Stocks Bear Market Beginnings, There Goes the First Sector

Stock-Markets / Stocks Bear Market Feb 24, 2011 - 07:53 AM GMTBy: Toby_Connor

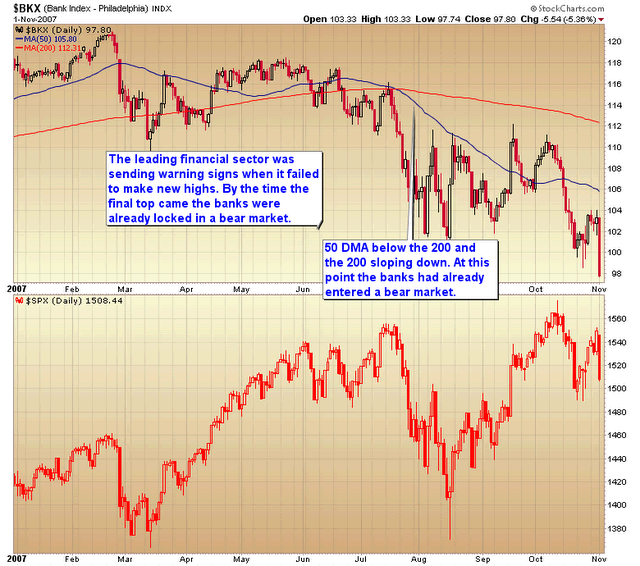

Bear markets begin when something fundamental breaks. Usually the sector initially affected will roll over before the general market and tends to be a warning sign of what lies ahead.

Bear markets begin when something fundamental breaks. Usually the sector initially affected will roll over before the general market and tends to be a warning sign of what lies ahead.

The last bear market was triggered when the credit bubble created by Greenspan's foolish monetary policy burst. It was exacerbated by Bernanke's foolish attempt to debase the currency and reflate the bubble. All he succeeded in doing was to inflate oil to $147, which put the finishing touches on an already crumbling economy.

The market gave us a warning when the financials began to diverge from the rest of the market. Considering that the banks were one of the leading sectors during the `02-`07 bull the fact that they couldn't follow the rest of the market to new highs after the February `07 correction was a big red flag that the bull was on its last legs.

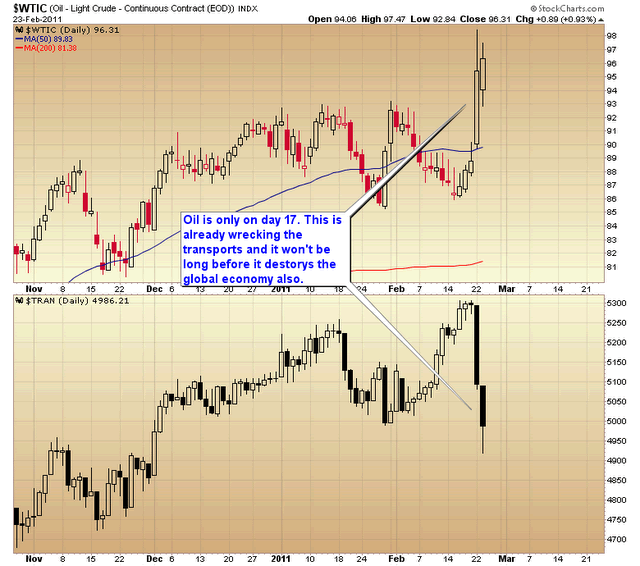

I've been saying for more than a year now that the unintended consequences of QE would be to spike inflation, which in turn would poison the global economy. I knew all along that Ben was never going to create any jobs by printing money and of course he hasn't.

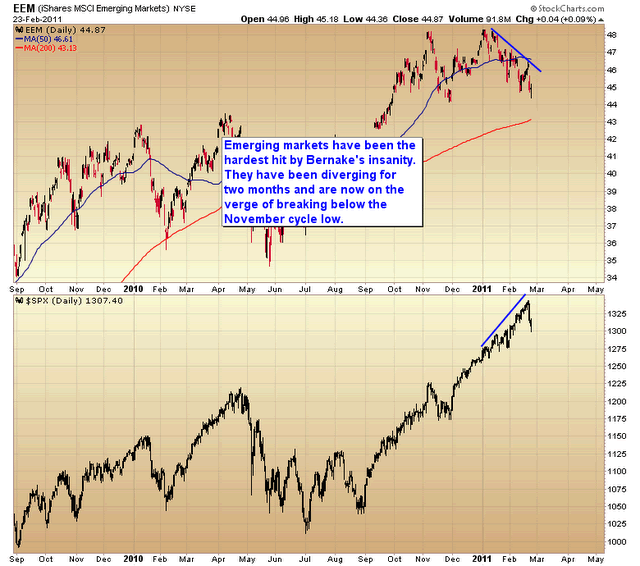

So if inflation is going to sink the economy and kill the stock market we should see warning signs from the sectors most affected by rising inflationary pressures, just like the banks warned us in `07 that the fundamentals were broken.

Sure enough I think we are starting to see those warning signs.

Emerging markets have been the hit hard by food inflation. We are now seeing food riots in many third world countries. Emerging markets just like financials during the last bull were one of the leading sectors. EEM is now starting to diverge from the rest of the global stock markets. It's now on the verge of breaking back below the November cycle low.

The other sector that is extremely sensitive to inflation is the transports. When energy costs spike shipping companies profit margins are squeezed. The last two days have seen the Dow Transports fold under the pressure of surging oil prices. Keep in mind oil is only on the 17th day of its intermediate cycle. That cycle lasts on average 50-70 days. I think we are going to see $5.00 gasoline by the time the dollar collapses into its three year cycle low later this spring.

If the market can recover from the recent correction and make new highs I don't expect the transports will be able to follow. That will set up a Dow Theory non-confirmation and most bear markets begin with a Dow Theory non-confirmation.

China is already in a bear market. I think most emerging markets have probably topped and I doubt the rest of the global markets have more than 2 or 3 months left before the next leg down in the secular bear market begins.

I think the brief party created by Bernanke's printing press is about to come to an end.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2011 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.