have everything going for it - including a "tell" in the fundamentals that suggests it may be about to be re-valued.

Catalyst has the right to earn 60% of the La Verde Project. La Verde is a Mexican copper porphyry project with NI 43-101 compliant resource of 2.1 billion pounds of Measured and Indicated copper and an Inferred Resourceof 1.3 billion pounds of copper.

Catalyst Copper is currently earning into a 3.4 billion pound copper deposit that remains open in all directions. Today their 60% share would equal 2 billion pounds of copper - 9.6 pounds per share - the current spot price of copper is $4.46/lb. With Catalyst currently trading at .22 an investor would be buying copper in the ground for .02 a pound.

Catalyst Copper, partnered with Teck Resources TCK-TSX, has commenced an aggressive 20,000 meter drill program for 2011.

Catalyst CEO John Greenslade just raised $850 million for Baja Mining and he is on record as stating that CCY is a "more straight forward project".

But here's the tell: for the last year CCY has traded about 500,000 shares a day. A lot of that trading is "seed stock" changing hands. Since February 1, 2011 - the average daily volume has jumped to about 1,840,000 - while the stock has risen to .22.

180,000 people a day move from the country to the city. Urban infrastructure devours copper. Over the next 12 months that demand might drive investment dollars into juniors with big resources like Catalyst Copper.

Are there copper juniors on your radar screen?

If not, maybe there should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.