Sales of Existing U.S. Homes Moved Up, But Median Price Establishes New Low

Commodities / Crude Oil Feb 24, 2011 - 03:13 AM GMTBy: Asha_Bangalore

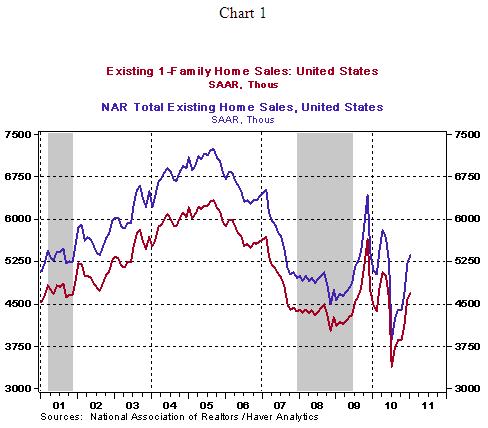

Sales of all existing homes rose 2.7% to an annual rate of 5.36 million units in July of 2010, while purchases of single-family existing homes rose 2.4% to an annual rate of 4.69 million, which is up 38% from the cycle low of 3.390 million registered in July 2010. Regionally, sales of existing homes fell in the Northeast (-4.6%), but rose in the Midwest (+1.8%), South (+3.6%) and West (+7.9%).

Sales of all existing homes rose 2.7% to an annual rate of 5.36 million units in July of 2010, while purchases of single-family existing homes rose 2.4% to an annual rate of 4.69 million, which is up 38% from the cycle low of 3.390 million registered in July 2010. Regionally, sales of existing homes fell in the Northeast (-4.6%), but rose in the Midwest (+1.8%), South (+3.6%) and West (+7.9%).

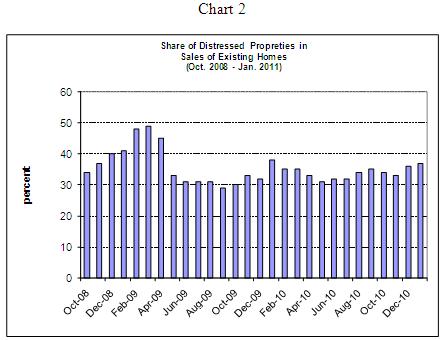

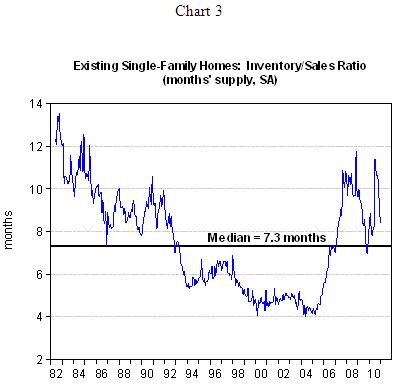

Distressed properties made up 37% of sales in December compared with 36% in December and 38% in January 2010. As shown n Chart 2, the percentage of distressed properties being sold is advancing but the official inventory/sales ratio is trending down (see Chart 3). The seasonally adjusted inventory-sales ratio of existing single-family homes dropped to 8.4-month supply from 8.7-month supply in December. The median inventory/sales ratio for existing single-family homes is 7.3-months. Based on this information, it appears that homeowners could be postponing considerations of sales given the price pressures from the large number of foreclosed properties in the market.

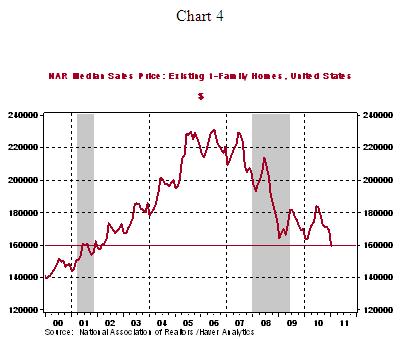

The persistent excess supply of existing homes has resulted in a continued reduction of home prices. The median price of an existing single-family home fell to $159,400 in January from $169,300 in the prior month. The median price of an existing single-family home is the lowest since February 2002 (see Chart 4).

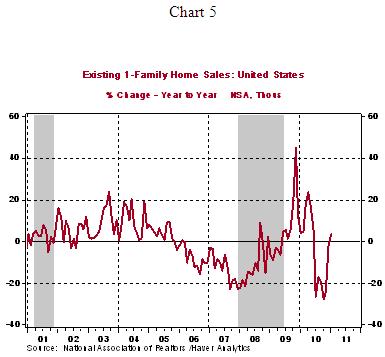

The good news buried in the report is that sales of single-family homes increased 3.3% from a year ago (see Chart 5), the first monthly gain after a string of six monthly declines. The main conclusion of the January existing sales report is that the housing market is not out of the woods as yet and it presents a risk to the optimism reflected in projections of economic growth.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.